With his history in the transfer market there is no guarantee that Carlos Tevez won’t still end up at Brazilian side Corinthians. But even if he doesn’t, some are saying that the bid itself represents a shift in power away from the European clubs, which have traditionally benefited from the players produced in Brazil, and towards Brazilian clubs themselves.

Brazil’s new found wealth is being flaunted elsewhere. Last month Bloomberg reported on a growing number of Brazilians buying property in Florida. According to the report:

“As many as half of the downtown Miami condos that have been sold to foreigners for more than $500,000 since January were purchased by Brazilians, said Craig Studnicky, president of International Sales Group LLC, an Aventura, Florida, property-marketing firm. Buyers from Brazil also accounted for about half of sales of more than $1 million in Miami Beach”.

The reason for this, according to Bloomberg, is “The Brazilian real’s 45 percent increase against the dollar from the end of 2008”

This has come about despite an increasingly difficult situation for the Brazilian central bank. Without reinstating the hard peg to the dollar which shattered amid devaluation in 1999, the Banco Central has tried to maintain an exchange rate with the dollar of about 2:1. However, to maintain this the inflationary policy of the Federal Reserve’s quantitative easing programs has had to be mirrored in Brazil. But, without the reserve currency status of the dollar to tempt a China or United Arab Emirates to stack up Brazilian currency claims, the Brazilians, like any country following the dollar, have had headline inflation.

As a result Brazil has been a noisy participant in the ‘currency wars’ triggered by US devaluation. Brazil’s finance minister Guido Mantega recently said that “struggles between countries” were “absolutely not over”.

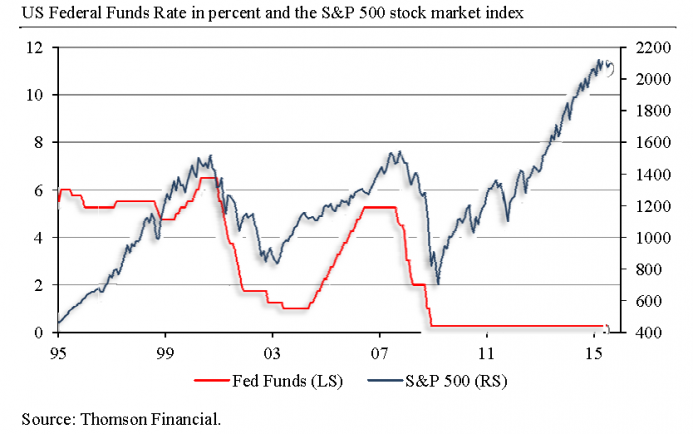

But Brazil hasn’t just relied on words. In the face of rising inflation imported from the US via the soft currency peg, the Banco Central has moved aggressively to raise interest rates. This has pushed the real to a near 12 year high and made it possible for Brazilians to go shopping for assets abroad.

But what does this mean for the rest of us? In defending quantitative easing Ben Bernanke says “the Federal Reserve has a particular obligation to help promote increased employment and sustain price stability”. In fact, for all the Fed’s money printing, unemployment remains stubbornly stuck at 9.2% and even the Fed’s diddled measure of ‘core’ inflation which doesn’t include food and energy prices (which have been skyrocketing) is beginning to tick up.

The inflationist policies of the Federal Reserve aren’t doing much for the US economy and they aren’t helping the average American. But Brazilians are benefitting from this shift in wealth and with the Fed preparing the ground for another round of quantitative easing Brazilians will be in the market for more assets, be they condos or centre forwards. When Miami hosts its first carnival for wealthy Brazilian expats Ben Bernanke should be the guest of honour.

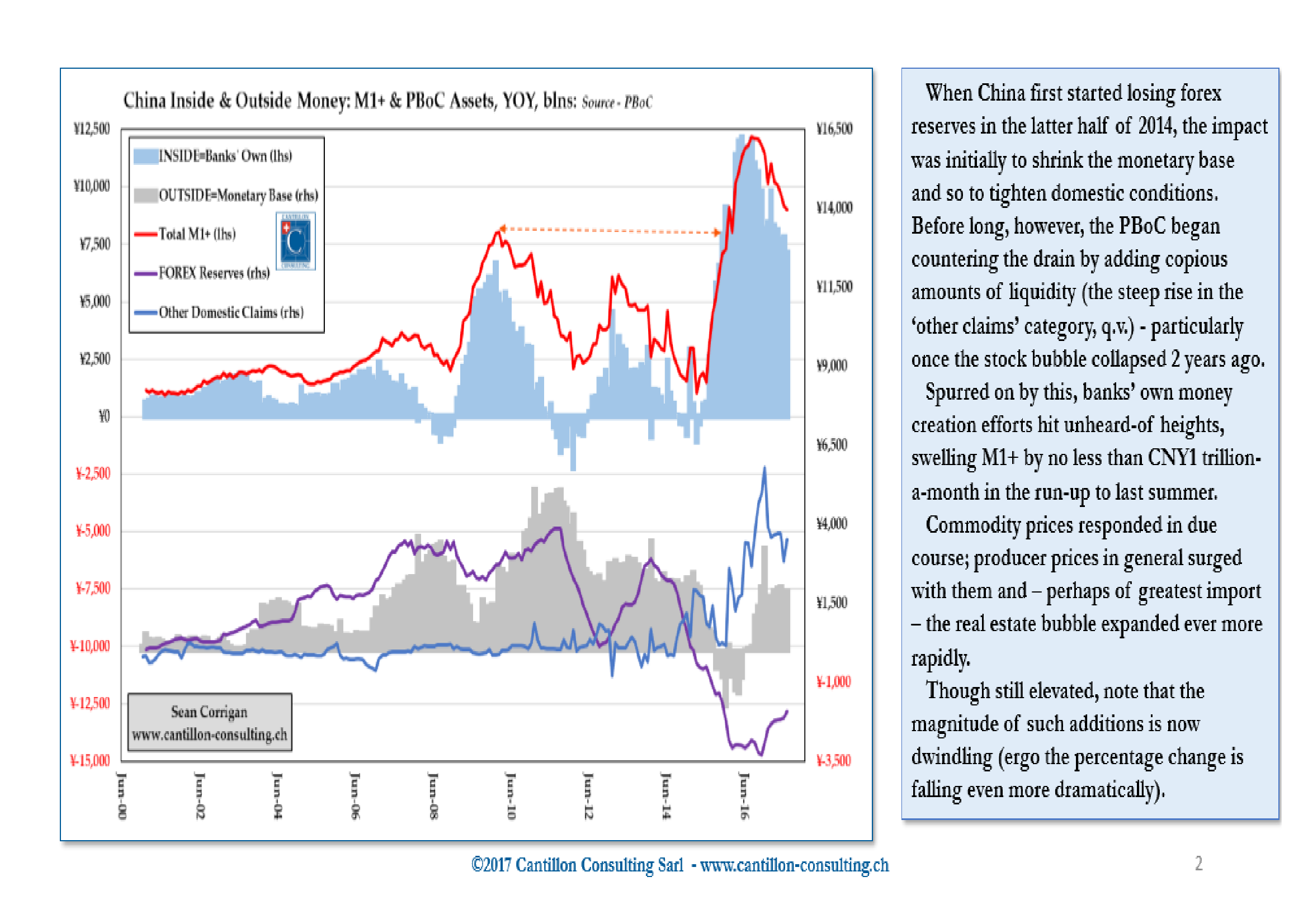

I work for an Austrian oriented investment consulting here in Brazil, and I gotta say that the cycle is reversing here as well.

Consumer price inflation is starting to accelerate faster than producer price inflation, as teaches ABCT. Unemployment is at record lows and money supply measures have weakened their growth rates.

Besides, IMO, we do have a housing bubble and a consumer credit bubble. Defaulting is increasing. Government taxing stays at almost 40%/GDP and the “national developers” are propping up a lot of long-term malinvesment through fascist BNDES.

Brazil’s savings rate is stuck arounf 18%/GDP. What’s propping us are the unending FX and FDI flows from Bernanke, Trichet, Chinese and others…

Beware… We’re still a banana republic.