Roger W Garrison’s Time and Money: The Macroeconomics of Capital Structure bursts with insight but this from the final chapter could be the missing link in the debate about the economic crisis:

[D]oes the existence and variability of production time have a first-order claim on our attention?

This is the question which divides the schools of economic thought. If the answer is ‘no’, then conventional macroeconomics is right to ignore production time when dealing with questions of short-run variations in output and employment. Austrian capital-based macroeconomics makes it a “foundational concern”.

It is that foundational concern which makes up the substance of the book. Garrison introduces and develops a macroeconomics of capital structure before assessing the Keynesian and Monetarist frameworks. He’s careful to ensure the reader does not come to believe that his Austrian School construction is a substitute for all other frameworks, but the implications of his work are profound in relation to the boom-bust cycle, fiscal policy, monetary policy and the prescriptions that might be made in the face of crisis.

But good news! It’s not necessary to read the book to learn the elements of his arguments. The author has made available these PowerPoint animations, which I thoroughly recommend:

This is the essential lesson of the book (p108):

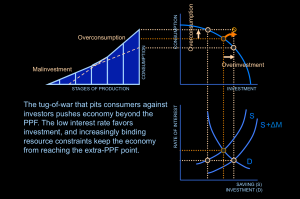

Production time can put a lag between an intervention in credit markets and the ultimate consequences of the intervention. Of particular concern to Hayek was credit expansion, which affects the capital structure’s intertemporal orientation. Cheap credit favours a reallocation of resources among the stages of production that is inconsistent with intertemporal preferences of consumers. More specifically, the artificially low rate of interest causes production plans to become more future-oriented and consumption plans to become less so.

Perhaps all this is just so much hot air, in which case, why did so many economists and commentators fail to see this crisis coming, then fail to predict even the general course of events? The 18 July 2009 edition of The Economist featured a textbook of modern economic theory melting away with the caption “Where it went wrong and how the crisis is changing it”. They began the relevant article,

OF ALL the economic bubbles that have been pricked, few have burst more spectacularly than the reputation of economics itself.

The article called for a reinvention of macroeconomics. This book could be part of that reinvention, one which looks increasingly overdue.

This article was previously published at stevebaker.info.

Sadly the Economist magazine did not draw the obvious conclusion from their July 2009 article (if “mainstream economics” is discredited then its policy advice is discredted) and contiues demand endless bailouts and “stimulus”.

However, this post is very good indeed. It is astonishing that a Member of the House of Commons can write this.

I will certainly try and spread this article about.

It’s interesting (and disappointing) that the mainstream schools of economics dismiss capital theory. Capital, to them, is nothing but a clump of money that is, somehow, always “there.” Of course, it isn’t.

Capital projects typically take a long time to complete (think of building a factory or a power plant.) It stands to reason that artificially-low interest rates would spur such projects. The low rate will allow the use of the borrowed money for a longer period of time.

Amazing that this is still ignored, and, when not ignored, is often made fun of.

Craig, like bread arriving from heaven , capital to the mainstream is always there as you say and always replenishing itself as well , magically , mysteriously , especially when more money units are made. Honestly , you could not make it up.

I always thought it was weird that Marx called his Magnum Opus ‘Capital’ but its really all about how capital isnt important at all.

Other than the planet earth itself, the capital stock is the greatest thing we have. It is thus easy to take for granted. It is also exceedingly complex, defying attempts to model it. A praxeological approach is the only one that can explain how the capital stock comes into existence, how it is maintained, how it depreciates, how it grows. For more on this, see A Capital Paradox: http://www.atomcapital.co.uk/wp-content/files_mf/1313578422AMPH_Report1210b.pdf