Governments have refused to accept the necessity of a period of economic re-adjustment following the credit-bubble. The bubble burst about five years ago and economic progress has been effectively suspended ever since. The consequences of this refusal to accept reality are at a minimum to make this adjustment unnecessarily drawn out and needlessly painful, without offering a better eventual outcome.

Reduced to its bare bones, the choice has been either to accept that unviable businesses and over-extended banks must go bust, or to ignore the problem and hope it goes away. We are familiar with this dilemma as investors: a business that refuses to adapt to new realities will eventually fail. Before it does, its investors have the chance either to sell their shares and perhaps reinvest their money more profitably, or to refuse to accept an early loss on their investment. Most of us, being human, take the latter course and usually regret it.

The lesson, if we care to learn it, is that the product of time and money is more valuable than the desire to avoid a book loss. In economic terms, it is better for resources to be deployed efficiently than to tie them up in inefficient or unwanted activity. This is a decision for markets, not governments, which brings us back to the necessity for economic re-adjustment. Governments have simply not faced up to the reality that we are in a post-credit-bubble mess: they still hope the problem will be resolved by time.

At this point we must dismiss objections that you cannot compare national accounts with those of a business. Such platitudes display wishful thinking more than a grasp of reality. However, wishful thinkers have a minor point in that governments have the wherewithal to put off the inevitable for longer than failing businesses; but the result is the zombie-like economy we face today.

Governments are refusing to let markets clear: prices have not been permitted to fall to a clearing level. They put it off because the American economist Irving Fisher came up with a plausible theory about financial deflation in the 1930s, and they don’t want to face the bankruptcies of the over-indebted, the businesses that rely on the state for their survival, and the banks that have foolishly lent them too much money.

Reality is now catching up with western governments. Their underlying financial position is rapidly deteriorating, with welfare costs spiralling out of control and governments already heavily in debt. They cannot realistically underwrite the global banking system, which is insolvent and considerably larger than the governments themselves. The economic recovery which is the governments’ get-out-of-jail card will not occur without that economic readjustment.

We are long past the point of no return: that was probably when the Federal Reserve Board under Greenspan decided to rescue the stock market by cutting interest rates to 1% in 2003/04. It has been crisis management by the state ever since. We have progressed to the point where governments have chosen to protect themselves, in preference to looking after the true interests of their electorates.

Governments are now reduced to screwing their electorates for their own survival, which is their last refuge from reality.

This article was previously published at GoldMoney.com.

We are indeed looking down the barrel…

The only economic bright spot in the West has been the boom on oil and gas production in North America – the boom that Barack Obama has, hypocritically, tried to take credit for (even as his people try to destroy the oil and gas expansion by new regulations and taxes).

But all the “monetary and fiscal easing” around the West (including Japan – and including India now, I admit that I am ignorant of China) has been a FALIURE, a total FAILURE.

Yet the establishment (including the “Nobel” price winners Krugman and Stiglitz) just demand even more government spending (on everything from “infrastructure”, i.e. Corporate Welfare, to failed welfare schemes such as educational “Head Start”).

They are a one trick pony – and the trick is create more money (from NOTHING) and then have government (and Corporate Welfare interests such as the housing market in Britain and the United States) spend the money – the trick has already failed, yet they continue to do it anyway.

If it was not so tragic the antics of the establishment elite (including the British government) would be an amusing farce.

As for the claims of “austerity” in Europe – actually government spending is HIGHER in all the major countries of Europe than it was before the crises started in 2007-8. And, of course, the monetary policy of the European Central Bank has been the same bail-out madness that it has been in Britain, the United States and………

The Euro Zone economies are failiing – but not because “government has been rolled back”, because government has NOT been rolled back in France, Italy, Germany (and so on).

The blatent dishonesty of the media (such as the Economist magazine) has been disgusting, they have even pretended that the tax increasing Italian government (the government of unelected “techocrats” put in power by a European Union backed de facto coup) has followed a “free market policy”.

Tax increases, new taxs – and demands for more government “investment” (in education and everyting else).

And that (according to the establishment media) is a free market policy in Italy.

Of course – just as the endless (ILLEGAL) bailouts from the European Central Bank are a “free market policy”.

Hopefully, in comming elections, the people of Italy (and other European countries) will see through the lies of the Economist magazine and so on – but what are the alternatives? There are alternatives (such as “Stop the Decline” in Italy), but what do they stand for? What are their specific policies?

Paul Marks, Governments are not able to create money from nowhere: any new money simply takes its value from money already in circulation.

This is the problem. £1 taken from the productive sector translates into £1 minus x when spent by the government.

Yet still they spend and still they print comforted by the superficiality of Keynes and Monetarist jargon.

There is a watershed somewhere, but where?

“they still hope the problem will be resolved by time” Yes the problem will be resolved by time (reality will not go away). It is only a matter of how. Hold on to your hat.

Governments are not able to create money from nowhere

Ah, but they do. And it spends just like the old money … for a while.

The economy is not something that can be managed, it can only be sabotaged. The debate ought not to be framed in terms of whether or not the economy is being managed properly, but how much damage the government is doing.

The current Zeitgeist appears to be that the economy (and therefore the productive taxpayers) exists to support the government, and anything else is not a relevant consideration.

Craig Howard, it is coin clipping by any other name. Nothing new about it not new money as such and a total fraud on the people, whoever does it

These crises have happened so often (22 times in the 20th Century according to Ron Paul in his book End the Fed), that I see it as entirely intentional. Banks know they can bet on every horse in a race (sub-prime loans) and collect their winnings by foisting the debt on the taxpayer.

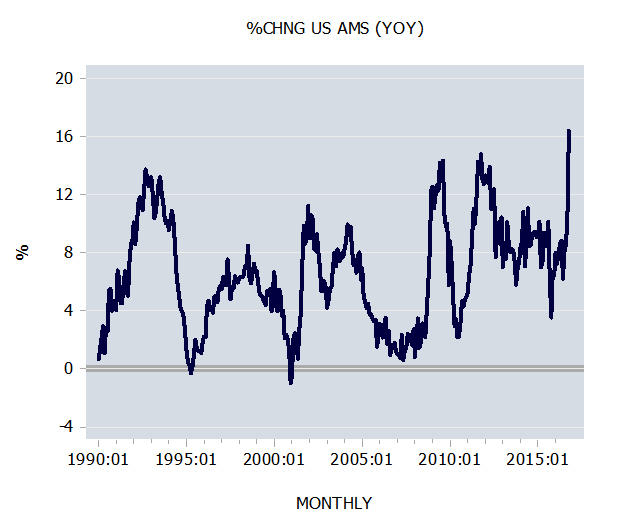

Max Keiser had this interesting chart

http://www.youtube.com/watch?v=ewA8KU9PJgs&feature=player_embedded#!

showing the wealth gap widening since nixon took the dollar (and therefore the pound) off the gold standard in 1971. This is conclusive evidence that network of Central Banks gained control the worlds currencies to steer wealth and power their way, ushering in fascism in order to preserve their position.

The trouble with Max Keiser is that he mixes true (and interesting) observations with lies.

I have spotted telling him lies in each show of his that I have seen.

That is why I never use him as a source – for anything.

He may have come up with something totally wonderful (and true) insight – but the next second he will slip a lie (a blatent untruth).

He is not a reliable man.