It isn’t often that a Bank of England Quarterly Bulletin starts “A revolution in how we understand economic policy” but, according to some, that is just what Money creation in the modern economy, a much discussed article in the most recent bulletin, has done.

In the article Michael McLeay, Amar Radia, and Ryland Thomas of the Bank’s Monetary Analysis Directorate seek to debunk the allegedly commonplace, textbook understanding of money creation. These unnamed textbooks, they claim, describe how the central bank conducts monetary policy by varying the amount of narrow or base money (M0). This monetary base is then multiplied out by banks, via loans, in some multiple into broader monetary measures (e.g. M4).

Not so, say the authors. They begin by noting that most of what we think of as money is actually composed of bank deposits. These deposits are created by banks when they make loans. Banks then borrow the amount of narrow or base money they require to support these deposits from the central bank at the base rate, and the quantity of the monetary base is determined that way. In short, the textbook argument that central bank narrow or base money creation leads to broad money creation is the wrong way round; bank broad money creation leads to central bank narrow money creation. The supposedly revolutionary connotations are that monetary policy is useless, even that there is no limit to the amount of money banks can create.

In fact there is much less to this ‘revolution’ than meets the eye. Economists and their textbooks have long believed that broad money is created and destroyed by banks and borrowers(1). None that I am aware of actually thinks that bank lending is solely or even largely based on the savings deposited with it. Likewise, no one thinks the money multiplier is a fixed ratio. It might be of interest as a descriptive datum, but it is of no use as a prescriptive tool of policy. All the Bank of England economists have really done is to describe fractional reserve banking which is the way that, these days, pretty much every bank works everywhere.

But there’s an important point which the Bank’s article misses; banks do not create money, they create money derivatives. The narrow or base money issued by central banks comprises coins, notes, and reserves which the holder can exchange for coins and notes at the central bank. The economist George Reisman calls this standard money; “money that is not a claim to anything beyond itself…which, when received, constitutes payment”.

This is not the case with the broad money created by banks. If a bank makes a loan and creates deposits of £X in the process, it is creating a claim to £X of standard money. If the borrower makes a cheque payment of £Y they are handing over their claim on £Y of reserve money. The economist Ludwig von Mises called this fiduciary media, as Reisman describes it, “transferable claims to standard money, payable by the issuer on demand, and accepted in commerce as the equivalent of standard money, but for which no standard money actually exists”. They are standard money derivatives, in other words.

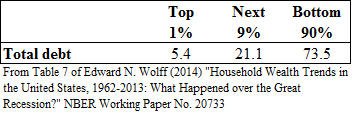

Banks know that they are highly unlikely to be called upon to redeem all the fiduciary media claims to standard money in a given period so, as the Bank of England economists explain, they expand their issue of fiduciary media by making loans; they leverage. Between May 2006 and March 2009 the ratio of M4 to M0, how many pounds of broad money each pound of narrow money was supporting, stood around 25:1.

But because central banks and banks create different things consumer preferences between the two, standard money or standard money derivatives, can change. In one state of affairs, call it ‘confidence’, economic agents are happy to hold these derivatives as substitutes for standard money. In another state of affairs, call it ‘panic’, those same economic agents want to swap their derivatives for the standard money it represents a claim on. This is what people were doing when they queued up outside Northern Rock. A bank run can be described as a shift in depositors’ preferences from fiduciary media to standard money.

Why should people’s preferences switch? In the case of Northern Rock people came to doubt that they would be able to actually redeem their fiduciary media for the standard money it entitled them to because of the vast over issue of fiduciary media claims relative to the standard money the bank held to honour them. Indeed, when Northern Rock borrowed from the Bank of England in September 2007 to support the commitments under its broad money expansion it increased the monetary base just as the Bank of England economists argue.

But there are limits to this. A bank will need some quantity of standard money to support its fiduciary media issue, either to honour withdrawals by depositors or settle accounts with other banks. If it perceives its reserves to be inadequate it will need to access new reserves. And the price at which it can access those reserves is the Bank of England base rate. If this base rate is relatively high banks will constrain their fiduciary media/broad money issue because the profits earned from making new loans will not cover the potential cost of the standard/narrow money necessary to support it. And if the base rate is relatively low banks will expand their fiduciary media/broad money issue because the standard/narrow money necessary to support it is relatively cheap.

Some commentators need to calm themselves. As the Bank of England paper says, the central bank does influence broader monetary conditions but it does so via its control of base rates rather than the control of the quantity of bank reserves. The reports of the death of monetary policy have been greatly exaggerated.

Notes:

(1) “Banks create money. Literally. But they don’t do so by printing up more green pieces of paper. Let’s see how it happens. Suppose your application for a loan of $500 from the First National Bank is approved. The lending officer will make out a deposit slip in your name for $500, initial it, and hand it to a teller, who will then credit your checking account with an additional $500. Total demand deposits will immediately increase by $500. The money stock will be larger by that amount. Contrary to what most people believe, the bank does not take the $500 it lends you out of someone else’s account. That person would surely complain if it did! The bank created the $500 it lent you” – The Economic Way of Thinking by Paul Heyne, Peter Boettke, and David Prychitko, 11th ed., 2006, page 403. Perhaps the Bank of England economists need to read a better textbook?

The idea (or practice) that a bank “creates money when it makes a loan” violates the central principle that loans should be from REAL SAVINGS.

Contra Keynes creating money (from nothing)is not “savings” “as real as any other kind of savings” – it (credit-money expansion) is not savings at all.

I did grin at the Bank’s Monetary Analysis Directorate -‘B MAD’.

Central Banks are in principle there to replace genuine, stable, quantifiable and self-regulating savings. Hence, they are none of the above. The Money Printers dont need the working public anymore. We are but signatories to a false contract with no fixed term or amount, authenticating our own fiscal demise.