The most important fact in economics today goes unmentioned by most economists and bankers: money is created as debt from banks, and it is cancelled when debts are repaid.[1]

I have asked many economists and bankers why this is so seldom mentioned, and always I get the same response: it’s too difficult for the public and most students to understand.

In fact, it’s not so difficult to understand. A famous economist once wrote: ‘The process by which banks create money is so simple that the mind is repelled.’[2]

Why, truly, is the fact so seldom mentioned? Another venerable quotation supplies the answer: ‘The general ignorance (of banking and finance) is not caused by any peculiar difficulty of this branch of political economy, but because those who are best informed are almost all interested in maintaining delusion and error, instead of dispersing both.’[3]

I introduce these respectably-sourced quotations to show that the statement ‘money is debt from banks’ is not an outrageous and invented claim like so many statements today, but something that has been known for a long time.

For instance, many years ago, if you looked up ‘Banking and Credit’ in the Encyclopaedia Britannica you would find the following paragraph: —

‘When a bank lends… two debts are created; the trader who borrows becomes indebted to the bank at a future date, and the bank becomes immediately indebted to the trader. The bank’s debt is a means of payment; it is credit money. It is a clear addition to the amount of the means of payment in the community.’[4]

The creation of money by banks has been described – by a banker – as a magic trick ‘hardly worthy of a third-rate magician.’[5] In magic tricks, the simplest manoeuvres are often the best and the easiest to hide. Audiences are expecting the familiar, when actually something quite different is taking place.

The magic trick of banking occurs when a bank lends. A loan from a bank creates two debts simultaneously: one from the borrower, and one from the bank. They add up to nothing, they come from nothing, and they will return to nothing when the customer’s debt is repaid.

But the two debts are essentially quite different. The debt owed by the bank is money, so the bank is able to charge interest on its own debt. In the words of an economist, ‘a bank is in the delightful position of living on the interest of what it owes’.[6]

The debt owed by the customer, on the other hand, is ordinary debt and it must be repaid, along with interest. More of that later.

After money is created, and until it is cancelled again, it behaves as we expect it to, passing from person to person in payment for things. This helps to deceive the public and prevents them from noticing how the money system contributes to bad things like huge inequality, the proliferation of weapons, and the powers of vast, badly-behaved corporations (these subjects are explored in Chapter 6).

How did this strange situation come to be? A short history makes many things clearer, including how the system developed naturally from people leaving money on deposit with a banker. So, this chapter will describe the simple history of how banks came to be ‘in the delightful position’ of creating money, and how eventually they came, with the help of governments and central banks, to create almost the whole of the world’s money supply.

….

Some of the earliest bits of writing which survive today are not literature or law or religious stories, but records on clay tablets of how much is owed by someone to someone else. This, for instance, was written on a tablet in Mesopotamia several thousand years ago:

‘Mannu-ki-Ahi and Babu-Asherad acknowledge they have 10 minas of silver belonging to Remanni-Adad, chariot-driver, at their disposal.’[7]

This is banking in its simplest form. A person (in this case, the chariot-driver Remanni-Adad) leaves money for safekeeping and gets a credit note (in this case, a clay tablet) in return. Temples in ancient Sumer, Babylon, Egypt, Greece and Rome stored money for people: they were religious institutions doubling up as banks – or was it the other way around?

There is obviously a big difference between bankers storing money and bankers creating money. So, how did banking evolve from simply storing money to creating it? Staying with Remanni-Adad and his bankers for a moment, we can see the simple stages in this evolution, and eventually how ‘money’ became ‘debt from a bank’.

The first stage is to imagine you are a temple banker. With all that money sitting around, and people happy to leave it there, you think ‘Why not put some of it to use?’ – by lending it, investing it, or simply spending it. Of course, every now and then someone will turn up asking for ‘their’ money, so you can’t lend or spend all of it. Part of a banker’s skill is to judge how much he should keep handy, and how much he can get away with lending, investing or spending.

By lending, he will get interest payments. By investing, he may get rich on profit. By spending, he will put himself in jeopardy: if word gets around that he’s spending too much, people may panic and rush to get their money before it’s all gone. There won’t be enough in his vaults to pay them all.

The game’s a bit risky, but the more skilfully the banker plays it the richer he will become.

At this stage, when the banker lends, spends or invests some of the money he’s supposed to be storing, he’s not actually creating money; he’s just putting some back into circulation. And ‘money’ is still gold or silver, or whatever happens to be money at the time.

The second stage towards understanding modern banking is to consider the clay tablet which Remanni-Adad, chariot-driver, got from his bankers. This clay tablet is a claim on silver. Remanni-Adad might keep his tablet in a safe place – or he might try to use it to buy something from someone else – perhaps a new wheel for his chariot. The wheel-seller will happily receive the clay tablet in payment – so long as he is confident that he, rather than Remanni-Adad, can use it to claim silver when he wants to. He is then the owner of the tablet.

If the wheel-seller uses the tablet to claim silver, the tablet goes back to the bank and is redundant. But if the tablet carries on being used to make payments, passing from hand to hand, it becomes money in circulation.[8] And it will be money of a new kind: bank-credit, i.e. debt from a bank. The modern equivalent of Remanni-Adad’s clay tablet is a bank-note. Many of these notes actually have the words ‘I promise to pay on demand the sum of…’ written on them. (Now, of course, those words are a bit of historical fiction, because they pay out nothing but themselves. In the past they paid out gold.)

This highlights the most important legal element in the development of banking. If the law only supports the original depositor in a claim on the silver, the tablet cannot circulate and become money. But if the law declares it will help whoever owns the tablet to claim the silver, the tablet can become money.

When the tablet begins to circulate, there are two kinds of money in circulation: hard cash made of valuable metal, and debt from a bank represented by clay tablets (equivalent to today’s bank notes). The bank has not only created money, it has created a new type of money: bank-credit.

There is another, even simpler way in which bank-debt becomes money. A banker has many customers. Supposing one customer wants to pay another customer. He can ask the banker to adjust the numbers in his accounts so that he owes the second customer rather than the first. A few alterations and hey presto! – payment has taken place. Again, debt from a bank is acting as money.

The third step in the evolution of bank-money introduces an element of outright fraud. Bankers notice their debts are circulating as money, and some of them think: Why not write out a few extra clay tablets or credit notes made out to no one in particular? The banker’s credit notes are money: he can use them to buy things. Some land, perhaps, or a couple of new chariots – or an investment in an exciting new business venture! A banker writes out some new notes (or clay tablets) – and hey presto, again! he is richer.

There is no ‘real money’ – silver or gold – to back these new notes, so there’s an even bigger difference between what the banker has in his vaults and what he owes to his customers (and to other people in possession of his circulating notes).[9]

Again, the same result – of creating new money – can be got by a banker simply writing numbers in his account books. He can create debt from himself – new money – by writing a line of credit for a customer and lending the money he has just created.

At different times, banks have created money in different multiples of what they hold in assets; sometimes two or three times their holdings, usually about ten times, just before a collapse perhaps seventy or eighty times.[10] A maximum was perhaps reached by Hitler’s bankers in Germany, who were creating credit up to 12,000 times the value of what they held in assets.[11]

This is the simple basis of bank-credit becoming money – and of banks creating money. It seems quite incredible that for hundreds of years, many – but not all! – bankers, economists and historians have denied, ignored, or made little of the simple fact that banks create money.

One banker happy to describe his business honestly was a Venetian banker and senator called Tommaso Contarini. In 1584, he described the simplicity and convenience of a banker transferring what he owes from one customer to another: “Buyer and seller are satisfied in a moment while the pen moves over the page, whereas a day would not be enough to complete the transaction for a great mass of merchandize by counting a great number of coins.” [12]

This passage shows the attraction of bank-debt as a form of money. It is convenient and easy, particularly for large payments. It is also safe from robbers, because large amounts of gold don’t have to be moved around. But it is not safe from bank-failures, or from dishonest bankers absconding with cash.

Tommaso Contarini also described the act of creating credit-money by writing numbers in his account books: “A banker may accommodate his friends without the payment of [real] money, merely by writing a brief entry of credit; and he can satisfy his own desires for fine furniture and jewels by merely writing two lines in his books.”[13] These lines are effectively IOU’s. We can imagine Contarini writing a number to say that he owes his furniture-maker a certain amount, and the furniture-maker paying for some wood by telling the banker to owe some of that amount to the wood-merchant instead. Contarini has created money ‘merely by writing a brief entry of credit.’

Of course, the furniture-maker will have to pay interest on the new money – and eventually pay it back.

All these activities emerge very naturally from bankers making use of money deposited with them. The banker, of course, has some anxieties. If his customers all turn up at once to claim cash, he will go bust. He may have to go into hiding to escape his creditors. And another thing: is it legal to create claims on silver he doesn’t have – on silver that doesn’t even exist? He may have his head cut off! – This has happened sometimes, for instance in Barcelona in 1360, when the authorities lost patience with bankers absconding with cash and going on the run.[14]

An English account from 1676 tells us that bankers at least once a year would ‘sue out a general pardon,’ to ‘avoid the penalty of those wholesome Laws made to prevent such Frauds, Oppressions, contempt of Government, and mischiefs to the Public as they are daily guilty of.’[15] It is interesting to note that only twenty years later, the English Parliament made those ‘frauds and oppressions’ legal by getting rid of those ‘wholesome laws’ – of which, more in the next chapter.

This brings in an important theme in our story: the relationship between bankers and the authorities. This has often been a difficult one. Power is jealous of its rivals. When kings and nobles were in charge, they were comfortable with robbery by the sword; they didn’t understand robbery by money-creation; they didn’t want a ‘money-power’ growing stronger and taking over.[16] Organised religions were also wary of ‘money-power’. Judaism, Christianity, Islam and Buddhism all disapproved of lending money at interest (let alone creating it at interest), especially within the community.[17]

Returning to the stages by which banking evolved, a few simple developments bring the story up to date.

First, when banks got into trouble (by running out of gold and silver to pay their customers) the State began to supply its own numbers – its own fake debt – as a substitute. This would initially happen in wartime. In England, the replacement first happened during wars with the French under Napoleon. It would be another century before Parliament gained the confidence to dispense with gold and silver altogether, supplying its own numbers (‘reserve’) on a permanent basis.

With the State in on the act, powers that were previously separate – government and finance – became one organism, sharing the same interest of maintaining the system. The tendrils of this combined power extend today into every aspect of social, financial, political, commercial and academic life. We are all dependent upon it.

When gold was replaced by ‘reserve’, all money became debt from banks –commercial banks and central banks – rented out at interest. Central banks rent out ‘reserve’ and ‘cash’; commercial banks rent out the figures they create, and write into customer’s accounts, when they make a loan.

The ‘debt’ of banks is now 100% fake; it is an illusion, a magician’s trick, performed so that money can be created, rented out, and then ‘retired’ for profit. Because laws enable the debt itself to become money, neither commercial banks nor central banks need ever pay out anything except their own debt: these laws will be the subject of the next chapter.

Before banking could reach its modern status as front-line robber-in-chief, however, it had one more stage to go. This was deregulation. During the 1990’s, the fundamental privileges of banks were extended to other ‘depository institutions’, and accounting practices were adjusted so that multiple persons could actually ‘own’ the same asset.

Madness had struck. Brilliant mathematicians were employed to invent new ways in which debt could be created for profit. A fundamental shift in culture and self-understanding took place. Greed became God. Responsibility went out of the window. ‘Bonuses’ encouraged reckless lending, and governments committed their taxpayers’ money to propping up a system that is utterly unjust.

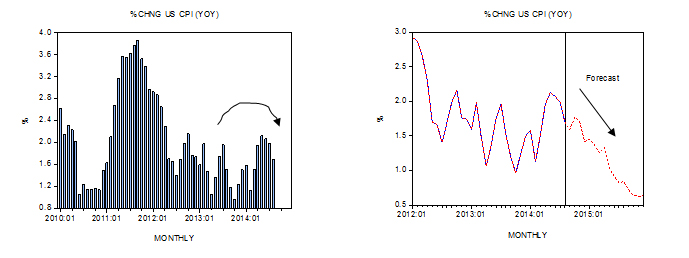

Here is an illustration of relative change in wages, production and financial assets after ‘deregulation’ in one country (Germany):[18]

The system is now almost perfected as a form of globalised robbery. There is, however, a further stage which is presently under way. This is the banning of cash altogether, so that all transactions go through bank and government channels. This new recipe for totalitarianism is being promoted by (among others) the ‘philanthropist’ Bill Gates.[19]

As for citizens and customers, we are mostly ignorant of how the system exploits us. We use numbers, notes and coins provided by governments and banks because that’s what money is in our contemporary world, and we have to live!

[1] The Bank of England, for instance, states it clearly: ‘Bank deposits are simply a record of how much the bank itself owes its customers.’ Quarterly Bulletin 2014 Q1, ‘Money creation in the modern economy.’

[2] John Kenneth Galbraith, Money: Whence it came, Where it Went p. 29. Also, from page 5 of the same book: ‘The study of money, above all other fields in economics, is the one in which complexity is used to disguise truth or to evade truth, not to reveal it.’

[3] Southern Magazine and Monthly Review, 1, p.81. 1841.

[4] 14th edition (1929) & 15th edition (1951). The article was written by Ralph Hawtrey, an English economist.

[5] W.J. Thorne in Banking (1948), p. 133

[6] Frank D. Graham, ‘Partial Reserve Money and the 100 Per Cent Proposal’ in The American Economic Review Vol. 26 (1936).

[7] Cuneiform Texts and the Writing of History by Marc Van De Mieroop (2005) p. 19.

[8] A. H. Pruessner noted that many of these clay tablets specified that whoever owned the tablet would own the debt from the banker; and ‘After this principle was once discovered, its advantages and benefits were found to be so manifold that nothing could stay its victorious advance.’ ‘The Earliest Traces of Negotiable Instruments’ in The American Journal of Semitic Languages and Literatures, Vol. 44, No. 2 (1928).

[9] In the words of a banking historian: ‘The last step in the evolution of the bank-note was the discovery by the [banker] that, as his promises to pay on demand passed from hand to hand as the equivalent of coin supposed to be behind them, so he might, on the faith of his own credit, issue promises to pay on demand that had no foundation of the precious metals as their basis.’ J.B. Martin, The Grasshopper in Lombard Street (1892) p. 127.

[10] Bankers tend to keep in step with one another in the multiples of how much credit they create; not conspiratorially, but out of individual self-interest . See C.A. Phillips, Bank Credit (1931) pp74-5.

[11] Avraham Barkai Nazi Economics (1990) p. 165.

Yale University Press, 1990

[12] Cited in Dunbar, Economic Essays 1904, p. 150 and W.S. Holdsworth, History of English Law (1925) Vol 8, p. 179.

[13] Cited in Dunbar, Economic Essays 1904, p. 148 and W.S. Holdsworth, History of English Law (1925) Vol 8 p. 179.

[14] Abbott Payson Usher, p. 242. Today, things are a little different: the authorities take money from taxpayers to prop up banks, and bankers are free to enjoy the fruits of their robberies.

[15] ‘…most of them do once a year (at least) sue out their general pardon, to avoid the penalty of those wholesome laws made to prevent such frauds, oppressions, contempt of government, and mischiefs to the public as they are daily guilty of.” – The Mystery of the New Fashioned Goldsmiths or Bankers, 1676.

[16] Medieval law put all sorts of impediments in the way of banking operations. Not only was usury – taking interest on loans – forbidden, but ‘The general attitude of medieval law to the assignment of debts, and the special requirements which transfers had to satisfy in order to be legally valid, made the emergence of fully negotiable paper impossible.’ Postan Medieval Trade and Finance (1973) p. 42.

[17] For instance, the Bible: “Thou shalt not lend upon usury to thy brother … Unto a stranger thou mayest lend upon usury.” A fascinating book about the failure of Christian attempts to universalize Jewish antipathy to usury is Benjamin Nelson, The Idea of Usury, 1969.

[18] Source: Helmut Creutz, The Money Syndrome www.TheMoneySyndrome.org

[19] http://norberthaering.de/en/32-english/news/784-gates-india-demonetization

That’s a brilliant article / chapter. The historical material is great. I’m looking forward to the next chapter.

The only part of the argument I have a problem with is to claim towards the end that private banks are in fact robbing the community at large. Actually pinning down how and where the robbery takes place and in a concise and clear manner is difficult, hence the argument that has been going on for a century or more over whether commercial banks should be allowed to create money.

Joseph Huber in his work “Creating New Money” (p.31, 2nd para) said that assuming one starts with a “central bank money only” economy (i.e. full reserve banking) and if commercial banks are allowed to create and lend out money, they can undercut existing lenders because they do not need to earn or borrow that money before lending it: they just print it. I’m pretty sure that’s right and that that results in an artificially low rate of interest.

Also it’s a widely accepted principle that taxpayers and government should not stand behind commercial ventures or activities, and depositing money at a bank with a view to the bank lending it on is clearly a commercial activity. Ergo deposit insurance should be withdrawn.