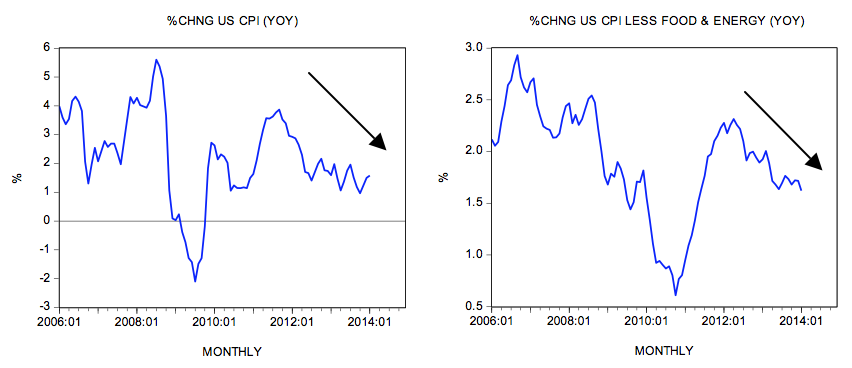

After settling at 3.9% in July 2011 the yearly rate of growth of the consumer price index (CPI) fell to 1.6% by January this year. Also, the yearly rate of growth of the consumer price index less food and energy displays a visible downtrend falling from 2.3% in April 2012 to 1.6% in January.

On account of a visible decline in the growth momentum of the consumer price index (CPI) many economists have concluded that this provides scope for the US central bank to maintain its aggressive monetary stance.

Some other economists, such as the president of the Chicago Federal Reserve Bank’s Charles Evans are even arguing that the declining trend in the growth momentum of the CPI makes it possible for the Fed to further strengthen monetary pumping. This, Evans holds, will reverse the declining trend in price inflation and will bring the economy onto a path of healthy economic growth. According to the Chicago Federal Reserve Bank president the US central bank should be willing to let inflation temporarily run above its target level of 2%. He also said that an unemployment rate of about 5.5% and an inflation rate of about 2% are indicative of a healthy economy.

But how is it possible that higher price inflation will make the economy stronger? If price inflation slightly above 2% is good for the economy, why not aim at a much higher rate of inflation, which will make the economy much healthier?

Contrary to Evans a strengthening in monetary pumping to lift the rate of price inflation will only deepen economic impoverishment by allowing the emergence of new bubble activities and by the strengthening of existing bubble activities.

It will increase the pace of the wealth diversion from wealth generators to various non-productive activities, thereby weakening the process of wealth generation.

Evans and other economists are of the view that a strengthening in monetary pumping will strengthen the flow of monetary spending, which in turn will keep the economy stronger.

On this way of thinking an increase in the monetary spending of one individual lifts the income of another individual whose increase in spending boosts the incomes of more individuals, which in turn boosts their spending and lifts the incomes of more individuals etc.

If, for whatever reasons, people curtail their spending this disrupts the monetary flow and undermines the economy. To revive the monetary flow it is recommended that the central bank should lift monetary pumping. Once the monetary flow is re-established this sets in motion self-sustaining economic growth, so it is held.

Again we suggest that monetary pumping cannot set in motion self-sustaining economic growth. It can only set in motion an exchange of something for nothing i.e. an economic impoverishment.

As long as the pool of real wealth is still growing monetary pumping can create the illusion that it can grow the economy. Once however, the pool is declining the illusion that the Fed’s loose policies can set in motion an economic growth is shattered.

If on account of the deterioration of the infrastructure a baker’s production of bread per unit of time is now 8 loaves instead of 10 loaves and the shoemaker’s production per unit of time is now 4 pair of shoes instead of 8 pair of shoes, then no amount of money printing can lift the production of real wealth per unit of time i.e. of bread and shoes. Monetary pumping cannot replace non-existent tools and machinery.

On the contrary the holders of newly printed money who don’t produce any real wealth will weaken the ability of wealth generators to produce wealth by diverting to themselves bread and shoes thereby leaving less real wealth to fund the maintenance and the expansion of the infrastructure.

Now, Fed officials give the impression that once they put the economy onto the so called self-sustained growth path the removal of the monetary stimulus will not generate major side effects. Note that a loose monetary policy sets in motion bubble activities. The existence of these activities is supported by the monetary pumping, which diverts to them real wealth from wealth generating activities.

Once monetary pumping is aborted bubble activities are forced to go under since they cannot fund themselves without the support of loose monetary policy – an economic bust ensues. The illusion that the Fed can bring the economy onto a self-sustaining growth path is shattered.

Summary and conclusion

On account of a visible decline in the growth momentum of the US price index many economists have concluded that this provides scope for the US central bank (the Fed) to maintain its aggressive monetary stance. Some economists such as the president of the Chicago Federal Reserve Bank, Charles Evans, even argue that the declining trend in the growth momentum of the CPI makes it possible for the Fed to further strengthen monetary pumping. This, it is held, will reverse the declining trend in price inflation and will bring the US economy onto a path of healthy economic growth. We suggest that contrary to Evans a strengthening in monetary pumping will only deepen economic impoverishment by allowing the emergence of new bubble activities and by the strengthening of existing bubble activities.

Is inflation good for long term economic growth? No it is not.

Monetary expansion (let us leave aside the absurd Irving Fisher “price level” definition of inflation – inflation is, in fact, any expansion of the money supply whether “prices in the shops” go up or not) creates a boom-bust which is not even a “zero sum game”.

At the end of the boom-bust the economy is not the same as it would have been had the boom-bust never taken place – it is actually WORSE off that it would have been had the boom-bust not taken place.

“Then prevent the bust – carry on the boom for ever”.

That is the Latin American (well most of Latin America – historically) “solution” of adding monetary expansion to monetary expansion (to try and keep the “boom” going). And if anyone thinks that Latin America is an area of prosperity – then they are quite mistaken.

Actually, as the “money” in question is Federal Reserve Notes, is it not in fact an expansion of debt? For some reason, the witches in Macbeth just popped into my head.

Fed policy mimics the “Goldilocks Theory”, it can’t be too hot or too cold, it should be just right, and implies that the Fed has the ability to measure the economy accurately enough to enpixelate the amount of money necessary for the perfect 2% inflation rate. An inflation rate of 2% annually would mean that after ten years the $1000 you’ve stuffed into your mattress would be worth only $820. This is good? No, of course not. Most people realize this so rather than save their money, which they correctly see as becoming increasingly worthless over time, they buy assets with it, HD TVs, bass boats, Toyota Corollas or even stock in American corporations, an activity that’s seen as positive by the US business community. It would be a negative if inflation went up too much, though. Most everyone has seen black and white photos of Germans pushing wheelbarrows full of Wiemar marks down to the bakery for a loaf of bread. Those much-honored Fed gurus need to have a steady hand on the big US money machine so it churns out just the right quantity of cash. Without them, we’d be screwed.

Inflation steals wealth of savers and puts it in hands of the better connected with power, who usually are not -by far- the best competitors in free market conditions.

That mechanism can create a wave of investments, but not guided by the best decision makers nor the best incentives. So at the end society ends poorer than at the beginning with a bunch of failed projects and many others that do not produce the minimum returns a free environment would demand (consuming wealth instead of creating it).

So with inflation you take wealth accumulated from productive people to give it to a bunch of wasters that did not have to struggle as they should to get it and that will not have the right incentives to get the proper return of the investment.

The mechanism is the very same one as with taxes and subsidies, but without letting people seeing it directly. There is no way such blunder can produce growth, wealth or anything good for anybody besides for some politicians and friends…

Frank Shostak says “If price inflation slightly above 2% is good for the economy, why not aim at a much higher rate of inflation, which will make the economy much healthier?”

Very silly argument. If vitamin C is good for you, why not take fifty times the recommended dose? The answer (in both cases) is that there is such a thing as “OPTIMUM”, though I realised long ago that 90% of the human race have a problem with that concept.

The point, as you may or may not realize, is that it’s practically impossible to determine the OPTIMUM amount of inflation, if there is such a thing. And your silly analogy doesn’t explain how, or even if, anyone can determine the optimum dosage of vitamin C, either. Wouldn’t the recommended dosage be dependent on the patient’s size, metabolism, diet, physical activity, etc., etc.? But the pills only come in certain predetermined sizes and excess vitamin C is eliminated through the urinary tract anyway. The same is not the case with overly enpixelated money.

Hey Ralph,

You do realize his point is not the reductio ad absurdum regarding the 2%, but that there is no rate at which the state can get it right.

John Spiers

Inflation and deflation are an adjustment to the value of money against the goods it is a medium of.

Print more money or increase the supply of credit and the value of money declines and the price goods appears to increase and conversely increase the supply of goods whilst leaving money unchanged then the value of money increases, and the price of goods appears to decline.

Leaving money to find its own value against the value of goods it exchanges would therefore seem, on the face of it, to be the most sensible policy. If you wish, this is the only Goldilocks theory that makes sense.

Unless, of course, the concept of supply and demand is not fully accepted as a reasonable proposition.