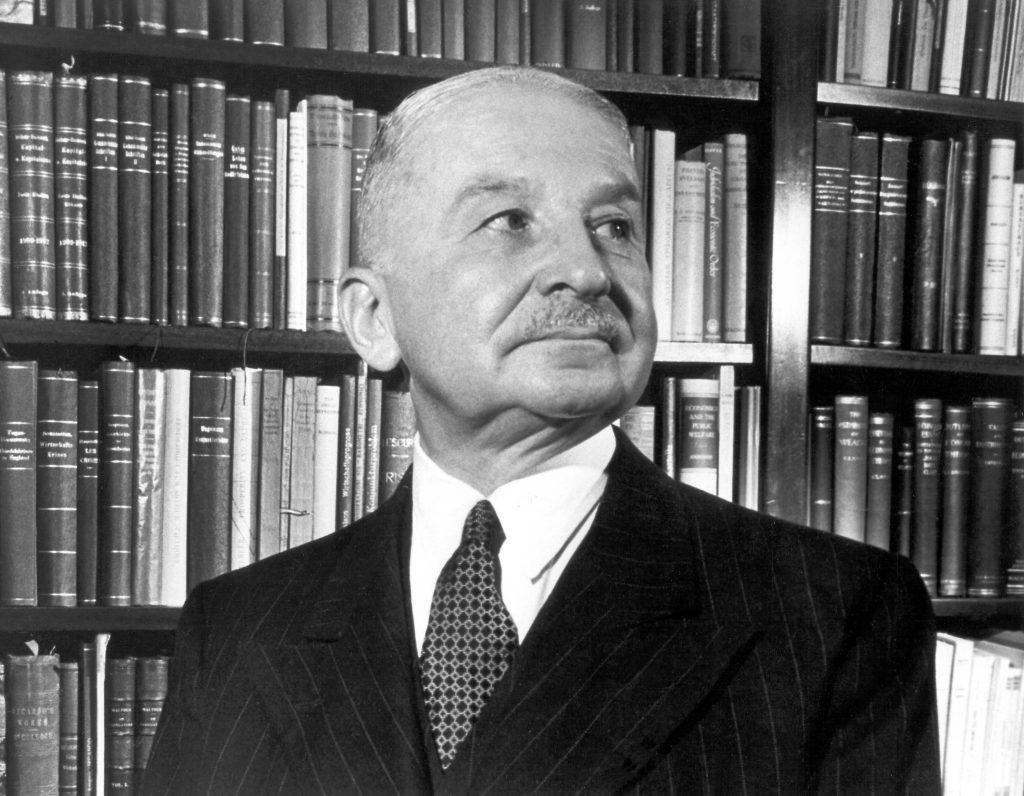

I founded the Cobden Centre inspired by the writing of F A Hayek, particularly his reference in “Denationalization of Money: the Argument Refined” (IEA, 1976) from which the following quote is taken.

I founded the Cobden Centre inspired by the writing of F A Hayek, particularly his reference in “Denationalization of Money: the Argument Refined” (IEA, 1976) from which the following quote is taken.

Free Money Movement

What we now need is a Free Money Movement comparable to the Free Trade Movement of the 19th century, demonstrating not merely the harm caused by acute inflation, which could justifiably be argued to be avoidable even with present institutions, but the deeper effects of producing periods of stagnation that are indeed inherent in the present monetary arrangements.

Now of course that Free Trade Movement was the movement set up by the businessman and radical social reforming liberal, Richard Cobden. Hayek knew that the original founders of that movement attacked the import tariffs or “Corn Laws” that harmed ordinary people. The Corn Laws forced the price of basic food stuffs so high that the working man was almost paying what we would pay today on our mortgages.

The legal privilege that this gave landowners to price gouge the masses at the expense of the privileged few was an outrage and the courageous corn law reformers did away with this invidious protection by repealing the Importation Act of 1815 with the Importation Act of 1846.

In Bright, J. and Thorold Rogers, J.E. (eds.) [1870](1908) Speeches on Questions of Public Policy by Richard Cobden, M.P., Vol. 1, London: T. Fisher Unwin, republished as Cobden, R. (1995), London: Routledge/Thoemmes, they cite a quote from a working man who sums up the iniquities of the Corn Laws that Richard Cobden used:

When provisions are high, the people have so much to pay for them that they have little or nothing left to buy clothes with; and when they have little to buy clothes with, there are few clothes sold; and when there are few clothes sold, there are too many to sell, they are very cheap; and when they are very cheap, there cannot be much paid for making them: and that, consequently, the manufacturing working man’s wages are reduced, the mills are shut up, business is ruined, and general distress is spread through the country. But when, as now, the working man has the said 25s. left in his pocket, he buys more clothing with it (ay, and other articles of comfort too), and that increases the demand for them, and the greater the demand…makes them rise in price, and the rising price enables the working man to get higher wages and the masters better profits. This, therefore, is the way I prove that high provisions make lower wages, and cheap provisions make higher wages.

Sir Robert Peel, who was Prime Minster at the time, was very educated in the works of Hume, Ricardo and Smith: he understood the law of comparative advantage. With a massive starving Irish population (the “potato famine”) and pressure from the likes of Cobden at home, Peel powered through the repeal of the laws. In Morley, J. (1905) The Life of Richard Cobden, 12th ed., London: T. Fisher Unwin, 985 p., republished by London: Routledge/Thoemmes (1995), Peel said in his resignation speech after the repeal had been done for the UK:

In reference to our proposing these measures, I have no wish to rob any person of the credit which is justly due to him for them. But I may say that neither the gentlemen sitting on the benches opposite, nor myself, nor the gentlemen sitting round me—I say that neither of us are the parties who are strictly entitled to the merit. There has been a combination of parties, and that combination of parties together with the influence of the Government, has led to the ultimate success of the measures. But, Sir, there is a name which ought to be associated with the success of these measures: it is not the name of the noble Lord, the member for London, neither is it my name. Sir, the name which ought to be, and which will be associated with the success of these measures is the name of a man who, acting, I believe, from pure and disinterested motives, has advocated their cause with untiring energy, and by appeals to reason, expressed by an eloquence, the more to be admired because it was unaffected and unadorned—the name which ought to be and will be associated with the success of these measures is the name of Richard Cobden. Without scruple, Sir, I attribute the success of these measures to him.

The pound Sterling has lost some 99% of its value since the suspension of commodity-backed money post World War I, as successive governments have chosen not to confront their electorates in an honest fashion and say how much all the activities they say they are doing for you to get your vote will cost you. Instead, tax receipts pick up the majority of the costs of government, but there is always a bit of debt they choose to monetize. This means printing it out of nothing or creating it electronically our of nothing, a term which today is now called QE or quantitive easing.

So, instead of a Free Money Movement, I have started what I call the “Honest Money Movement”.

Why do I use the word honest?

Well I simply use it to show that, like the iniquitous Corn Laws that our forefathers sought to destroy as they gave privilege and wealth to one minority party at the expense of the masses, governments can take everyone’s wealth to benefit them and the few who organize this wealth transfer for them, i.e. the Central Bank and its client banks in the private sector who organize bond sales and purchases. They get the new money wealth effect first, just like the aristocratic land owners of old got the excess price of corn at the expense of the masses of working people.

If honest money is demanded, a government can no longer monetize debt it has to live or fall by its tax receipts only. This means when a politician comes to you at election time with a menu saying “we are going to give you X and Y” they will now have to say, “we propose to take £A and £B from you and give £A and £B to Mr X and Mrs Y” and you can then decide the merits of this knowing what you are getting yourself involved with.

Sir Robert Peel plays another role in our story. He was the first Prime Minster to do something about the bad effects of private sector bankers issuing notes purporting to convert into gold on demand. The trouble being, just as the landed aristocrats kept corn high at the expense of the wealth of the people, so the goldsmiths issued promises to pay on demand on bits of paper that functioned as money, over the actual amount of gold in their safe keeping. This criminality was stopped by the Bank Charter Act of 1844: the original text can be seen here and the amended text, that is still in force today, can be seen here.

Unfortunately for us, there was no restriction on the creation of demand deposits. A demand deposit is where a bank creates an IOU or a bank deposit out of thin air which functions as money.

You as the deposit holder can make payments to anyone who will accept your transfer of this IOU to them. Whenever you write a cheque it is drawn on a bank deposit, whenever you make an electronic payment, you make it from a bank deposit. In Peel’s day, there were over 20 bits of paper, called promissory notes, issued by the goldsmiths of the day, to every unit of gold. When people tried to redeem in gold, there was a “panic” and bust followed the boom.

The rapid creation of bank demand deposits since then has had the same effect. I seek to encourage an amendment to the Bank Charter Act to include deposits and finish off the job that Peel so courageously started. This would stop credit-fuelled boom and bust. All booms and busts, even the South Sea Bubble and the Tulip Mania, can be traced back to credit-fuelled binges that have been created by governments. Remove this power from the governments and their proxies, the bankers, and we can have honest money, peaceful enjoyment of the fruits of our labours and the enrichment of only those who earn it.

A starting point to advance this honest money movement is our banking reform proposal is available here. I hope you will help push for reform and end dishonest money and dishonest government.

A starting point to advance this honest money movement is our banking reform proposal is available here. I hope you will help push for reform and end dishonest money and dishonest government.

More information

- Toby’s interview with Brian Micklethwait explores Toby’s philosophy in more detail: it can be found here.

- The staggering errors behind the policy of QE.

- In The Causes of the Economic Crisis, Mises forecasts and explains the breakdown of the German mark and the market crash of 1929: buy here or read online here (PDF).

The level of financial engineering that has been undertaken in the last half century is a testament to how innovative the human mind can be. If only that level of inventiveness were channelled toward productive work. As much as I adhere to the honest money movement and to see its return, we need to address why it was abadoned. War, social spending, monetizing debt, QE, etc…are just tools used and sanctioned by society and the people they elect to avoid the pain and responsibility of having to produce our way to prosperity. I want honest money, but what good will it do us if we abandon it down the road in favour of convenience? I adore the Cobden Centre for providing ‘concrete’ roadmaps to honest money. What’s also required is a shift of consciousness. Perhaps if we, as consumers, producers, politicians and investors didn’t abuse these corruptible monetary mechanisms to such a radical degree, we would establish the honest money by not participating or fueling the fiat money universe. It’s rather difficult for an addict to give up his or her addiction when they’re constantly surrounded by it. Fiat money needs to accelerate to maintain its value, real money actually increases in value in terms of purchasing power.

Whereas until recently I did not expect to see honest money in my lifetime, I now suspect it is closer than ever before and will come in a form we do not know. In the meantime, I say it would be a great idea to institute competing currencies as Ron Paul is doing in his legislation bill – http://www.govtrack.us/congress/bill.xpd?bill=h111-4248

Cobden Centre is a gem!…and a very inexpensive teacher:)