There is a new campaign to end austerity. First, the IMF lets it be known it has second thoughts about it; then we are told the threshold of 90% government debt to GDP which must not be crossed, set by Professors Reinhart & Rogoff, is based on an excel spread-sheet error. Lastly, Bill Gross of PIMCO, the largest bond fund in the world, tells us austerity is not working.

The new mood is spreading, to the relief of beleaguered countries like Spain and Italy. Austerity is painful, and politicians don’t like it because it makes them unpopular. Nor do Keynesian and monetarist economists, who see its failure as justification for more intervention.

Austerity, as practised by Western governments, involves maintaining public spending at the cost of the private sector. It is therefore hardly surprising that it leads to the destruction of the wealth-creation necessary to support government finances. Its only, if questionable virtue, is statistical: the maintenance of government spending ensures that its share of GDP does not fall, thereby not undermining “growth”. But government spending is simply a constraint on the productive private sector, because any economic resource diverted from it to pay for government is effectively squandered.

If an economy is to progress at all, there has to be as much austerity as possible, aimed squarely and solely at the government sector. Give individuals and businesses a lighter tax burden, the result of smaller government, and economic prospects will rapidly improve. Instead, the new anti-austerity mood will translate into a new licence for governments to relax their spending restraints.

Anyway, central banks including the ECB have shown they are ready to underwrite government spending if the markets are not prepared to, at almost zero interest cost. This explains why the yield on Italian debt, for example, has fallen despite the political drift of its non-government away from spending restraint.

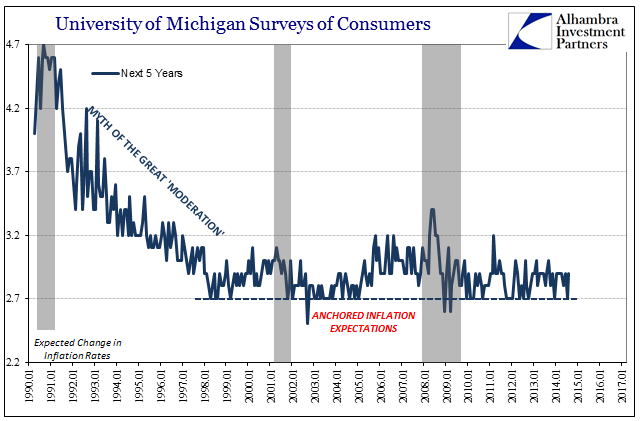

One reason this is tolerated by bond investors such as PIMCO is the simple assumption that inflation is only a problem if there is a pick-up in demand. With all major economies either slowing or moving into recession that fear is increasingly remote. But history tells us this is a mistake, and that prices are capable of rising even in a recession, and a proper understanding of price theory also demonstrates the falsity of the assumption.

For the moment, ordinary people and their banks are showing a preference for money over goods, and have been since the banking crisis five years ago, which is why demand remains subdued. However, increasing risks to bank deposits from bank failures are likely to trigger a flight into physical cash and goods. And with economies all over the world stalling under the burden of the cost of government, this risk to banks and bank deposits is both increasing and becoming more immediate.

Complacency over inflation and interest rates also has to face the new impetus given to the expansion of the money supply implied by the abandonment of austerity. And this is merely another reason for monetary expansion, added to all the others. What we are seeing played out in front of us is no more than the compelling political reasons behind nearly every hyperinflation in modern history, which will almost certainly end in the collapse of today’s paper currencies.

This article was previously published at GoldMoney.com.

Can the establishment (the “mainstream” media and so on) point at many countries where total government spending (including bailouts and so on) is LOWER today than it was when the crises started in fiscal 2007-8?

I do not think they can – because I do not think many such countries (where total government spending is lower now than it was in fiscal 2007-8) exist.

In short TAX INCREASING part of “austerity” is real (hence, for example, the reaction of the people of Iceland over the weekend), but the CUTTING TOTAL GOVERNMENT SPENDING part of “austerity” is not real in most countries. Total government spending in most countries is not lower than it was in fiscal 2007-8 – it is higher.

When the ConDem coalition came into government, in the UK, in 2010, I naively believed that they would drastically reduce the number of people who are employed by the state (local and national, quangos and other taxpayer funded enterprises). How wrong I was. There should be hundreds of thousands of those who were given non-jobs during the 13 years of Labour misrule, who are now feeling the effects of what they contributed to bring us to this sorry mess. Instead, I don’t see any meaningful programme to reduce their numbers. Well, someone’s going to have to do it, sooner of later before we are reduced to penury and reduced to scavenging for food.

So many mistakes in Alasdair Macleod’s article I’m not sure where to start.

In his third paragraph he trots out the tired old myth promoted by the political right, namely that government spending destroys wealth. So the NHS or law enforcement “destroy wealth”? The truth is that we have public spending because the electorate regard sundry forms of public spending as conferring more wealth on them than more booze, cars or foreign holidays. It’s plain impossible to PROVE that the electorate are right or wrong there. Likewise if a member of the oldest profession is paid more than a nurse, that PROVES the former creates more wealth than the latter (according to strict free market principles). But is the free market right there?

Incidentally I’m very much on the political right myself: I stood for the BNP in an election a few years ago. But I can distinguish between crass arguments put by the political right and intelligent right of centre arguments.

In his second paragraph, Macleod confuses Eurozone problems with the problems of countries which issue their own currencies (a very common mistake). Contrary to MacLeod’s suggestions no Keynsian – or at least no Keynsian with a brain – would suggest that Spain and Italy (cited by MacLeod) can have austerity magically removed via Keynsian stimulus.

Reason is that the basic problem in the EZ is the divergence in competitiveness that has arisen over recent years. And requires getting periphery costs down, which in the case of the EZ is done in a thoroughly ham fisted way: imposing austerity. While I favour Keynsian type stimulus in a country in a recession which also issues its own currency, that remedy is not available for the Spains and Italys of this world.

The truth is that we have public spending because the electorate regard sundry forms of public spending as conferring more wealth on them than more booze, cars or foreign holidays.

That’s incredibly incorrect. The electorate certainly regards many government services [your NHS, for example] as valuable. But no one at all considers the rendering of the service as “conferring wealth” on them.

I pay a private company to have my garbage collected weekly. It’s a service I find worthwhile. It saves me the trouble of driving my rubbish to the dump [tip?] and keeps my house neater and more sanitary. I’m more than willing to exchange some of my money for the collection.

Never in a hundred years, though, would I imagine that Dave the garbageman was conferring wealth on me. It’s really quite laughable. If anything, it’s the opposite.

If the garbage is picked up by the government, nothing in my example changes — except that it would probably cost more. In short, government is a drain on the economy whether the service is valued or not.

“So the NHS or law enforcement “destroy wealth”?”.

Well, of course they do. Neither are subject to the discipline of competition or profitability and so they become inefficient and in the process they destroy wealth just as much as keeping a bankrupt company afloat destroys wealth.

In fact almost all government spending destroys wealth for much the same reason.

If governments wish to provide a service they should be required to do so in competition and that does not include forcibly requiring, taxpayers to fund the cost through taxes.

Let them act in open competition and require them to make a proper return on their capital investment.

Then you might have government spending that is not destructive.

PS. quite extraordinary you should think the BNP right wing, I have always thought of it as part of the far left.

The truth is that we have public spending because the electorate regard sundry forms of public spending as conferring more wealth on them than more booze, cars or foreign holidays

“The electorate” isn’t a hive mind with a single will, it is a collection of millions of individuals with diverse aims and priorities. Each individual gets an opportunity every five years to vote for the best candidate of a bad bunch. Parties are elected with far less than 50% of the popular vote. Opposition voters in safe seats don’t really count at all.

There is no reason to suppose that a significant portion of the public want the government spending that we currently observe. From almost everyone’s perspective, most government spending is wasteful. The government purchases goods and services that people don’t want at all, or only want at a much lower cost. People put up with it only because they believe the alternatives on offer are worse.

Incidentally I’m very much on the political right myself: I stood for the BNP in an election a few years ago

Ralph, I read the BNP’s 2010 manifesto. Although I knew the socialist roots of the so-called ‘far right’, I was still struck by how obviously left wing it all was – Old Labour sort of stuff.