With a Critique of the Errors of the ECB and the Interventionism of Brussels

1. Introduction: The Ideal Monetary System

Theorists of the Austrian school have focused considerable effort on elucidating the ideal monetary system for a market economy. On a theoretical level, they have developed an entire theory of the business cycle which explains how credit expansion unbacked by real saving and orchestrated by central banks via a fractional-reserve banking system repetitively generates economic cycles. On a historical level, they have described the spontaneous evolution of money and how coercive state intervention encouraged by powerful interest groups has distanced from the market and corrupted the natural evolution of banking institutions. On an ethical level, they have revealed the general legal requirements and principles of property rights with respect to banking contracts, principles which arise from the market economy itself and which, in turn, are essential to its proper functioning.[1]

All of the above theoretical analysis yields the conclusion that the current monetary and banking system is incompatible with a true free-enterprise economy, that it contains all of the defects identified by the theorem of the impossibility of socialism, and that it is a continual source of financial instability and economic disturbances. Hence, it becomes indispensable to profoundly redesign the world financial and monetary system, to get to the root of the problems that beset us and to solve them. This undertaking should rest on the following three reforms: (a) the re-establishment of a 100-percent reserve requirement as an essential principle of private property rights with respect to every demand deposit of money and its equivalents; (b) the abolition of all central banks (which become unnecessary as lenders of last resort if reform (a) above is implemented, and which as true financial central-planning agencies are a constant source of instability) and the revocation of legal-tender laws and the always-changing tangle of government regulations that derive from them; and (c) a return to a classic gold standard, as the only world monetary standard that would provide a money supply which public authorities could not manipulate and which could restrict and discipline the inflationary yearnings of the different economic agents.[2]

As we have stated, the above prescriptions would enable us to solve all our problems at the root, while fostering sustainable economic and social development the likes of which have never been seen in history. Furthermore, these measures can both indicate which incremental reforms would be a step in the right direction, and permit a more sound judgement about the different economic-policy alternatives in the real world. It is from this strictly circumstantial and possibilistic perspective alone that the reader should view the Austrian analysis in relative “support” of the euro which we aim to develop in the present paper.

2. The Austrian Tradition of Support for Fixed Exchange Rates versus Monetary Nationalism and Flexible Exchange Rates

Traditionally, members of the Austrian school of economics have felt that as long as the ideal monetary system is not achieved, many economists, especially those of the Chicago school, commit a grave error of economic theory and political praxis when they defend flexible exchange rates in a context of monetary nationalism, as if both were somehow more suited to a market economy. In contrast, Austrians believe that until central banks are abolished and the classic gold standard is re-established along with a 100-percent reserve requirement in banking, we must make every attempt to bring the existing monetary system closer to the ideal, both in terms of its operation and its results. This means limiting monetary nationalism as far as possible, eliminating the possibility that each country could develop its own monetary policy, and restricting inflationary policies of credit expansion as much as we can, by creating a monetary framework that disciplines as far as possible economic, political, and social agents, and especially, labour unions and other pressure groups, politicians, and central banks.

It is only in this context that we should interpret the position of such eminent Austrian economists (and distinguished members of the Mont Pèlerin Society) as Mises and Hayek. For example, there is the remarkable and devastating analysis against monetary nationalism and flexible exchange rates which Hayek began to develop in 1937 in his particularly outstanding book, Monetary Nationalism and International Stability.[3] In this book, Hayek demonstrates that flexible exchange rates preclude an efficient allocation of resources on an international level, as they immediately hinder and distort real flows of consumption and investment. Moreover, they make it inevitable that the necessary real downward adjustments in costs take place via a rise in all other nominal prices, in a chaotic environment of competitive devaluations, credit expansion, and inflation, which also encourages and supports all sorts of irresponsible behaviours from unions, by inciting continual wage and labour demands which can only be satisfied without increasing unemployment if inflation is pushed up even further. Thirty-eight years later, in 1975, Hayek summarized his argument as follows:

“It is, I believe, undeniable that the demand for flexible rates of exchange originated wholly from countries such as Great Britain, some of whose economists wanted a wider margin for inflationary expansion (called ‘full employment policy’). They later received support, unfortunately, from other economists[4] who were not inspired by the desire for inflation, but who seem to have overlooked the strongest argument in favour of fixed rates of exchange, that they constitute the practically irreplaceable curb we need to compel the politicians, and the monetary authorities responsible to them, to maintain a stable currency” [italics added].

To clarify his argument yet further, Hayek adds:

“The maintenance of the value of money and the avoidance of inflation constantly demand from the politician highly unpopular measures. Only by showing that government is compelled to take these measures can the politician justify them to people adversely affected. So long as the preservation of the external value of the national currency is regarded as an indisputable necessity, as it is with fixed exchange rates, politicians can resist the constant demands for cheaper credits, for avoidance of a rise in interest rates, for more expenditure on ‘public works,’ and so on. With fixed exchange rates, a fall in the foreign value of the currency, or an outflow of gold or foreign exchange reserves acts as a signal requiring prompt government action.[5] With flexible exchange rates, the effect of an increase in the quantity of money on the internal price level is much too slow to be generally apparent or to be charged to those ultimately responsible for it. Moreover, the inflation of prices is usually preceded by a welcome increase in employment; it may therefore even be welcomed because its harmful effects are not visible until later.”

Hayek concludes:

“I do not believe we shall regain a system of international stability without returning to a system of fixed exchange rates, which imposes upon the national central banks the restraint essential for successfully resisting the pressure of the advocates of inflation in their countries — usually including ministers of finance” (Hayek 1979 [1975], 9-10).

With respect to Ludwig von Mises, it is well known that he distanced himself from his valued disciple Fritz Machlup when in 1961 Machlup began to defend flexible exchange rates in the Mont Pèlerin Society. In fact, according to R.M. Hartwell, who was the official historian of the Mont Pèlerin Society,

“Machlup’s support of floating exchange rates led von Mises to not speak to him for something like three years” (Hartwell 1995, 119).

Mises could understand how macroeconomists with no academic training in capital theory, like Friedman and his Chicago colleagues, and also Keynesians in general, could defend flexible rates and the inflationism invariably implicit in them, but he was not willing to overlook the error of someone who, like Machlup, had been his disciple and therefore really knew about economics, and yet allowed himself to be carried away by the pragmatism and passing fashions of political correctness. Indeed, Mises even remarked to his wife on the reason he was unable to forgive Machlup:

“He was in my seminar in Vienna; he understands everything. He knows more than most of them and he knows exactly what he is doing” (Margit von Mises 1984, 146).

Mises’s defence of fixed exchange rates parallels his defence of the gold standard as the ideal monetary system on an international level. For instance, in 1944, in his book Omnipotent Government, Mises wrote:

“The gold standard put a check on governmental plans for easy money. It was impossible to indulge in credit expansion and yet cling to the gold parity permanently fixed by law. Governments had to choose between the gold standard and their — in the long run disastrous — policy of credit expansion. The gold standard did not collapse. The governments destroyed it. It was incompatible with etatism as was free trade. The various governments went off the gold standard because they were eager to make domestic prices and wages rise above the world market level, and because they wanted to stimulate exports and to hinder imports. Stability of foreign exchange rates was in their eyes a mischief, not a blessing. Such is the essence of the monetary teachings of Lord Keynes. The Keynesian school passionately advocates instability of foreign exchange rates” [italics added].[6]

Furthermore, it comes as no surprise that Mises scorned the Chicago theorists when in this area, as in others, they ended up falling into the trap of the crudest Keynesianism. In addition, Mises maintained that it would be relatively simple to re-establish the gold standard and return to fixed exchange rates:

“The only condition required is the abandonment of an easy money policy and of the endeavors to combat imports by devaluation.”

Moreover, Mises held that only fixed exchange rates are compatible with a genuine democracy, and that the inflationism behind flexible exchange rates is essentially antidemocratic:

“Inflation is essentially antidemocratic. Democratic control is budgetary control. The government has but one source of revenue — taxes. No taxation is legal without parliamentary consent. But if the government has other sources of income it can free itself from their control” (Mises 1969, 251-253).

Only when exchange rates are fixed are governments obliged to tell citizens the truth. Hence, the temptation to rely on inflation and flexible rates to avoid the political cost of unpopular tax increases is so strong and so destructive. So, even if there is not a gold standard, fixed rates restrict and discipline the arbitrariness of politicians:

“Even in the absence of a pure gold standard, fixed exchange rates provide some insurance against inflation which is not forthcoming from the flexible system. Under fixity, if one country inflates, it falls victim to a balance of payment crisis. If and when it runs out of foreign exchange holdings, it must devalue, a relatively difficult process, fraught with danger for the political leaders involved. Under flexibility, in contrast, inflation brings about no balance of payment crisis, nor any need for a politically embarrassing devaluation. Instead, there is a relatively painless depreciation of the home (or inflationary) currency against its foreign counterparts” (Block 1999, 19, italics added).

3. The Euro as a “Proxy” for the Gold Standard (or Why Champions of Free Enterprise and the Free Market Should Support the Euro While the Only Alternative Is a Return to Monetary Nationalism)

As we have seen, Austrian economists defend the gold standard because it curbs and limits the arbitrary decisions of politicians and authorities. It disciplines the behaviour of all the agents who participate in the democratic process. It promotes moral habits of human behaviour. In short, it checks lies and demagogy; it facilitates and spreads transparency and truth in social relationships. No more and no less. Perhaps Ludwig von Mises said it best:

“The gold standard makes the determination of money’s purchasing power independent of the changing ambitions and doctrines of political parties and pressure groups. This is not a defect of the gold standard, it is its main excellence” (Mises 1966, 474).

The introduction of the euro in 1999 and its culmination beginning in 2002 meant the disappearance of monetary nationalism and flexible exchange rates in most of continental Europe. Later we will consider the errors committed by the European Central Bank. Now what interests us is to note that the different member states of the monetary union completely relinquished and lost their monetary autonomy, that is, the possibility of manipulating their local currency by placing it at the service of the political needs of the moment. In this sense, at least with respect to the countries in the euro zone, the euro began to act and continues to act very much like the gold standard did in its day. Thus, we must view the euro as a clear, true, even if imperfect, step toward the gold standard. Moreover, the arrival of the Great Recession of 2008 has even further revealed to everyone the disciplinary nature of the euro: for the first time, the countries of the monetary union have had to face a deep economic recession without monetary policy autonomy. Up until the adoption of the euro, when a crisis hit, governments and central banks invariably acted in the same way: they injected all the necessary liquidity, allowed the local currency to float downward and depreciated it, and indefinitely postponed the painful structural reforms that were needed and which involve economic liberalization, deregulation, increased flexibility in prices and markets (especially the labour market), a reduction in public spending, and the withdrawal and dismantling of union power and the welfare state. With the euro, despite all the errors, weaknesses, and concessions we will discuss later, this type of irresponsible behaviour and forward escape has no longer been possible.

For instance, in Spain, in just one year, two consecutive governments have been literally forced to take a series of measures which, though still quite insufficient, up to now would have been labelled as politically impossible and utopian, even by the most optimistic observers:

- article 135 of the Constitution has been amended to include the anti-Keynesian principle of budget stability and equilibrium for the central government, the autonomous communities, and the municipalities;

- all of the projects that imply increases in public spending, vote purchasing, and subsidies, projects upon which politicians regularly based their action and popularity, have been suddenly suspended;

- the salaries of all public servants have been reduced by 5 percent and then frozen, while their work schedule has been expanded;

- social security pensions have been frozen de facto;

- the standard retirement age has been raised across the board from 65 to 67;

- the total budgeted public expenditure has decreased by over 15 percent; and

- significant liberalization has occurred in the labour market, business hours, and in general, the tangle of economic regulation.[7]

Furthermore, what has happened in Spain is also taking place in Ireland, Portugal, Italy, and even in countries which, like Greece, until now represented the paradigm of social laxity, the lack of budget rigour, and political demagogy.[8] What is more, the political leaders of these five countries, now no longer able to manipulate monetary policy to keep citizens in the dark about the true cost of their policies, have been summarily thrown out of their respective governments. And states which, like Belgium and especially France and Holland, until now have appeared unaffected by the drive to reform, are also starting to be forced to reconsider the very grounds for the volume of their public spending and for the structure of their bloated welfare state. This is all undeniably due to the new monetary framework introduced with the euro, and thus it should be viewed with excited and hopeful rejoicing by all champions of the free-enterprise economy and the limitation of government powers. For it is hard to conceive of any of these measures being taken in a context of a national currency and flexible exchange rates: whenever they can, politicians eschew unpopular reforms, and citizens everything that involves sacrifice and discipline. Hence, in the absence of the euro, authorities would again have taken what up to now has been the usual path, i.e. a forward escape consisting of more inflation, the depreciation of the currency to recover “full employment” and gain competitiveness in the short term (covering their backs and concealing the grave responsibility of labour unions as true generators of unemployment), and in short, the indefinite postponement of the necessary structural reforms.

Let us now focus on two significant ways the euro is unique. We will contrast it both with the system of national currencies linked together by fixed exchange rates, and with the gold standard itself, beginning with the latter. We must note that abandoning the euro is much more difficult than going off the gold standard was in its day. In fact, the currencies linked with gold kept their local denomination (the franc, the pound, etc.), and thus it was relatively easy, throughout the 1930s, to unanchor them from gold, insofar as economic agents, as indicated in the monetary regression theorem Mises formulated in 1912 (Mises 2009 [1912], 111-123), continued without interruption to use the national currency, which was no longer exchangeable for gold, relying on the purchasing power of the currency right before the reform. Today this possibility does not exist for those countries that wish, or are obliged, to abandon the euro. Since it is the only unit of currency shared by all the countries in the monetary union, its abandonment requires the introduction of a new local currency, with unknown and much less purchasing power, and includes the emergence of the immense disturbances that the change would entail for all the economic agents in the market: debtors, creditors, investors, entrepreneurs, and workers.[9] At least in this specific sense, and from the standpoint of Austrian theorists, we must admit that the euro surpasses the gold standard, and that it would have been very useful for mankind if in the 1930s the different countries involved had been obliged to stay on the gold standard, because as is the case today with the euro, any other alternative was nearly impossible to put into practice and would have affected citizens in a much more damaging, painful, and obvious way.

Hence, to a certain extent it is amusing (and also pathetic) to note that the legion of social engineers and interventionist politicians who, led at the time by Jacques Delors, designed the single currency as one more tool for use in their grandiose projects to achieve a European political union, now regard with despair something they never seem to have been able to predict: that the euro has ended up acting de facto as the gold standard, disciplining citizens, politicians, and authorities, tying the hands of demagogues and exposing pressure groups (headed by the unfailingly privileged unions), and even questioning the sustainability and the very foundations of the welfare state.[10] According to the Austrian school, this is precisely the main comparative advantage of the euro as a monetary standard in general, and against monetary nationalism in particular; this and not the more prosaic arguments, like “the reduction of transaction costs” or “the elimination of exchange risk,” which were deployed at the time by the invariably short-sighted social engineers of the moment.

Now let us consider the difference between the euro and a system of fixed exchange rates, with respect to the adjustment process which takes place when different degrees of credit expansion and intervention arise between the different countries. Obviously, in a fixed-rate system, these differences manifest themselves in considerable exchange-rate tensions that eventually culminate in explicit devaluations and the high cost in terms of lost prestige which, fortunately, these entail for the corresponding political authorities. In the case of a single currency, like the euro, such tensions manifest themselves in a general loss of competitiveness, which can only be recovered with the introduction of the structural reforms necessary to guarantee market flexibility, along with the deregulation of all sectors and the reductions and adjustments necessary in the structure of relative prices. Moreover, the above ends up affecting the revenues of each public sector, and thus, of its credit rating. In fact, under the present circumstances, in the euro area, the current value in the financial markets of each country’s sovereign public debt has come to reflect the tensions which typically revealed themselves in exchange-rate crises, when rates were more or less fixed in an environment of monetary nationalism. Therefore, at this time, the leading role is not played by foreign-currency speculators, but by the rating agencies, and especially, by international investors, who, by purchasing sovereign debt or not, are healthily setting the pace of reform while also disciplining and determining the fate of each country. This process may be called “undemocratic,” but it is actually the exact opposite. In the past, democracy suffered chronically and was corrupted by irresponsible political actions based on monetary manipulation and inflation, a veritable tax of devastating consequences, which is imposed outside of parliament on all citizens in a gradual, concealed, and devious way. Today, with the euro, the recourse to an inflationary tax has been blocked, at least at the local level of each country, and politicians have suddenly been exposed, and have been obliged to tell the truth and accept the corresponding loss of support. Democracy, if it is to work, requires a framework which disciplines the agents who participate in it. And today in continental Europe that role is being played by the euro. Hence, the successive fall of the governments of Ireland, Greece, Portugal, Italy, Spain and France, far from revealing a democracy deficit, manifests the increasing degree of rigor, budget transparency, and democratic health which the euro is encouraging in its respective societies.

4. The Diverse and Motley “Anti-euro Coalition”

As it would be interesting and highly illustrative, we should now, if only briefly, comment on the diverse and motley amalgam formed by the euro’s enemies. This group includes in its ranks such disparate elements as doctrinaires of the far left and right; nostalgic or unyielding Keynesians like Krugman and Stiglitz, dogmatic monetarists in support of flexible exchange rates, like Barro and others; naive advocates of Mundell’s theory of optimum currency areas; terrified dollar (and pound) chauvinists; and in short, the legion of confused defeatists who “in the face of the imminent disappearance of the euro” propose the “solution” of blowing it up and abolishing it as soon as possible.[11]

Perhaps the clearest illustration (or rather, the most convincing piece of evidence) of the fact that Mises was entirely correct in his analysis of the disciplining effect of fixed exchange rates, and especially of the gold standard, on political and union demagogy lies in the way in which the leaders of leftist political parties, union members, “progressive” opinion makers, anti-system “indignados,” far-right politicians, and in general, all fans of public spending, state subsidies, and interventionism openly and directly rebel against the discipline the euro imposes, and specifically, against the loss of autonomy in each country’s monetary policy, and what that implies: the much-reviled dependence on markets, speculators, and international investors when it comes to being able (or not) to sell the growing sovereign public debt required to finance continual public deficits. One need only glance at the editorials in the most leftist newspapers[12], or read the statements of the most demagogic politicians[13], or of leading unionists, to observe that this is so, and that nowadays, just like in the 1930s with the gold standard, the enemies of the market and the defenders of socialism, the welfare state, and union demagogy are protesting in unison, both in public and in private, against “the rigid discipline the euro and the financial markets are imposing on us,” and they are demanding the immediate monetization of all the public debt necessary, without any countermeasure in the form of budget austerity or reforms that boost competitiveness.

In the more academic sphere, but also with ample coverage in the media, contemporary Keynesian theorists are mounting a major offensive against the euro, again with a belligerence only comparable to that Keynes himself showed against the gold standard in the 1930s. Especially paradigmatic is the case of Krugman[14], who as a syndicated columnist, tells the same old story almost every week about how the euro means a “straitjacket” for employment recovery, and he even goes so far as to criticize the profligate American government for not being expansionary enough and for having fallen short in its (huge) fiscal stimulus packages.[15] More intelligent and highbrow, though no less mistaken, is the opinion of Skidelsky, since he at least explains that the Austrian business cycle theory[16] offers the only alternative to his beloved Keynes and clearly recognizes that the current situation actually involves a repeat of the duel between Hayek and Keynes during the 1930s.[17]

Stranger yet is the stance taken on flexible exchange rates by neoclassical theorists in general, and by monetarists and members of the Chicago school in particular.[18] It appears that this group’s interest in flexible exchange rates and monetary nationalism predominates over their (we presume sincere) desire to encourage economic liberalization reforms. Indeed, their primary goal is to maintain monetary policy autonomy and be able to devalue (or depreciate) the local currency to “recover competitiveness” and absorb unemployment as soon as possible, and only then, eventually, do they focus on trying to foster flexibility and free market reforms. Their naivete is extreme, and we referred to it in our discussion of the reasons for the disagreement between Mises, on the side of the Austrian school, and Friedman, on the side of the Chicago theorists, in the debate on fixed versus flexible exchange rates. Mises always saw very clearly that politicians are not likely to take steps in the right direction if they are not literally obligated to do so, and that flexible rates and monetary nationalism remove practically every incentive capable of disciplining politicians and doing away with “downward rigidity” in wages (which thus becomes a sort of self-fulfilling assumption that monetarists and Keynesians wholeheartedly accept) and with the privileges enjoyed by unions and all other pressure groups. Mises also observed that as a result, in the long run, and even in spite of themselves, monetarists end up becoming fellow travelers of the old Keynesian doctrines: once “competitiveness” has been “recovered,” reforms are postponed, and what is even worse, unionists become accustomed to having the destructive effects of their restrictionist policies continually masked by successive devaluations.

This latent contradiction between defending the free market and supporting monetary nationalism and manipulation via “flexible” exchange rates is also evident in many proponents of the most widespread interpretation of Robert A. Mundell’s theory of “optimum currency areas.”[19] Such areas would be those in which, to begin with, all productive factors were highly mobile, because if that is not the case, it would be better to compartmentalize them with currencies of a smaller scope, to permit the use of an autonomous monetary policy in the event of any “external shock.” However, we should ask ourselves: Is this reasoning sound? Not at all: the main source of rigidity in labour and factor markets actually lies in, and is sanctioned by, intervention and state regulation of the markets, so it is absurd to think states and their governments are going to commit harakiri first, thus relinquishing their power and betraying their political clientele, in order to adopt a common currency afterward. Instead, the exact opposite is true: only when politicians have joined a common currency (the euro in our case) have they been forced to implement reforms which until very recently it would have been inconceivable for them to adopt. In the words of Walter Block:

“… government is the main or only source of factor immobility. The state, with its regulations … is the prime reason why factors of production are less mobile than they would otherwise be. In a bygone era the costs of transportation would have been the chief explanation, but with all the technological progress achieved here, this is far less important in our modern ‘shrinking world.’ If this is so, then under laissez-faire capitalism, there would be virtually no factor immobility. Given even the approximate truth of these assumptions the Mundellian region then becomes the entire globe — precisely as it would be under the gold standard–.”[20]

This conclusion of Block’s is equally applicable to the euro area, to the extent that the euro acts, as we have already indicated, as a “proxy” for the gold standard which disciplines and limits the arbitrary power of the politicians of the member states.

We must not fail to stress that Keynesians, monetarists, and Mundellians are all mistaken because they reason exclusively in terms of macroeconomic aggregates, and hence they propose, with slight differences, the same sort of adjustment via monetary and fiscal manipulation, “fine tuning,” and flexible exchange rates. They believe that all of the effort it takes to overcome the crisis should therefore be guided by macroeconomic models and social engineering. Thus, they completely disregard the profound microeconomic distortion that monetary (and fiscal) manipulation generate in the structure of relative prices and in the capital-goods structure. A forced devaluation (or depreciation) is “one size fits all,” i.e. it entails a sudden linear percentage drop in the price of consumer goods and services and productive factors, a drop which is the same for everyone. Although in the short term this gives the impression of an intense recovery of economic activity and of a rapid absorption of unemployment, it actually completely distorts the structure of relative prices (since without monetary manipulation, some prices would have fallen more, others less, and others would not have fallen at all and might even have risen), leads to a widespread poor allocation of productive resources, and causes a major trauma which any economy would take years to process and recover from.[21] This is the microeconomic analysis centered on relative prices and the productive structure which Austrian theorists have characteristically developed[22] and which, in contrast, is entirely missing from the analytical toolbox of the assortment of economic theorists who oppose the euro.

Finally, outside the purely academic sphere, the tiresome insistence with which Anglo-Saxon economists, investors, and financial analysts attempt to discredit the euro by foretelling the bleakest future for it is to a certain extent suspicious. This impression is reinforced by the hypocritical position of the different US administrations (and also, to a lesser extent, the British government) in wishing (half-heartedly) that the euro zone would “get its economy in order,” and yet self-interestedly omitting to mention that the financial crisis originated on the other side of the Atlantic, i.e. in the recklessness and the expansionary policies pursued by the Federal Reserve for years, and the effects of which spread to the rest of the world via the dollar, as it is still used as the international reserve currency. Furthermore, there is almost unbearable pressure for the euro zone to introduce monetary policies at least as expansionary and irresponsible (“quantitative easing”) as those adopted in the United States, and this pressure is doubly hypocritical, since such an occurrence would undoubtedly deliver the coup de grace to the single European currency.

Might not this stance in the Anglo-Saxon political, economic, and financial world be hiding a buried fear that the dollar’s future as the international reserve currency may be threatened if the euro survives and is capable of effectively competing with the dollar in a not-too-distant future? All indications suggest that this question is becoming more and more pertinent, and though today it does not appear very politically correct, it pours salt on the wound that is most painful for analysts and authorities in the Anglo-Saxon world: the euro is emerging as an enormously powerful potential rival to the dollar on an international level.[23]

As we can see, the anti-euro coalition brings together quite varied and powerful interests. Each distrusts the euro for a different reason. However, they all share a common denominator: the arguments which form the basis of their opposition to the euro would be exactly the same, and they might well repeat and word them even more emphatically, if instead of the single European currency, they had to come to grips with the classic gold standard as the international monetary system. In fact, there is a large degree of similarity between the forces which joined in an alliance in the 1930s to compel the abandonment of the gold standard and those which today seek (up to now unsuccessfully) to reintroduce old, outdated monetary nationalism in Europe. As we have already indicated, technically it was much easier to abandon the gold standard than it would be today for any country to leave the monetary union. In this context, it should come as no surprise that members of the anti-euro coalition often even fall back on the most shameless defeatism: they predict a disaster and the impossibility of maintaining the monetary union, and then right afterward, they propose the “solution” of dismantling it immediately. They even go so far as to hold international contests (– where else — in England, Keynes’s home and that of monetary nationalism) in which hundreds of “experts” and crackpots participate, each with his own proposals for the best and most innocuous way to blow up the European monetary union.[24]

5. The True Cardinal Sins of Europe and the Fatal Error of the European Central Bank[25]

No one can deny that the European Union chronically suffers from a number of serious economic and social problems. Nevertheless, the maligned euro is not one of them. Rather, the opposite is true: the euro is acting as a powerful catalyst which reveals the severity of Europe’s true problems and hastens or “precipitates” the implementation of the measures necessary to solve them. In fact, today, the euro is helping spread more than ever the awareness that the bloated European welfare state is unsustainable and needs to be substantially reformed.[26] The same can be said for the all-encompassing aid and subsidy programs, among which the Common Agricultural Policy occupies a key position, both in terms of its very damaging effects and its total lack of economic rationality.[27] Most of all, it can be said for the culture of social engineering and oppressive regulation which, on the pretext of harmonizing the legislation of the different countries, fossilizes the single European market and prevents it from being a genuine free market.[28] Now more than ever, the true cost of all these structural flaws is becoming apparent in the euro area: without an autonomous monetary policy, the different governments are being literally forced to reconsider (and when applicable, to reduce) all their public expenditure items, and to attempt to recover and gain international competitiveness by deregulating and increasing as far as possible the flexibility of their markets (especially the labour market, which has traditionally been very rigid in many countries of the monetary union).

In addition to the above cardinal sins of the European economy, we must add another which is perhaps even graver, due to its peculiar, devious nature. We are referring to the great ease with which European institutions, many times because of a lack of vision, leadership, or conviction about their own project, allow themselves to become entangled in policies that in the long run are incompatible with the demands of a single currency and of a true free single market.

First, it is surprising to note the increasing regularity with which the burgeoning and stifling new regulatory measures are introduced into Europe from the Anglo-Saxon academic and political world, specifically the United States[29], and often when such measures have already proven ineffective or extremely disruptive. This unhealthy influence is a long-established tradition. (Let us recall that agricultural subsidies, the antitrust legislation, and regulations concerning “corporate social responsibility” have actually originated, like many other failed interventions, in the United States.) Nowadays such regulatory measures crop up repeatedly and are reinforced at every step, for example with respect to the so called “fair market value” and the rest of the International Accounting Standards, or to the (until now, fortunately, failed) attempts to implement the so-called agreements of Basel III for the banking sector and Solvency II for the insurance sector, both of which suffer from insurmountable and fundamental theoretical deficiencies as well as serious problems in relation to their practical application.[30]

A second example of the unhealthy Anglo-Saxon influence can be found in the European Economic Recovery Plan, which the European Commission launched at the end of 2008 under the auspices of the Washington Summit, with the leadership of Keynesian politicians like Barack Obama and Gordon Brown, and on the advice of economic theorists who are enemies of the euro, like Krugman and others.[31] The plan recommended to member countries an expansion of public spending of around 1.5 percent of GDP (some 200 billion euros on an aggregate level). Though some countries, like Spain, made the error of expanding their budgets, the plan, thank God and the euro, and much to the despair of Keynesians and their acolytes[32], soon came to nothing, once it became clear that it only served to increase the deficits, preclude the achievement of the Maastricht Treaty objectives, and severely destabilize the sovereign debt markets of the countries of the euro zone. Again, the euro provided a disciplinary framework and an early curb on the deficit, in contrast to the budget recklessness of countries that are victims of monetary nationalism, and specifically, the United States and especially England, which closed with a public deficit of 10.1 percent of GDP in 2010 and 8.8 percent in 2011, which on a worldwide scale was only exceeded by Greece and Egypt. Despite such bloated deficits and fiscal stimulus packages, unemployment in England and the United States remains at record (or very high) levels, and their respective economies are just not getting off the ground.

Third, and above all, there is mounting pressure for a complete European political union, which some suggest as the only “solution” that could enable the survival of the euro in the long term. Apart from the “Eurofanatics,” who always defend any excuse that might justify greater power and centralism for Brussels, two groups coincide in their support for political union. One group consists, paradoxically, of the euro’s enemies, particularly those of Anglo-Saxon origin: there are the Americans, who, dazzled by the centralized power of Washington and aware that it could not possibly be duplicated in Europe, know that with their proposal they are injecting a divisive virus deadly to the euro; and there are the British, who make the euro an (unjustified) scapegoat upon which to vent their (totally justified) frustrations in view of the growing interventionism of Brussels. The other group consists of all those theorists and thinkers who believe that only the discipline imposed by a central government agency can guarantee the deficit and public-debt objectives established in Maastricht. This is an erroneous belief. The very mechanism of the monetary union guarantees, just like the gold standard, that those countries which abandon budget rigor and stability will see their solvency at risk and be forced to take urgent measures to re-establish the sustainability of their public finances if they do not wish to suspend payments.

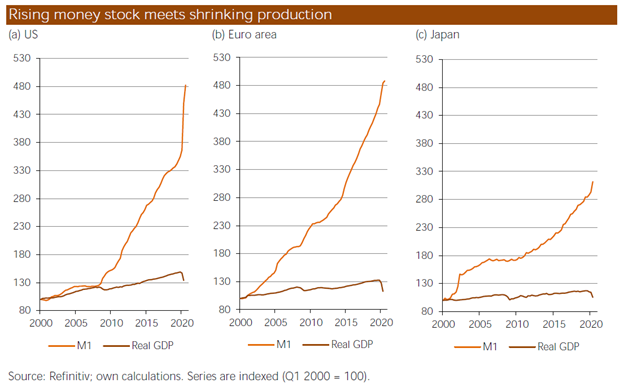

Despite the above, the most serious problem does not lie in the threat of an impossible political union, but in the unquestionable fact that a policy of credit expansion carried out in a sustained manner by the European Central Bank during a period of apparent economic prosperity is capable of canceling, at least temporarily, the disciplinary effect exerted by the euro on the economic agents of each country. Thus, the fatal error of the European Central Bank consists of not having managed to isolate and protect Europe from the great expansion of credit orchestrated on a worldwide scale by the US Federal Reserve beginning in 2001. Over several years, in a blatant failure to comply with the Maastricht Treaty, the European Central Bank allowed M3 to grow by even more than 9 percent per year, which far exceeds the objective of 4.5 percent growth in the money supply, an aim originally set by the ECB itself.[33] Furthermore, even though this increase was appreciably less reckless than that brought about by the US Federal Reserve, the money was not distributed uniformly among the countries of the monetary union, and it had a disproportionate impact on the periphery countries (Spain, Portugal, Ireland, and Greece), which saw their monetary aggregates grow at a pace far more rapid, between three and four times more, than France or Germany. Various reasons can be given to explain this phenomenon, from the pressure applied by France and Germany, both of which sought a monetary policy that during those years would not be too restrictive for them, to the extreme short-sightedness of the periphery countries, which did not wish to admit they were in the middle of a speculative bubble, as is the case with Spain, and thus were also unable to give categorical instructions to their representatives in the ECB council to make an important issue of strict compliance with the monetary-growth objectives established by the European Central Bank itself. In fact, during the years prior to the crisis, all of these countries, except Greece[34], easily observed the 3-percent deficit limits, and some, like Spain and Ireland, even closed their public accounts with large surpluses.[35] Hence, though the heart of the European Union was kept out of the American process of irrational exuberance, the process was repeated with intense virulence in the European periphery countries, and no one, or very few people, correctly diagnosed the grave danger in what was happening.[36] If academics and political authorities from both the affected countries and the European Central Bank, instead of using macroeconomic and monetarist analytical tools imported from the Anglo-Saxon world, had used those of the Austrian business cycle theory[37] — which after all is a product of the most genuine continental economic thought — they would have managed to detect in time the largely artificial nature of the prosperity of those years, the unsustainability of many of the investments (especially with respect to real estate development) that were being launched due to the great easing of credit, and in short, that the surprising influx of rising public revenue would be of very short duration. Still, fortunately, though in the most recent cycle the European Central Bank has fallen short of the standards European citizens had a right to expect, and we could even call its policy a “grave tragedy,” the logic of the euro as a single currency has prevailed, thus clearly exposing the errors committed and obliging everyone to return to the path of control and austerity. In the next section, we will briefly touch on the specific way the European Central Bank formulated its policy during the crisis and how and on what points this policy differs from that followed by the central banks of the United States and United Kingdom.

6. The Euro vs. the Dollar (and the Pound) and Germany vs. the USA (and the UK)

One of the most striking characteristics of the last cycle, which ended in the Great Recession of 2008, has undoubtedly been the differing behaviour of the monetary and fiscal policies of the Anglo-Saxon area, based on monetary nationalism, and those pursued by the member countries of the European monetary union. Indeed, from the time the financial crisis and economic recession hit in 2007-2008, both the Federal Reserve and the Bank of England have adopted monetary policies which have consisted of reducing the interest rate to almost zero; injecting huge quantities of money into the economy (euphemistically known as “quantitative easing”); and continuously, directly, and unabashedly monetizing the sovereign public debt on a massive scale.[38] To this extremely lax monetary policy (in which the recommendations of monetarists and Keynesians concur) is added the strong fiscal stimulus involved in maintaining, both in the United States and in England, budget deficits close to 10 percent of the respective GDPs (which, nevertheless, at least the most recalcitrant Keynesians, like Krugman and others, do not consider anywhere near sufficient).

In contrast with the situation of the dollar and the pound, in the euro area, fortunately, money cannot so easily be injected into the economy, nor can budget recklessness be indefinitely maintained with such impunity. At least in theory, the European Central Bank lacks authority to monetize the European public debt, and though it has accepted it as collateral for its huge loans to the banking system, and beginning in the summer of 2010 even sporadically made direct purchases of the bonds of the most threatened periphery countries (Greece, Portugal, Ireland, Italy and Spain), there is certainly a fundamental economic difference between the behaviour of the United States and United Kingdom, and the policy continental Europe is following: while monetary aggression and budget recklessness are deliberately, unabashedly, and without reservation undertaken in the Anglo-Saxon world, in Europe such policies are carried out reluctantly, and in many cases after numerous, consecutive and endless “summits.” They are the result of lengthy and difficult negotiations between many parties, negotiations in which countries with very different interests must reach an agreement. Furthermore, what is even more important, when money is injected into the economy and support is provided to the debt of countries that are having difficulties, such actions are always balanced with, and taken in exchange for, reforms based on budget austerity (and not on fiscal stimulus packages) and on the introduction of supply-side policies which encourage market liberalization and competitiveness.[39] Moreover, though it would have been better had it happened much sooner, the “de facto” suspension of payments by the Greek state, which has given a nearly 75-percent “haircut” to the private investors who mistakenly trusted in Greek sovereign debt holdings, has clearly signalled to markets that the other countries in trouble have no other alternative than to firmly, rigorously, and without delay carry out all necessary reforms. As we have already seen, even states like France, which until now appeared untouchable and comfortably nestled in a bloated welfare state, have lost the highest credit rating on their debt, seen its differential with the German bund rise, and found themselves increasingly doomed to introduce austerity and liberalization reforms to avoid jeopardizing what has always been their indisputable membership among the euro zone hardliners.[40]

From the political standpoint, it is quite obvious that Germany (and particularly the chancellor Angela Merkel) has the leading role in urging forward this whole process of rehabilitation and austerity (and opposing all sorts of awkward proposals which, like the issuance of “European bonds,” would remove the incentives the different countries now have to act with rigor). Many times Germany must swim upstream. For on the one hand, there is constant international political pressure for fiscal stimulus measures, especially from the US Obama administration, which is using the “crisis of the euro” as a smokescreen to hide the failure of its own policies. And on the other hand, Germany has to contend with rejection and a lack of understanding from all those who wish to remain in the euro solely for the advantages it offers them, while at the same time they violently rebel against the bitter discipline that the European single currency imposes on all of us, and especially on the most demagogic politicians and the most irresponsible privileged interest groups.

In any case, and as an illustration which will understandably exasperate Keynesians and monetarists, we must highlight the very unequal results which until now have been achieved with American fiscal-stimulus policies and monetary “quantitative easing,” in comparison with German supply-side policies and fiscal austerity in the monetary environment of the euro: public deficit, in Germany, 1%, in the United States, over 8.20%; unemployment, in Germany, 5.9%, in the United States, close to 9%; inflation, in Germany, 2.5%, in the United States, over 3.17%; growth, in Germany, 3%, in the United States, 1.7%. (The figures for United Kingdom are even worse than those for the US.) The clash of paradigms and the contrast in results could not be more striking.[41]

7. Conclusion: Hayek versus Keynes

Just as with the gold standard in its day, today a legion of people criticize and despise the euro for what is precisely its main virtue: its capacity to discipline extravagant politicians and pressure groups. Plainly, the euro in no way constitutes the ideal monetary standard, which, as we saw in the first section, could only be found in the classic gold standard, with a 100-percent reserve requirement on demand deposits, and the abolition of the central bank. Hence, it is quite possible that once a certain amount of time has passed and the historical memory of recent monetary and financial events has faded, the European Central Bank may go back to committing the grave errors of the past, and promote and accommodate a new bubble of credit expansion.[42] However, let us remember that the sins of the Federal Reserve and the Bank of England have been much worse still and that, at least in continental Europe, the euro has ended monetary nationalism, and for the states in the monetary union, it is acting, even if only timidly, as a “proxy” for the gold standard, by encouraging budget rigor and reforms aimed at improving competitiveness, and by putting a stop to the abuses of the welfare state and of political demagogy.

In any case, we must recognize that we stand at a historic cross-roads.[43] The euro must survive if all of Europe is to internalize and adopt as its own the traditional German monetary stability, which in practice is the only and the essential disciplinary framework from which, in the short and medium term, European Union competitiveness and growth can be further stimulated. On a worldwide scale, the survival and consolidation of the euro will permit, for the first time since World War II, the emergence of a currency capable of effectively competing with the monopoly of the dollar as the international reserve currency, and therefore capable of disciplining the American ability to provoke additional systemic financial crises which, like that of 2007, constantly endanger the world economic order.

Just over eighty years ago, in a historical context very similar to ours, the world was torn between maintaining the gold standard, and with it budget austerity, labour flexibility, and free and peaceful trade; or abandoning the gold standard, and thus everywhere spreading monetary nationalism, inflationary policies, labour rigidity, interventionism, “economic fascism,” and trade protectionism. Hayek, and the Austrian theorists led by Mises, made a titanic intellectual effort to analyze, explain, and defend the advantages of the gold standard and free trade, in opposition to the theorists who, led by Keynes and the monetarists, opted to blow up the monetary and fiscal foundations of the laissez-faire economy which until then had fueled the Industrial Revolution and the progress of civilization.[44] On that occasion, economic thought ended up taking a very different route from that favored by Mises and Hayek, and we are all familiar with the economic, political, and social consequences that followed. As a result, today, well into the twenty-first century, incredibly, the world is still afflicted by financial instability, the lack of budget rigor, and political demagogy. For all these reasons, but mainly because the world economy urgently needs it, on this new occasion[45], Mises and Hayek deserve to finally triumph, and the euro (at least provisionally, and until it is replaced once and for all by the gold standard) deserves to survive.[46]

REFERENCES

ANDERSON, B. M. 1924. “Cheap Money, Gold, and the Federal Reserve Bank Policy.” Chase Economic Bulletin, vol. 4, no. 3, August 4, p. 9.

BAGUS, P. 2010. The Tragedy of the Euro. Auburn, Alabama: Ludwig von Mises Institute. (Madrid: Unión Editorial, 2011.)

BARBIERI, P. 2012. “The Tragedy of Argentina.” The Wall Street Journal, April 20-22, p. 15.

BARRO, R. 2012. “An Exit Strategy from the Euro.” The Wall Street Journal, Tuesday, January 10, p. 16.

BLACKSTONE, B., M. KARNITSCHNIG, and R. THOMSON. 2012. “Europe’s Banker Talks Tough: Draghi Says Continent’s Social Model is ‘Gone,’ Won’t Backtrack on Austerity.” The Wall Street Journal Europe, February 24.

BLOCK, W. 1999. “The Gold Standard: A Critique of Friedman, Mundell, Hayek and Greenspan from the Free Enterprise Perspective.” Managerial Finance, vol. 25, no. 5, pp. 15-33.

BOOTH, P. 2011. “Europe’s Single Market Isn’t a Free Market.” The Wall Street Journal, Friday, December 23, p. 17.

CABRILLO, F. 2012. “Encadenados al Euro.” Expansión, January 30, p. 39.

EICHENGREEN, B. 2011. The Rise and the Fall of the Dollar and the Future of the International Monetary System. Oxford and New York: Oxford University Press.

ESTEFANIA, J. 2011. “Constitución antipática.” El País, Monday, December 12, p. 29.

FELDSTEIN, M. 2011. “The Euro Zone’s Double Failure.” The Wall Street Journal, Friday-Sunday, December 16, p. 17.

GALLO, A. 2012. “Trade Policy and Protectionism in Argentina.” Economic Affairs, vol. 32, no. 1, February, pp. 55-59.

GOOLSBEE, A. 2011. “Europe’s Currency Road to Nowhere.” The Wall Street Journal, Wednesday, November 30, p. 18.

HARTWELL, R. M. 1995. A History of the Mont Pèlerin Society. Indianapolis: Liberty Fund.

HAYEK, F. A. 1971. Monetary Nationalism and International Stability. New York: Augustus M. Kelley. [First edition, London: Longmans, Green, 1937.]

HAYEK, F. A. 1979. Unemployment and Monetary Policy: Government as Generator of the “Business Cycle.” San Francisco, California: Cato Institute. Lecture given February 8, 1975 and entitled, “Inflation, the Misdirection of Labor, and Unemployment” at the Academia Nazionale dei Lincei in Rome in celebration of the 100th anniversary of Luigi Einaudi’s birth.

HOLLANDE, F. 2012. “La vía conservadora de la austeridad es ineficaz y peligrosa.” La Gaceta, Thursday, January 26, p. 1.

HUERTA DE SOTO, J. 2003. “Nota crítica sobre la propuesta de reforma de las normas internacionales de contabilidad.” Partida Doble, no. 21, April, pp. 24-27.

HUERTA DE SOTO, J. 2009. “The Fatal Error of Solvency II”. Economic Affairs, 29, no. 2, pp. 74-77.

HUERTA DE SOTO, J. 2010. “Algunas reflexiones complementarias sobre la crisis económica y la teoría del ciclo.” Procesos de Mercado: Revista Europea de Economía Política, vol. 7, no. 2, autumn, pp. 193-203.

HUERTA DE SOTO, J. 2011. “Economic Recessions, Banking Reform and the Future of Capitalism.” Economic Affairs, vol. 31, no. 2, June, pp. 76-84.

HUERTA DE SOTO, J. 2012. Money, Bank Credit, and Economic Cycles, 3rd revised edition, 2012. Auburn, Alabama, USA: Ludwig von Mises Institute. [First Spanish edition, 1998.]

KRUGMAN, P. 2012. “The Austerity Debacle.” The New York Times, January 29.

LAPERRIERE, A. 2012. “The High Cost of the Fed’s Cheap Money.” The Wall Street Journal, Tuesday, March 6.

LUSKIN, D. L. and ROCHE KELLY, L. 2012. “Europe’s Supply-Side Revolution.” The Wall Street Journal, Monday, February 20, p. 17.

MARTÍN FERRAND, M. 2012. “El euro es la solución.” ABC, Friday, April 13, p. 14.

MISES, L. von. 1966. Human Action: A Treatise on Economics. 3rd ed. Chicago: Henry Regnery.

MISES, L. von. 1969. Omnipotent Government: The Rise of Total State and Total War. New Rochelle, New York: Arlington House.

MISES, L. von. 2009. The Theory of Money and Credit. Auburn, Alabama: Ludwig von Mises Institute. [First German edition, 1912.]

MISES, M. von. 1984. My Years with Ludwig von Mises. Iowa, USA: Center for Futures Education.

MUNDELL, R. 1961. “Optimal Currency Areas.” The American Economic Review, vol. 51, September, pp. 657-664.

O’CAITHNIA, B. 2011. “Compounding Agricultural Poverty: How the EU’s Common Agricultural Policy is Strangling European Recovery.” Institutions in Crisis: European Perspectives on the Recession. David Howden, ed. Cheltenham, UK and Northampton, USA: Edward Elgar, pp. 200-228.

SKIDELSKY, R. 2011. “The Keynes-Hayek Rematch.” August 19. La Vanguardia, October 6, p. 21.

SORMAN, G. 2011. “La crisis del euro no va a tener lugar.” ABC, October 30, p. 54.

STIGLITZ, J. 2012. “Después de la austeridad”. El Pais, Negocios, Sunday, May 13, p. 19.

ULRICH, F. 2011. “Fiscal Stimulus, Financial Ruin.” Institutions in Crisis: European Perspectives on the Recession. David Howden, ed. Cheltenham, UK and Northampton, USA: Edward Elgar, pp. 142-163.

VIDAL-FOLCH, X. 2012. “Heroica reconstrucción del estado fallido griego.” El País, Thursday, February 23, p. 21.

WHYTE, J. 2011. “The High Cost of a Cheap Pound.” The Wall Street Journal, May 17.

[1] The main authors and theoretical formulations can be consulted in Huerta de Soto 2012 [1998].

[2] Ibid., chapter 9.

[3] F.A. Hayek 1971 [1937].

[4] Though Hayek does not expressly name them, he is referring to the theorists of the Chicago school, led by Milton Friedman, who in this and other areas shake hands with the Keynesians.

[5] Later we will see how, with a single currency like the euro, the disciplinary role of fixed exchange rates is taken on by the current market value of each country’s sovereign and corporate debt.

[6] To underline Mises’s argument even more clearly, I should indicate that there is no way to justifiably attribute to the gold standard the error Churchill committed following World War I, when he fixed the gold parity without taking into account the serious inflation of pound sterling banknotes issued to finance the war. This event has nothing to do with the current situation of the euro, which is freely floating in international markets, nor with those problems which affect countries in the euro zone’s periphery and which stem from the loss in real competitiveness suffered by their economies during the bubble (Huerta de Soto 2012 [1998], 447, 622-623 in the English edition).

[7] In Spain, different Austrian economists, including me, had for decades been clamoring unsuccessfully for the introduction of these (and many other) reforms which only now have become politically feasible, and have done so suddenly, with surprising urgency, and due to the euro. Two observations: first, the measures which constitute a step in the right direction have been sullied by the increase in taxes, especially on income, movable capital earnings and wealth (see the manifesto against the tax increase which I and fifty other academics signed in February 2012); second, the principles of budget stability and equilibrium are a necessary, but not a sufficient, condition for a return to the path toward a sustainable economy, since in the event of another episode of credit expansion, only a huge surplus during the prosperous years would make it possible, once the inevitable recession hit, to avoid the grave problems that now affect us.

[8] For the first time, and thanks to the euro, Greece is facing up to the challenges its own future poses. Though blasé monetarists and recalcitrant Keynesians do not wish to recognize it, internal deflation is possible and does not involve any “perverse” cycle if accompanied by major reforms to liberalize the economy and regain competitiveness. It is true that Greece has received and is receiving substantial aid, but it is no less true that it has the historic responsibility to refute the predictions of all those prophets of doom who, for different reasons, are determined to see the failure of the Greek effort so they can retain in their models the very stale (and self-interested) hypothesis that prices (and wages) are downwardly rigid (see also our remarks in footnote 9 about the disastrous effects of Argentina’s highly praised devaluation of 2001). For the first time, the traditionally bankrupt and corrupt Greek state has taken a drastic remedy. In two years (2010-2011) the public deficit has dropped 8 percentage points; the salaries of public servants have been cut by 15 percent initially and another 20 percent after that, and their number has been reduced by over 80,000 employees and the number of town councils by almost half; the retirement age has been raised; the minimum wage has been lowered, etc. (Vidal-Folch 2012). This “heroic” reconstruction contrasts with the economic and social decomposition of Argentina, which took the opposite (Keynesian and monetarist) road of monetary nationalism, devaluation, and inflation.

[9] Therefore, fortunately, we are “chained to the euro,” to use Cabrillo’s apt expression (Cabrillo 2012). Perhaps the most hackneyed contemporary example Keynesians and monetarists offer to illustrate the “merits” of a devaluation and of the abandonment of a fixed rate is the case of Argentina following the bank freeze (“corralito”) that took place beginning in December of 2001. This example is seriously erroneous for two reasons. First, at most, the bank freeze is simply an illustration of the fact that a fractional-reserve banking system cannot possibly function without a lender of last resort (Huerta de Soto 2012 [1998], 785-786). Second, following the highly praised devaluation, Argentina’s per capita GDP fell from 7,726 dollars in 2000 to 2,767 dollars in 2002, thus losing two-thirds of its value. This 65-percent drop in Argentinian income and wealth should give serious pause to all those who nowadays are clumsily and violently demonstrating, for example in Greece, to protest the relatively much smaller sacrifices and drops in prices involved in the healthy and inevitable internal deflation which the discipline of the euro is requiring. Furthermore, all the patter about Argentina’s “impressive” growth rates, of over 8 percent per year beginning in 2003, should impress us very little if at all, when we consider the very low starting point after the devaluation, as well as the poverty, paralysis, and chaotic nature of the Argentinian economy, where one-third of the population has ended up depending on subsidies and government aid, the real rate of inflation exceeds 30 percent, and scarcity, restrictions, regulations, demagogy, the lack of reforms, and government control (and recklessness) have become a matter of course (Gallo 2012). Along the same lines, Pierpaolo Barbieri states: “I find truly incredible that serious commentators like economist Nouriel Roubini are offering Argentina as a role model for Greece” (Barbieri 2012).

[10] Even the President of the ECB, Mario Draghi, has gone so far as to expressly state that the “continent’s social model is ‘gone'” (Blackstone, Karnitschnig, and Thomson 2012).

[11] I do not include here the analysis of my esteemed disciple and colleague Philipp Bagus (The Tragedy of the Euro, Ludwig von Mises Institute, Auburn, Alabama, USA 2010), since from Germany’s point of view, the manipulation to which the European Central Bank is subjecting the euro threatens the monetary stability Germany traditionally enjoyed with the mark. Nevertheless, his argument that the euro has fostered irresponsible policies via a typical tragedy-of-the-commons effect seems weaker to me, because during the bubble stage, most of the countries that are now having problems, with the only possible exception of Greece, were sporting a surplus in their public accounts (or were very close to one). Thus, I believe Bagus would have been more accurate if he had titled his otherwise excellent book The Tragedy of the European Central Bank (and not of the euro), particularly in light of the grave errors committed by the European Central Bank during the bubble stage, errors we will remark on in a later section of this article (thanks to Juan Ramón Rallo for suggesting this idea to me).

[12] The editorial line of the defunct Spanish newspaper Público was paradigmatic in this sense. (See also, for example, the case of Estefanía 2011, and of his criticism of the aforementioned reform of article 135 of the Spanish Constitution to establish the “anti-Keynesian” principle of budget stability and equilibrium.)

[13] See, for example, the statements of the socialist candidate for the French presidency, for whom “the path of austerity is ineffective, deadly, and dangerous” (Hollande 2012), or those of the far-right candidate, Marine Le Pen, who believes the French “should return to the franc and bring the euro period to a close once and for all” (Martín Ferrand 2012).

[14] One example among many articles is Krugman 2012; see also Stiglitz 2012.

[15] The US public deficit has stood at between 8.2 and 10 % over the last three years, in sharp contrast with German deficit, which stood at only 1% in 2011.

[16] An up-to-date explanation of the Austrian theory of the cycle can be found in Huerta de Soto 2012 [1998], chapter 5.

[17] Skidelsky 2011.

[18] A legion of economists belong to this group, and most of them (surprise, surprise!) come from the dollar-pound area. Among others in the group, I could mention, for example, Robert Barro (2012), Martin Feldstein (2011), and President Barack Obama’s adviser, Austan Goolsbee (2011). In Spain, though for different reasons, I should cite such eminent economists as Pedro Schwartz, Francisco Cabrillo, and Alberto Recarte.

[19] Mundell 1961.

[20] Block 1999, 21.

[21] See Whyte’s (2011) excellent analysis of the serious harm the depreciation of the pound is causing in United Kingdom; and with respect to the United States, see Laperriere 2012.

[22] Huerta de Soto 2012 [1998].

[23] “The euro, as the currency of an economic zone that exports more than the United States, has well-developed financial markets, and is supported by a world class central bank, is in many aspects the obvious alternative to the dollar. While currently it is fashionable to couch all discussions of the euro in doom and gloom, the fact is that the euro accounts for 37 percent of all foreign exchange market turn over. It accounts for 31 percent of all international bond issues. It represents 28 percent of the foreign exchange reserves whose currency composition is divulged by central banks” (Eichengreen 2011, 130). Guy Sorman, for his part, has commented on “the ambiguous attitude of US financial experts and actors. They have never liked the euro, because by definition, the euro competes with the dollar: following orders, American so-called experts explained to us that the euro could not survive without a central economic government and a single fiscal system” (Sorman 2011). In short, it is clear that champions of competition between currencies should direct their efforts against the monopoly of the dollar (for example, by supporting the euro), rather than advocate the reintroduction of, and competition between, “little local currencies” of minor importance (the drachma, escudo, peseta, lira, pound, franc, and even the mark).

[24] Such is the case with, for example, the contest held in the United Kingdom by Lord Wolfson, the owner of Next stores. Up to now, this contest has attracted no fewer than 650 “experts” and crackpots. Were it not for the crass and obvious hypocrisy involved in such initiatives, which are always held outside the euro area (and especially in the Anglo-Saxon world, by those who fear, hate, or scorn the euro), we should commend the great effort and interest shown in the fate of a currency which, after all, is not their own.

[25] It might be worth noting that the author of these lines is a “Eurosceptic” who maintains that the function of the European Union should be limited exclusively to guaranteeing the free circulation of people, capital, and goods in the context of a single currency (if possible the gold standard).

[26] I have already mentioned, for instance, the recent legislative changes that have delayed the retirement age to 67 (and even indexed it with respect to future trends in life expectancy), changes already introduced or on the way in Germany, France, Italy, Spain, Portugal, and Greece. I could also cite the establishment of a “copayment” and increasing areas of privatization in connection with health care. These are small steps in the right direction, which, because of their high political cost, would not have been taken without the euro. They also contrast with the opposite trend indicated by Barack Obama’s health-care reform, and with the obvious resistance to change when it comes to tackling the inevitable reform of the British National Health Service.

[27] O’Caithnia 2011.

[28] Booth 2011.

[29] See, for example, “United States’ Economy: Over-regulated America: The home of laissez-faire is being suffocated by excessive and badly written regulation,” The Economist, February 18, 2012, p. 8, and the examples there cited.

[30] Huerta de Soto 2003 and 2009.

[31] On the hysterical support for the grandiose fiscal stimulus packages of this period, see Fernando Ulrich 2011.

[32] Krugman 2012, Stiglitz 2012.

[33] Specifically, the average rise in M3 in the euro zone from 2000 to 2011 exceeded 6.3%, and we should highlight the increases that occurred during the bubble years 2005 (from 7% to 8%), 2006 (from 8% to 10%), and 2007 (from 10% to 12%). The above data show that, as has already been indicated, the goal of a zero deficit, though commendable, is merely a necessary, though not a sufficient, condition for stability: during the expansionary phase of a cycle induced by credit expansion, public-spending commitments may be made based on the false tranquility which surpluses generate, yet later, when the inevitable recession hits, these commitments are completely unsustainable. This demonstrates that the objective of a zero deficit also requires an economy that is not subject to the ups and downs of credit expansion, or at least that the budgets be closed out with much larger surpluses during the expansionary years.

[34] Therefore, Greece would be the only case to which we could apply the “tragedy of the commons” argument Bagus (2010) develops concerning the euro. In light of the reasoning I have presented in the text, and as I have already mentioned, I believe a more apt title for Bagus’s remarkable book, The Tragedy of the Euro, would have been The Tragedy of the European Central Bank.

[35] The surpluses in Spain were as follows: 0.96%, 2.02%, and 1.90% in 2005, 2006, and 2007 respectively. Those of Ireland were: 0.42%, 1.40%, 1.64%, 2.90%, and 0.67% in 2003, 2004, 2005, 2006, and 2007 respectively.

[36] The author of these lines could be cited as an exception (Huerta de Soto 2012 [1998], xxxvii).

[37] Ibid.

[38] At this time (2011-2012), the Federal Reserve is directly purchasing at least 40 percent of the newly issued American public debt. A similar statement can be made regarding the Bank of England, which is the direct holder of 25 percent of all the sovereign public debt of the United Kingdom. In comparison with these figures, the (direct and indirect) monetization carried out by the European Central Bank seems like innocent “child’s play.”

[39] Luskin and Roche Kelly have even referred to “Europe’s Supply-Side Revolution” (Luskin and Roche Kelly 2012). Also highly significant is “A Plan for Growth in Europe,” which was urged February 20, 2012 by the leaders of twelve countries in the European Union (including Italy, Spain, the Netherlands, Finland, Ireland, and Poland), a plan which comprises only supply-side policies and does not mention any fiscal stimulus measure. There is also the manifesto “Initiative for a Free and Prospering Europe” (IFPE) signed in Bratislava in January 2012 by, among others, the author of these lines. In short, a change of models seems a priority in countries which, like Spain, must move from a speculative, “hot” economy based on credit expansion to a “cold” economy based on competitiveness. Indeed, as soon as prices decline (“internal deflation”) and the structure of relative prices is readjusted in an environment of economic liberalization and structural reforms, numerous opportunities for entrepreneurial profit will arise in sustainable investments, which in a monetary area as extensive as the euro area are sure to attract financing. This is how to bring about the necessary rehabilitation and ensure the longed-for recovery in our economies, a recovery which again should be cold, sustainable, and based on competitiveness.

[40] In this context, and as I explained in the section devoted to the “Motley Anti-euro Coalition,” we should not be surprised by the statements of the candidates to the French presidency, which are mentioned in footnote 13.

[41] Estimated data as of December 31, 2011.

[42] Elsewhere I have mentioned the incremental reforms which, like the radical separation between commercial and investment banking (as in the Glass Steagall Act), could improve the euro somewhat. At the same time, it is in United Kingdom where, paradoxically (or not, in light of the devastating social damage that has resulted from its banking crisis), my proposals have aroused the most interest, to the point that a bill was even presented in the British Parliament to complete Peel’s Bank Charter Act of 1844 (curiously, still in effect) by extending the 100-percent reserve requirement to demand deposits. The consensus reached there to separate commercial and investment banking should be considered a (very small) step in the right direction (Huerta de Soto 2010 and 2011).

[43] My uncle by marriage, the entrepreneur Javier Vidal Sario from Navarre, who remains perfectly lucid and active at the age of ninety-three, assures me that in all his life, he had never, not even during the years of the Stabilization Plan of 1959, witnessed in Spain a collective effort at institutional and budget discipline and economic rehabilitation comparable to the current one. Also historically significant is the fact that this effort is not taking place in just one country (for example, Spain), nor in relation to one local currency (for example, the old peseta), but rather is spread throughout all of Europe, and is being made by hundreds of millions of people in the framework of a common monetary unit (the euro).

[44] As early as 1924, the great American economist Benjamin M. Anderson wrote the following: “Economical living, prudent financial policy, debt reduction rather than debt creation — all these things are imperative if Europe is to be restored. And all these are consistent with a greatly improved standard of living in Europe, if real activity be set going once more. The gold standard, together with natural discount and interest rates, can supply the most solid possible foundation for such a course of events in Europe.” Clearly, once again, history is repeating itself (Anderson 1924). I am grateful to my colleague Antonio Zanella for having called my attention to this excerpt.

[45] Moreover, this historic situation is now being revisited in all its severity upon China, the economy of which is at this time on the brink of expansionary and inflationary collapse. See “Keynes versus Hayek in China,” The Economist, December 30, 2011.

[46] As we have already seen, Mises, the great defender of the gold standard and 100-percent-reserve free banking, in the 1960s collided head-on with theorists who, led by Friedman, supported flexible exchange rates. Mises decried the behaviour of his disciple Machlup, when the latter abandoned the defense of fixed exchange rates. Now, fifty years later and on account of the euro, history is also repeating itself. On that occasion, the advocates of monetary nationalism and exchange-rate instability won, with consequences we are all familiar with. This time around let us hope that the lesson has been learned and that Mises’s views will prevail. The world needs it and he deserves it.

This essay misses the big point that the euro is debt-money, not just fiat. So it is a macroeconomic weapon of mass destruction designed to grow an un-repayable debt bubble until it pops -as is doing- and the “creditors” gets all at liquidation price.

I don’t think Mr de Soto disagrees. If I read it correctly, he is saying that a gold standard should be the aim.

“Mises’s defence of fixed exchange rates parallels his defence of the gold standard as the ideal monetary system on an international level.”

The overriding point is that fixed exchange rates are far better than floats in ANY currency regime, because floating currencies imply inflation for those currencies that are falling, over and above the fiat oversupply inflation ,and inflation is THE monetary cancer.