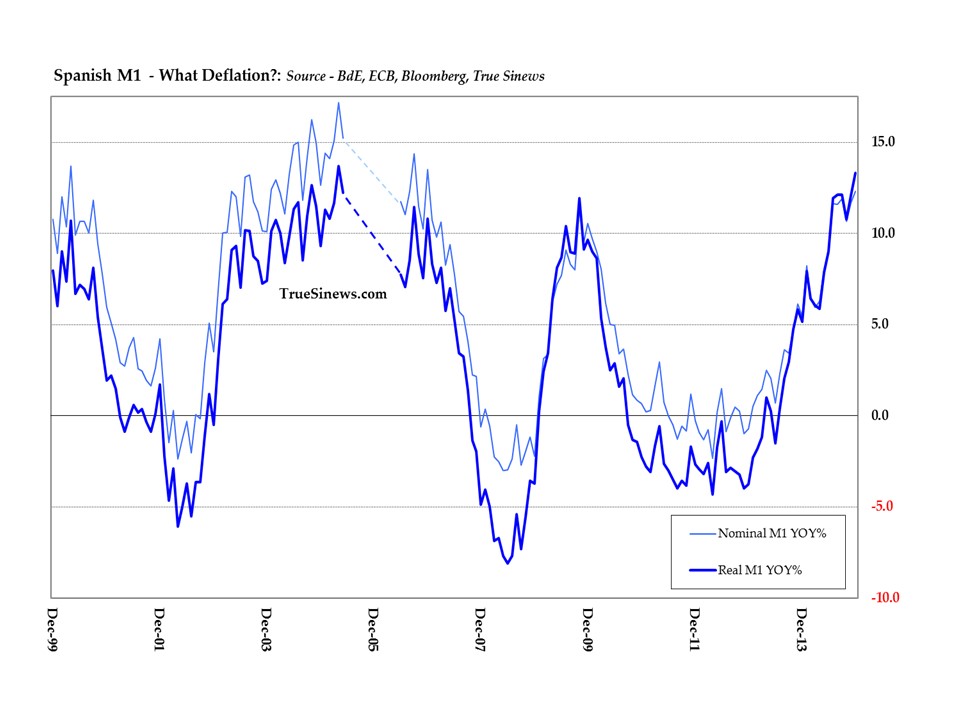

Here’s a question for all the cheering QEuro fans out there. If you came across a country where both real and nominal money supply were growing at rates in the low teens – something its people had not experienced for almost a decade and close to the fastest seen in the last four – would you consider it to be a victim of ‘deflation’? If not, what help do you suppose an expansionary central bank would be to it?

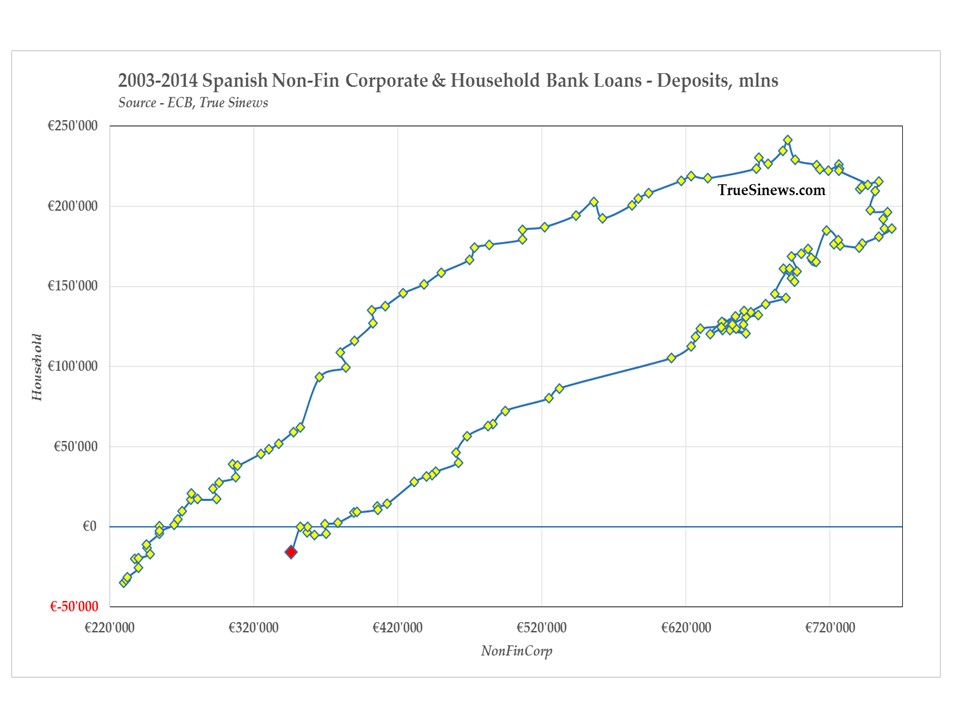

Imagine next what would be the state of that nation if, in a five year burst of temporary insanity, it had it had contracted 2 ½ times as many bank loans as it had when it first went mad and that it had thus registered four times the net indebtedness (loans less deposits) as when it began– a deficit which nearly equalled the combined shortfall of its two largest neighbours put together, despite the fact that they were three times as heavily populated.

Now you might well suppose that, if such a thing could ever be advisable in such circumstances, the central bank could readily offer an effective incentive to carry the tendency further were it only to act to suppress interest rates across the curve.

But consider instead what would be the case if, after another five, nearly six, years of blood, sweat, toil and tears, that nation had rid itself of 30% of its loans, had added 25% to its stock of deposits, and had therefore shrunk its net indebtedness by an impressive two-thirds to return itself to where it was in relation to national income eleven years previously. If you were also told that households, having gone into hock to the tune of 28% net from an initial position of small surplus, were now, thankfully, back in credit, would you imagine that the plight of the saver might outweigh that of the borrower in the ordering of their priorities?

If so, you would be considering whether Spain should rejoice at Snr. Draghi’s latest coup de main or whether it should balefully consider that he was not only gilding a lily, but bedizening one from which the bloom had long since faded, into the bargain?

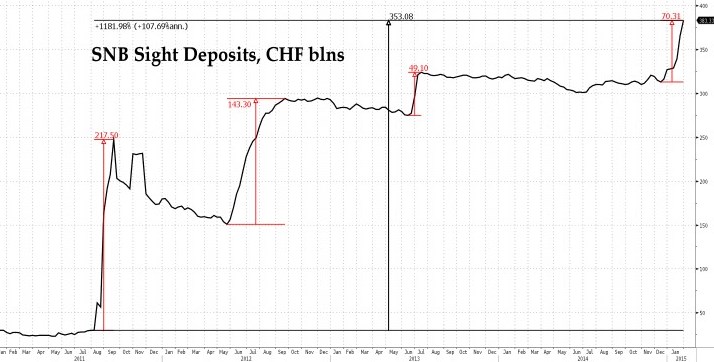

Nor might you sing Hosannas if you were Swiss or Danish since it is principally in those two peripheral nations that the overspill is most violent. Denmark has cancelled this year’s government bond auction schedule in a kind of QE by omission even as the central bank has continued to force interest rates deeper and deeper into negative territory – to the point where there are apocryphal tales being told of a people who are among the developed world’s most indebted being paid to take out floating-rate mortgages.

That will end well, if true!

As for the Swiss, it seems that the habit dies hard of putting the national balance sheet at the disposal of those wanting to short the euro at subsidised rates. We say this because, even though the €1.20 hard floor was abolished in the middle of the month, in the two weeks since, sight deposit balances have risen by some CHF44 billion – clearly a much higher run rate than during the preceding six weeks when a mere CHF29 billion was accumulated. The most that can be said for this is that the SNB has been improving its average (assuming the very strong hints of continued intervention are confirmed), getting euros on board at rates from CHF0.85 to CF1.05 so far and again depressing bond yields further below zero.

With Syriza trying to work out how far they can push a Union which would gladly be shot of them if that were not to open the infamous box of a certain over-inquisitive Greek lady; with Bepe Grillo still trying to engineer a referendum on the euro membership of his native Italy; Podemos pulling the aggrieved of Spain into the streets in their thousands; and the AfD having come out of their conference in Bremen all signed up to fighting the mainstream parties, not each other, the pressure will persist. There will be many trying to find a safer haven for all those shiny new euros with which Mario will be happy to furnish them so they can express their doubts over the course he is taking in cold, hard(er) cash. The Danes and the Swiss may therefore end up with rather more of them than they otherwise might wish.

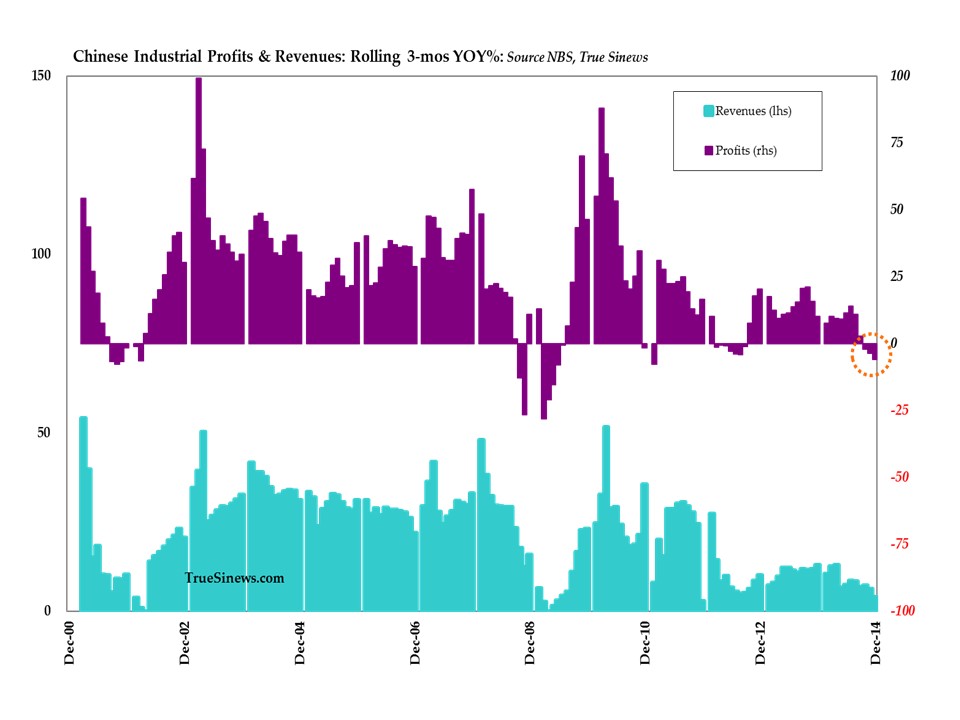

If we look beyond this to the wider markets, we can see the ripples from the stone thrown in by the ECB spreading as far away as China where the press is starting to run stories about how disadvantageous the rise of the yuan is becoming for a nation tacitly hoping for a quick, external outlet for some of the unwanted goods which its heavily underutilized industrial base is all too capable of producing.

Coupled with the growing unease of some of those who have borrowed those ever rising dollars to dabble in the onshore market – possibly via the medium of one of those commodity plays whose collateral value is not exactly beyond question these days – this is beginning to test the mettle of the PBoC at its idiosyncratic daily fix (the one where it simply refuses to entertain any bids beyond the rate it has settled upon and so allows a recalcitrant market no outlet for its frustrations).

Though nothing definitive has yet occurred and even if, rather than breaking any key levels, the stock market is tending to churn up and down near the highs, one is hard pressed not to give in to the foreboding that the sands are shifting: that, grain by grain, the cosy consensus of the last several quarters is starting to erode.

Take for example the fact that the US market is beginning to lose some of the effortless predominance it has so long enjoyed. Indeed, that leadership – wherein a rising stock market draws in the capital with which to move the dollar higher while the rise in the dollar makes the equities denominated therein gain more ground on their global rivals – has been challenged these past three weeks or so to a 2-sigma extent not seen since mid-2010.

This reversal, though not yet so large as to magnify our nascent sense of alarm, does add to the suspicion that change is in the air. That said, however, some longer term projections do still allow for the possibility that stocks might yet press on to complete the current 3QE pattern which began with assistance from all three big CBs, back in late 2012, and so map out a full TMT bubble move before the reaction truly sets in (q.v., the Nasdaq Composite). So what we are presented with is another case of letting the market decide which way it wants to move before committing ourselves too heavily to one side or the other. Note, too, that this is a waiting game which itself marks a very different phase from the straightforward momentum chase of recent months.

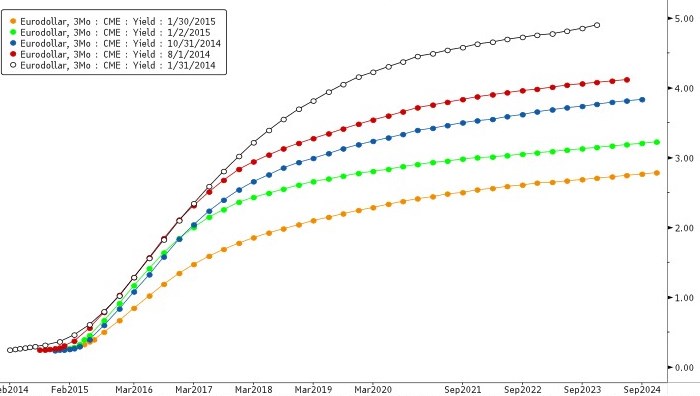

If stocks are ambivalent, fixed income seems to entertain no such doubts. Even that bear market dog-with-fleas, the 5-year T-Note, is back to its lowest yield since the ‘taper tantrum’ while the next quinquennial slice of the curve has made record lows, narrowing the spread between spot and forward 5s by 175bps in three months to reach the lowest level of recent times. We can perhaps best observe the developments by a glance at the eurodollar curve.

But, far from placating the market, even the remarkable run of successive record lows in bond yields is starting to raise the eyebrows of many of those whose wills are beginning to be bent to the policymakers’ doom-laden croaking about the imminence of ‘deflation’. It would be amusing if it were not so serious: in order to justify their crass, hyperactive heterodoxy, the central bankers are having to scare the very horses they are simultaneously trying to lead oh-so calmly to water.

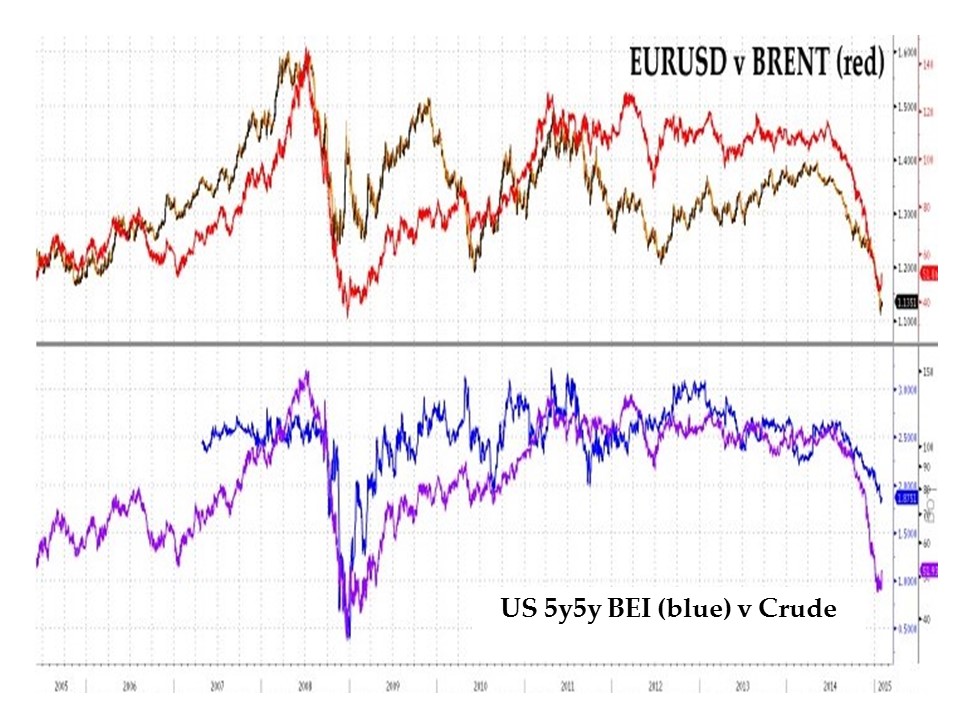

Another frequently cited storm warning is the 5-year forward break-even inflation reading as derived from the difference between vanilla and index-linked govvies. Your author must here confess to feeling this is far too arbitrary a number. We gauge the ‘inflation expectations’ which the authorities have insisted are key to judging the success of monetary policy from a spread – and now, worse, from a hypothetical forward spread which is the derived difference of two other arbitrary pairs of differences. Yet all this is reckoned in a segmented bond market subject to both institutional and regulatory imperatives, to vicissitudes of issuance, and to a vast official distortion made worse by the fact that, at very low nominal rates the reluctance to price the residual ‘real’ yields on linkers too far into the negative column is compressing the BEI spread between them – a phenomenon additionally exacerbated in the forward version by dint of the rapidly flattening yield curve.

It would be wiser to bear in mind that just because we can define and measure the 5y5y break-even does not of itself imbue the measure with any genuine informational significance even if one cannot deny that it has come to exercise a certain lurid fascination in the mind of the market as well as in that of the official rate-setter.

Adding a further strand to this hangman’s noose, many of yesterday’s Peak Resource commodity bulls have undergone a temperamental slump which matches for its giddiness that of the prices of the industrial commodities themselves. Again, the spectre of ‘deflation’ has come to peer over our shoulder as we watch the tape.

Here we would only caution that the inferences people are deriving from commodity prices may not be as cast-iron (sorry) as they appear because it is not, in fact, so easy to disentangle the factors contributing to that decline in a world where we have so many broken pricing mechanisms in play.

Take crude, for one. Given the extraordinary growth in supply of which we have long been aware and given, too, the muted growth of (physical) demand in a world unable to shake off the shackles of the last boom, the presence of record long positioning in speculative markets at the end of July was a clear omen of doom, even if the timing of the sudden, catastrophic phase shift from a three-year sideways, ever-narrowing range to a runaway cascade was impossible to predict in advance.

All sorts of commodities in their turn have acted similarly over this last cycle; silver, gold, copper, tin, nickel, iron ore, rubber, uranium, minor metals, some ags, and so on – but the booms and busts have not all been coincident, a divergence from which we can infer that they are as much a story of a rolling wave of fickle, speculative over-exposure and subsequent mass liquidation as they are of anything to do with underlying, real-side economic factors at work in their use.

‘Doctor’ Copper is another commodity to which many outsiders like to refer, yet its medical credentials have been called into question by the huge distortions entailed in many years of shadowy Chinese malfeasance. What is therefore impossible to decide is how much the current slide relates to weaker contemporary real demand and how much is due to the unwinding of the greatly exaggerated, financially-enhanced, apparent demand from which we are presently correcting.

Again, the malinvestment bubble in mining itself was both enormous and – given the echo effects of loose credit firstly on selling prices and then on project finance – thoroughly comprehensible. But to move from diagnosis to prognosis, what we again have to ask is this: if we accept that there was a period of widespread over-expansion in the industry – albeit one formerly hidden by a credit-enabled take-up of the end product at ever higher prices – is today’s fall-out the same thing as evidence of a generally weaker economy, or is it just a belatedly more accurate reflection of what the state of that economy has truly been all along? The solution to that riddle, if one could reach one, would tell one whether the big losses to come will be confined mainly to the commodity sector itself or dispersed more generally across the equity universe.

What today’s reverse Malthusianism does overlook is the inarguable case that, if we made a miraculous scientific breakthrough tomorrow which unlocked what was an essentially limitless and near-free source of energy, we would all be unequivocally better off. Reasoning from such a Garden of Eden scenario, we can be resolute in maintaining that a supply-led fall in prices is good overall – not just for ‘consumers’ – but for intermediary producers of all other goods and services, too. And, yes, it may well be, as has been bandied about, that some 10% of US earnings are energy related and so in jeopardy, but devotees of Bastiat’s Things Which are Not Seen will have already asked themselves how much the earnings of energy users have been depressed by the success of the energy providers and whether, therefore, the ongoing rebalancing is the unmitigated evil some fear it to be.

Above all, we might take comfort from the realisation that oil & gas consumption still only amounts to 5% or so of global GDP. Or we could, were we not also to bring to mind the injunction that in a non-linear system such as ours we cannot entirely discount that large effects emanate from small causes or that, given its high profile, the sector’s travails could contribute meaningfully to a souring of general sentiment and so perhaps take us across that critical mass threshold beyond which rotations and reversals morph into landslides of liquidation. But to see why we think this is even possible, we need to go back a step or two to explain what we think is the source of such fragility.

Back in the immediate aftermath of LEH, we wrote that the scale of the coming reflation would be unprecedented and that it would certainly boost commodity and asset prices in the short run, but we also warned that we needed the debt overhang to be rapidly eradicated, renewed entrepreneurship to be promoted, and heavy-handed state intervention to be avoided (we entertained few real hopes on that that last score) if the recovery were to take root. Otherwise, we predicted, we would find ourselves on a tedious roller-coaster of anaemic growth interspersed with weary episodes of recurrent stagnation where the supposed triumph of the authorities’ 1933 moment would give way to their dread of repeating a 1937 one, meaning they could never pull the trigger on ending their stimulus programmes. This, we envisaged, would ensure that the whole system would become ever more addicted to the medicine and ever more subject to its unwelcome side-effects.

We also felt, back then, that if we were to avoid this switchback turning into a negative-g log flume of downturn, the West had to have its house in order by the time that China realised it was doing more harm than good with its own gargantuan injections and that it had to revise its whole approach as a consequence. So it is proving to be.

In the interim, we have all been strung along by the persistent faith that, this quarter, the next, or the one after that, Europe would once more arise from the ashes. When that seemed too much of a stretch we were briefly distracted instead with the foolishness that was Abenomics, and all the while we had the cheery presumption that the Daddy of them all, the US, was slowly getting back on track and so would be enough to keep our illusions alive.

But now we have nothing – or close thereto – to which to cling except for the fact that while so many central banks remain so doggedly accommodative we cannot seem to bring ourselves not to plunge for a further rise in the market. The pockets of our trousers have, after all, long since burned through as a result of all the hot money which has been thrust into them these past several years.

But, whatever the imperatives to remain fully invested and highly leveraged, it cannot be denied that the underpinnings of our optimism are becoming ever more slender. Japan has predictably disappointed. Europe again stands on the verge of major political upheaval and the reaction to the oft-promised QEuro has either been muted (in the real world) or actively counter-productive (in its disruptive, possibly system-threatening effect on the capital and currency markets), suggesting that clinical tolerance is setting in there, too.

EMs are over-owned, are becoming disfavoured, and are anyway not weighty enough to swing the balance. Add to this the sad fact that America is fostering conflict and instability all around the Eastern and Southern rim of Europe and we are left only with the belief in US economic recovery – at first stoutly resisted, but later held with all the fervour of the true convert – to maintain our faith. Hence, as we said, the outperformance of Wall St amid the growing strength of the dollar, a constellation which has even induced high-ranking pundits of the kind who should – but somehow never do – know better to start exulting recklessly at the putative ‘decoupling’ of the Land of the Free from the rest of the poor, huddled mass of humanity.

Now though, the States is starting to stutter as well – with a run of softer-than-expected macro data, fears of what the shale shock will mean both for jobs and credit, and a few wobbles on the corporate earnings front (even if many of these are only strong-dollar, money illusion effects).

In the recent past, such bad news would have been perversely seen as market positive for its capacity to call forth more from the Mighty Oz’s bag of monetary tricks. But what can we now expect from the ‘Goldilocks’ scenario of weakness calling forth some form of official, ‘Greenspan Put’ compensation? Only the weak, negative assistance that it might further delay the day the Fed finally takes its first baby steps to renormalization. There is therefore not much by way of porridge in that particular bowl, we fear!

In such a world, it would not take much for the multitude of stale longs to become anxious. Though it will be said – as it always is – that there is copious ‘cash on the sidelines’ waiting for exactly such an opportunity or, conversely, that a setback in one market must lead to a rise in another (‘the money has to go somewhere’), this overlooks the fact that asset prices can only advance on such a broad and enduring front as they have if they are being fed a steady nourishment of a credit created expressly for that purpose.

When this is the case, it is just as true in reverse; that when people take fright and the assets begin to fall, or the carry trade starts to go awry, the associated credit can quickly evaporate – that where the money ‘goes’ is whence it came: into fractional reserve oblivion. The one place where the classic Fisherian ‘debt deflation’ – or, if you prefer, the Hayekian ‘secondary depression’ – can most easily occur is in the market for financial claims, especially when that market may already have reached its ‘permanently high plateau’.

It may not happen just yet, but it certainly pays to be alert to the possibility that, one fine morning, it surely will.