- Despite three Federal Reserve rate cuts, leveraged loan credit quality is rapidly declining

- Covenant-lite issues now account for more than 80% of US$ issues

- CLO managers, among others, may need to sell, but few buyers are evident

For those of you who have not read Michael Lewis’s, The Big Short, the great financial crisis of 2008/2009 was caused by too much debt. The sector which precipitated the great unravelling was the US mortgage market and the particular instrument of mass destruction was the collateralised debt obligation, a security that turned out to be far from secure.

Today, more than a decade on from the crisis, interest rates are close to historic lows throughout much of the developed world. The problem of too much debt has been solved with even more debt. The nature of the debt has changed, so too has the make-up of debtors and creditors, but the very low level of interest rates, when compared to 2008, means that small changes in interest rates have a greater impact the price of credit.

Here is a hypothetical example, to explain the changed relationship between interest rates and credit. Back in 2008 a corporate borrower might have raised capital by issuing debt paying 6%, today the same institution can borrow at 3%. This means they can double the amount of capital raised by debt financing without any change in their annual interest bill. Put another way, apart from the repayment of the principal, which can usually be rolled over, the cost of debt financing has halved over the course of the decade. Firms can raise capital by issuing equity or debt, but, as interest rates decline, debt has become cheaper than equity finance.

In the example above, however, assuming the corporation chooses to double its borrowings, it becomes twice as sensitive to changes in interest rates. A rise from 3% to 4% increases its interest payments by one third, whereas, previously, a rise from 6% to 7% amounted to an increase of just one sixth.

So much for the borrower, but what about the lender? Bonds and other interest bearing securities are generally purchased by investors who need to secure a stable, long-term, stream of fixed income. As interest rates fall they are faced with a dilemma, either accept a lower return or embrace greater risk of default to achieve the same income. At the heart of the financial crisis was the illusion of the free lunch. By securitising a diversified portfolio of high-risk debt, the individual default risk was supposed to be ameliorated. The supposition was that non-correlated investments would remain non-correlated. There is a saying in financial markets, ‘during a crisis, correlations all rise to one.’ In other words, diversification seldom works when you really need it because during a crisis every investor wants the same thing, namely liquidity. Even if the default risk remains unchanged, the market liquidity risk contrives to wipe the investor out.

An alternative to a fixed-income security, which may be especially attractive in a rising interest rate environment (remember the Fed was tightening for a while prior to 2019), is a floating-rate investment. In theory, as short-term interest rates rise the investor can reinvest at more attractive rates. If the yield curve is essentially flat, floating rate investments will produce similar income streams to longer maturity investments, but they will be less sensitive to systemic market risk because they have shorter duration. In theory, credit risk should be easier to manage.

What’s new?

More than ten years into the recovery, we are witnessing one of the longest equity bull-markets in history, but it has been driven almost entirely by falling interest rates. The bond market has also been in a bull-trend, one which commenced in the early 1980’s. For investors, who cannot stomach the uncertainty of the equity market, the fixed income market is a viable alternative, however, as government bond yields have collapsed, income-yielding investments have been increasingly hard to find. With fixed income losing its lustre, credit products have sought to fill the void. Floating-rate leveraged loans, often repackaged as a collateralised loan obligation (CLO), are proving a popular alternative source of income.

The typical CLO is a floating-rate tradable security backed by a pool of, usually, first-lien loans. Often these are the debt of corporations with poor credit ratings, such as the finance used by private equity firms to facilitate leveraged buyouts. On their own, many of these loans rank on the margins of investment grade but, by bundling them together with better rated paper, CLO managers transform base metal into gold. The CLO manager does not stop there, going on to dole out tranches, with different credit risks, to investors with differing risk appetites. There are two general types of tranche; debt tranches, which pay interest and carry a credit rating from an independent agency, and equity tranches, which give the purchaser ownership in the event of the sale of the underlying loans. CLOs are hard to value, they are actively managed meaning their risk profile is in a constant state of flux.

CLOs are not new instruments and studies have shown that they are subject to lower defaults than corporate bonds. This is unsurprising since the portfolios are diversified across many businesses, whilst corporate bonds are the debt of a single issuer. CLO issuers argue that corporations are audited unlike the liar loans of the sub-prime mortgage debacle and that banks have passed ‘first loss’ risk on to third parties. I am not convinced this will save them from a general collapse in confidence. Auditors can be deceived and the owners of the ‘first loss’ exposure will need to hedge. CLOs may be diversified across multiple industry sectors but the market price of the underlying loans will remain highly dependent on that most transitory of factors, liquidity.

Where are we now?

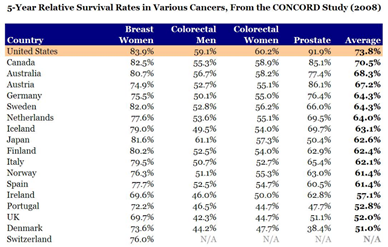

Enough of the theory, in practice many CLOs are turning toxic. According to an October article in the American Banker – A $40 billion pile of leveraged loans is battered by big losses – the loans of more than 50 companies have seen their prices decline by more than 10%. The slowing economy appears to be the culprit, credit rating agencies are, as always, reactive rather than proactive, so the risk that many CLOs may soon cease to be investment grade is prompting further selling, despite the absence of actual credit downgrades. The table below shows magnitude of the problem as at the beginning of last month: –

Source: Bloomberg

It is generally agreed that the notional outstanding issuance of US$ leveraged loans is around $1.2trln, of which some $660bln (55%) are held in CLOs, however, a recent estimate from the Bank of England – How large is the leveraged loan market? suggests that the figure is closer to $1.8trln. The authors go on to state: –

We estimate that there is more than US$2.2 trillion in leveraged loans outstanding worldwide. This is larger than the most commonly cited estimate and comparable to US subprime before the crisis.

As global interest rates have declined the leveraged loan market has more than doubled in size since its post crisis low of $497bln in 2010. Being mostly floating-rate structures, enthusiasm for US$ loans accelerated further in the wake of Federal Reserve (Fed) tightening of short-term rates. This excess demand has undermined quality, it is estimated that around 80% of US$ and 90% of Euro issues are covenant-lite – in other words they have little detailed financial information, often relying on the EBITDA adjustments calculated by the executives of the corporations issuing the loans. Those loans not held by CLOs sit on the balance sheet of banks, insurance companies and pension funds together with mutual funds and ETFs. Several more recent issues, failing to find a home, sit on the balance sheets of the underwriting banks.

Here is a chart showing the evolution of the leveraged loan market over the last decade: –

Source: BIS

Whilst the troubled loans in the first table above amount to less than 4% of the total outstanding issuance, there appears to be a sea-change in sentiment as rating agencies begin to downgrade some issues to CCC – a notch below investment grade. This grade deflation is important because most CLO’s are not permitted to hold more than 7.5% of CCC rated loans in their portfolios. Some estimates suggest that 29% of leveraged loans are rated just one notch above CCC. Moody’s officially admits that 40% of junk-debt issuers rate B3 and lower. S&P announced that the number of issuers rated B- or lower, referred to as ‘weakest links’, rose from 243 in August to 263 in September, the highest figure recorded since 2009 when they peaked at 300. S&P go on to note that in the largest industry sector, consumer products, downgrades continue to outpace upgrades.

As the right-hand of the two charts above reveals, the debt multiple to earnings of corporate loans is at an all-time high. Not only has the number of issuer downgrades risen but the number of issuers has also increased dramatically. At the end of 2010 there were 658 corporate issuers, by October 2019 the number of issuers had swelled 56% to 1025.

The credit spread between BB and the Leveraged Loan Index has been widening throughout the year despite three rate reductions from the Fed: –

Source: Morgan Stanley, FTSE

Q4 2018 saw a sharp decline in prices as the effect of previous Fed tightening finally took its toll. Then the Fed changed tack, higher grade credit recovered but the Leveraged Loan Index never followed suit.

Despite a small inflow into leveraged loan ETFs in September, the natural buyers of sub-investment grade paper have been unnaturally absent of late. Leveraged loan mutual funds have seen steady investment outflows for almost a year.

The inexperience of the new issuers is matched by the inexperience of the investor base. According to data from Prequin, between 2013 and 2017 a total of 322 funds made direct lending investments of which 71 had never entered the market before, during the previous five year only 85 funds had made investments of which just 19 were novices.

Inexperienced investors often move as one and this is evident in the recent absence of liquidity. The lack of willing buyers also highlights another weakness of the leveraged loan market, a lack of transparency. Many of the loans are issued by private companies, information about their financial health is therefore only available to existing holders of their equity or debt. Few existing holders are inclined to add to their exposure in the current environment. New purchasers are proving reticence to fly blind, as a result liquidity is evaporating further just at the moment it is most needed.

If the credit ratings of leveraged loans deteriorate further, contagion may spill over into the high-yield bond market. Whilst the outstanding issuance of high-yield bonds has been relatively stable, the ownership, traditionally insurers and pension funds, has been swelled by mutual fund investors and holders of ETFs. These latter investors prize liquidity more highly than longer-term institutions: the overall high-yield investor base has become less stable.

Inevitably, commentators are beginning to draw parallels with mortgage and CDO crisis. The table below, from the Bank of England report, compares leveraged loans today with sub-prime mortgages in 2006: –

Source: Bank of England

The comparisons are disquieting, the issuers and underlying assets of the leveraged loan market may be more diversified than the mortgages of 2006, but, with interest rates substantially lower today, the sensitivity of the entire market, to a widening of credit spreads, is considerably greater.

The systemic risks posed by a meltdown in the CLO market is not lost on the BIS, page 11 of the latest BIS Quarterly Review – Structured finance then and now: a comparison of CDOs and CLOs observes: –

…the deteriorating credit quality of CLOs’ underlying assets; the opacity of indirect exposures; the high concentration of banks’ direct holdings; and the uncertain resilience of senior tranches, which depend crucially on the correlation of losses among underlying loans.

These are all factors to watch closely. The authors’ remain sanguine, however, pointing out that CLOs are generally less complex than CDOs, containing little credit default swap or resecuritisation exposure. They also note that CLOs are less frequently used as collateral in repurchase agreements rendering them less likely to be funded by short-term capital. This last aspect is a double-edge sword, if a security has a liquid repo market it can easily be borrowed and lent. A liquid repo market allows additional leverage but it also permits short-sellers to provide essential liquidity during a buyers strike, in the absence of short-sellers there may be no one to provide liquidity at all.

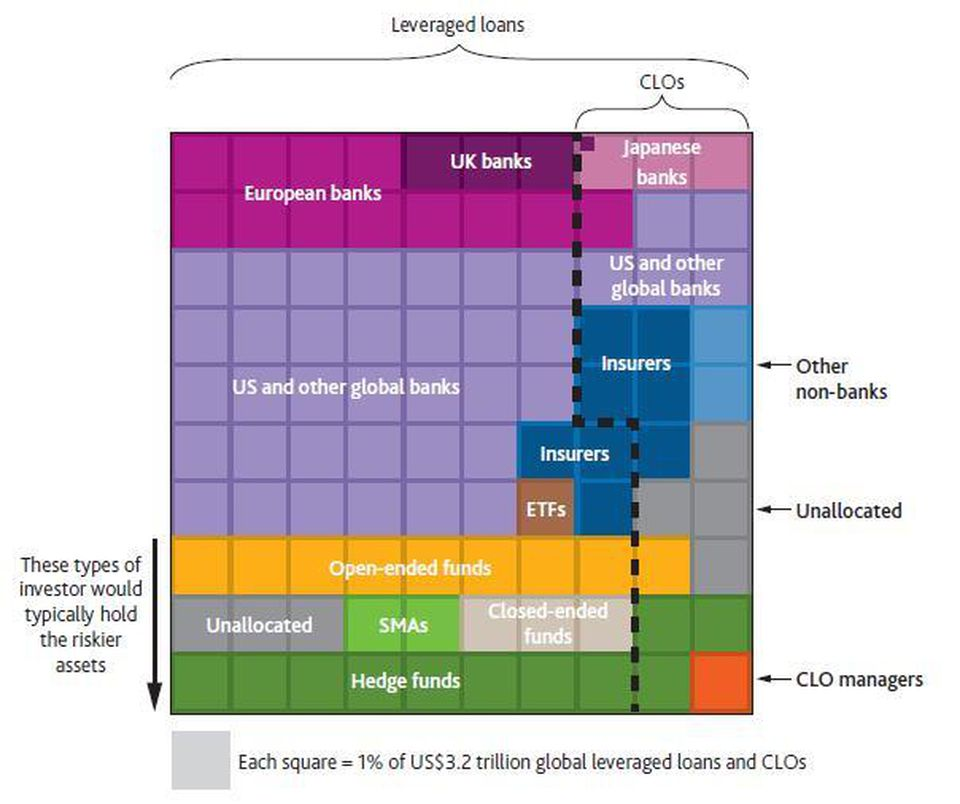

In terms of counterparties, the table below shows which institutions have the largest exposure to leveraged loans: –

Source: Bank of England

Bank exposure is preeminent but the flow from CLOs will strain bank balance sheets, especially given the lack of repo market liquidity.

Conclusions and Investment Opportunities

The CLO and leveraged loan market has the capacity to destabilise the broader financial markets. Rate cuts from the Fed have been insufficient to support prices and economic headwinds look set to test the underlying businesses in the next couple of years. A further slashing of rates and balance sheet expansion by the Fed may be sufficient to stave off a 2008 redux but the warning signs are flashing amber. Total financial market leverage is well below the levels that preceded the financial crisis of 2008, but as Mark Twain is purported to have said, ‘History doesn’t repeat but it rhymes.’

Until the US election in November 2020 is past, equity markets should remain supported. Government bond yields are unlikely to rise and, should signs of economic weakness materialise, may plumb new lows. Credit spread widening, however, even as government bond yields decline, is a pattern which will become more prevalent as the cash-flow implications of floating-rate borrowing instil some much needed sobriety into the market for leveraged loans. With interest rates close to historic lows credit markets are, once again, the weakest link.