For over a decade, now, the American economy has been on an economic rollercoaster, of an economic boom between 2003 and 2008, followed by a severe economic downturn, and with a historically slow and weak recovery starting in 2009 up to the present.

Before the dramatic stock market decline of 2008-2009, many were the political and media pundits who were sure that the “good times” could continue indefinitely, including some members of the Board of Governors of the Federal Reserve, America’s central bank.

When the economic downturn began and then worsened, many were the critics who were sure that this proved the “failure” of capitalism in bringing such financial and real economic disruption to America and the world.

There were resurrected long questioned or rejected theories from the Great Depression years of the 1930s that argued that only far-sighted and wise government interventions and regulations could save the country from economic catastrophe and guarantee we never suffer from a similar calamity in the future.

The Boom-Bust Cycle Originates in Government Policy

Not only is the capitalist system not responsible for the latest economic crisis, but all attempts to severely hamstring or regulate the market economy out of existence only succeeds in undermining the greatest engine of economic progress and prosperity known to mankind.

The recession of 2008-2009 had its origin in years of monetary mismanagement by the Federal Reserve System and misguided economic policies emanating from Washington, D.C. For the five years between 2003 and 2008, the Federal Reserve flooded the financial markets with a huge amount of money, increasing it by 50 percent or more by some measures.

For most of those years, key market rates of interest, when adjusted for inflation, were either zero or even negative. The banking system was awash in money to lend to all types of borrowers. To attract people to take out loans, these banks not only lowered interest rates (and therefore the cost of borrowing), they also lowered their standards for credit worthiness.

To get the money, somehow, out the door, financial institutions found “creative” ways to bundle together mortgage loans into tradable packages that they could then pass on to other investors. It seemed to minimize the risk from issuing all those sub-prime home loans, which we viewed afterwards as the housing market’s version of high-risk junk bonds. The fears were soothed by the fact that housing prices kept climbing as home buyers pushed them higher and higher with all of that newly created Federal Reserve money.

At the same time, government-created home-insurance agencies like Fannie Mae and Freddie Mac were guaranteeing a growing number of these wobbly mortgages, with the assurance that the “full faith and credit” of Uncle Sam stood behind them. By the time the Federal government formally took over complete control of Fannie and Freddie 2008, they were holding the guarantees for half of the $10 trillion American housing market.

Easy Money and Lower Interest Rates Led to the Bust

Low interest rates and reduced credit standards were also feeding a huge consumer-spending boom that that resulted in a 25 percent increase in consumer debt between 2003 and 2008, from $2 trillion to over $2.5 trillion. With interest rates so low, there was little incentive to save for tomorrow and big incentives to borrow and consume today. But, according to the U.S. Census Bureau, during that five-year period average real income only increased by at the most 2 percent. Peoples’ debt burdens, therefore, rose dramatically.

The easy money and government-guaranteed house of cards all started to come tumbling down 2008, with a huge crash in the stock market that brought some indexes down 30 to 50 percent from their highs. The same people in Washington who produced this disaster then said that what was needed was more regulation to repair the very financial and housing markets their earlier actions so severely undermined.

That included, at the time, a shotgun wedding between the U.S. government and the largest banks in America, when in October of 2008, the heads of those financial institutions were commanded to come to Washington, D.C. for a meeting with, then, Secretary of the Treasury, Henry Paulson and former Federal Reserve Chairman, Ben Bernanke.

They were told the Federal government was injecting cash into the banking system with a purchase of $245 billion of shares of bank stocks in the financial sector. The banking CEOs present – some of who made it clear they neither needed nor wanted an infusion of government money – were basically told they would not be allowed to leave the Treasury building until they had signed on the dotted line. (The money was eventually returned to the Treasury, with bank buybacks of the shares in which the government had “invested.”)

Opening the Monetary Spigot Again

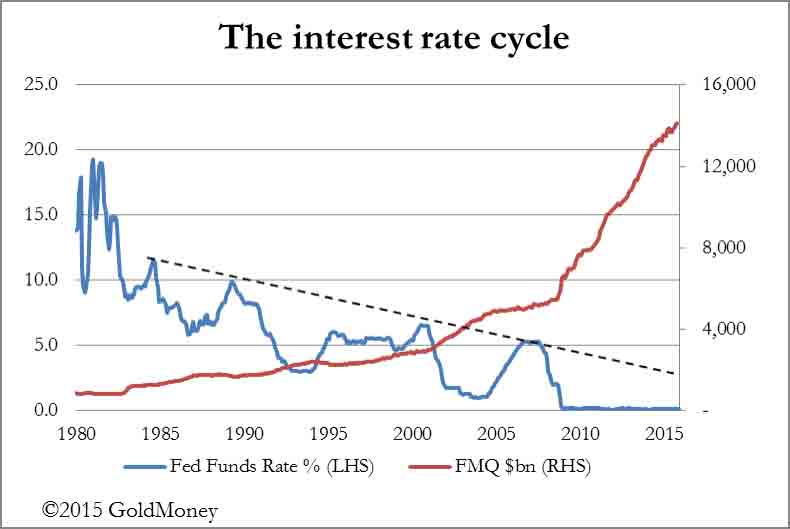

The Federal Reserve, in the meantime, turned on the monetary spigot, increasing the monetary base (cash and bank reserves) between 2007 and 2015 from $740 billion to around $4 trillion, brought about through a series of monetary creation policies under the general heading of “quantitative easing.”

A variety of key interest rates, as a consequence, when adjusted for inflation, have been in the negative range most of the time for seven years. Nominal and real interest rates, therefore, cannot be considered to be telling anything truthful about the actual availability of savings in the economy and its relationship to market-based profitability of potential investments.

Interest rates manipulation has worked similar to a price control keeping the price of a good below its market-determined and clearing level. It has undermined the motives and abilities of some people to save on the supply-side, while distorting demand-side decision-making in terms of both the types and time-horizons of possible investments to undertake, since the real scarcity and cost of borrowing for capital formation has been impossible to realistically estimate and judge in a financial market without market-based interest rates.

Markets have been distorted, investment patterns have been given wrong and excessive directions, and labor and resources have been misdirected into various employments that will eventually be shown to be unsustainable.

Low Inflation and Faulty Price Indexes

Keynesians and other supporters of “stimulus” policies have argued that there has been no need to fear “excesses” in the economy because price inflation has been tame – running less than two percent a year practically the entire time since 2008.

First, it needs to be remembered that this measurement of price inflation is based upon one or another type of statistical price index. This by necessity hides from view all the individual price changes that make up the statistical average, and which has seen in the last few years significant price increases in subsectors of the market.

Second, the full impact of the massive monetary expansion has been prevented from having its full effect due to a policy gimmick that the Federal Reserve has been following since virtually the start of its quantitative easing policies. The central bank has been paying banks a rate of interest slightly above the interest rate it could earn from lending to borrowers in the private sector.

Thus, it has been more profitable for many banks to leave large amounts of their available reserves unlent as “excess reserves” that have been totaling almost $2.8 trillion of the nearly $4 trillion that Federal Reserve as created. Having created all this additional lending potential, the Fed has been manipulating interest rates, again, this time to keep a large amount of it from coming on the market.

Third, particularly since 2014, the world has been increasingly awash in expanding oil supplies that has resulted in dramatically lower prices for refined oil products of all types, and most visibly to the average consumer in the form of falling prices to fill up one’s car with gasoline.

Greater supplies of useful and widely used raw materials and resources at significantly lower cost should be considered a boon to all in the economy, in making production and finished goods less expensive, and thereby raising the standards of living of all demanding such products.

Instead, the Federal Reserve worries about “price deflation” as a drag on the economy, rather than as a market-based stimulus through supply-side plentifulness that, in the long run, reduces the scarcity and cost of desired goods and services.

Central banks around the world have all gravitated to the idea that the “ideal” rate of price inflation that assures economic stability and sustainability is around two percent a year. Fixated on averages and aggregates, the central bankers continue to give little or no attention to the really important influence their monetary policies have on economic affairs: the distortion of the structures of relative prices, profit margins, resource uses and capital investments.

The “Austrian” Theory of Money and the Business Cycle

In my new book, Monetary Central Planning and the State, which will be published in October 2015 by the Future of Freedom Foundation in a eBook format available from Amazon, I explain the “Austrian” theory of money and the business cycle in contrast to both Keynesian Economics and Monetarism.

Developed especially by Ludwig von Mises and Friedrich A. Hayek in the 20th century, the Austrian theory uniquely demonstrates the process by which central bank-initiated monetary expansion and interest rate manipulation invariably sets the stage for both an artificial boom and an eventual, inescapable bust.

Their theory is explained in the context of an analysis of the most severe economic downturn of the last one hundred years, the Great Depression. The crash of 1929 and the depression that followed was the outcome of Federal Reserve monetary policy in the 1920s, when the goal was price level stabilization – neither price inflation nor price deflation. But beneath the apparent stability of the statistical price level, monetary expansion and below-market rates of interest generated a mismatch between savings and investment in the American economy that finally broke in 1929 and 1930.

But the depth and duration of the Great Depression through the greater part of the 1930s was also not due to anything inherent in the market economy. Rather than allow markets to find their new, post-boom market-clearly levels in terms of prices, wages, and resource reallocations, governments in America and Europe undertook a wide variety of massive economic interventions.

The outcome was rising and prolonged unemployment, idle factories, unused capital and vast amounts of economic waste caused by wage and price interventions, large government budget deficits and accompanying accumulated debt, uneconomic public works projects, barriers to international trade due to economic nationalism and protectionism, and introduction of forms of government planning and control over people’s lives and market activities.

Faulty and Misguided Keynesian Ideas

Many of these rationales for “activist” monetary and fiscal policy emerged and took form under the cover of the emerging Keynesian Revolution as first presented by British economist, John Maynard Keynes. In Monetary Central Planning and the State, I also offer a detailed critique of the fundamental premises of the Keynesian approach and why its policy prescriptions in fact lead to the very boom-bust cycle the Keynesians claim to want to prevent.

Furthermore, it is shown why it is that every essential building-block of the Keynesian edifice is based on faulty economic premises, superficial conceptions of how markets actually function, and why its end result is more government control with none of the benefit of economic stability that the Keynesians say is their goal.

Also, in spite of Milton Friedman’s valuable contributions to an understanding of the superiority of competitive markets in general, his own version of activist monetary policy through a “rule” of monetary expansion and “automatic” fiscal stabilizers was more an “immanent criticism” within the Keynesian macroeconomic framework, rather than a fundamental alternative such as the “Austrian” economists have offered.

Private Free Banking, Not Central Banking

What, then, is to be done, in terms of the workings and the institutions of the monetary system? A good part of Monetary Central Planning and the State is devoted to explaining the inherent economic weaknesses and political shortcomings of all forms of central banking.

In a nutshell, central banking suffers from many of the same problems as all other forms of central planning – the presumption that monetary central planners can ever successfully manage the monetary and banking system better than a truly competitive private banking system operating on the basis of market-chosen forms of money and media of exchange.

It is shown how systems of private competitive banking could function if government central banking were brought to an end. This is done through a critical analysis of the proposals for a private monetary and banking system as found in the writings of Ludwig von Mises, Friedrich A. Hayek, Murray N. Rothbard, and the “modern” proponents of monetary freedom: Lawrence H. White, George Selgin, and Kevin Dowd.

Monetary Central Planning and the State ends with a brief list of the steps that could and should be taken to begin the successful transition from central banking to a free market monetary and banking system of the future.

If the last one hundred years has shown and demonstrated anything, it is that governments – even when in the hands of the well intentioned – have neither the knowledge, wisdom nor ability to manage the social and economic affairs of multitudes of hundreds of millions, and now billions, of people around the world. The end result has always been loss of liberty and economic misdirection and distortion.

It is the Time for Monetary Freedom

A hundred years of central banking in the United States since the establishment of the Federal Reserve System in 1913 has equally demonstrated the inability of monetary central planners to successfully direct the financial and banking affairs of the nation through the tools of monopoly control over the quantity of money and the resulting powerful influence on money’s value and the interest rates at which savers and borrowers interact.

It is time for a radical denationalization of money, a privatization of the monetary and banking system through a separation of government from money and all forms of financial intermediation.

That is the pathway to ending the cycles of booms and busts, and creating the market-based institutional framework for sustainable economic growth and betterment.

It is time for monetary freedom to replace the out-of-date belief in government monetary central planning.

Source: http://www.epictimes.com/richardebeling/2015/09/austrian-economics-and-monetary-freedom/