[The original can be seen here http://truesinews.com/2015/04/14/the-south-china-sea-bubble/]

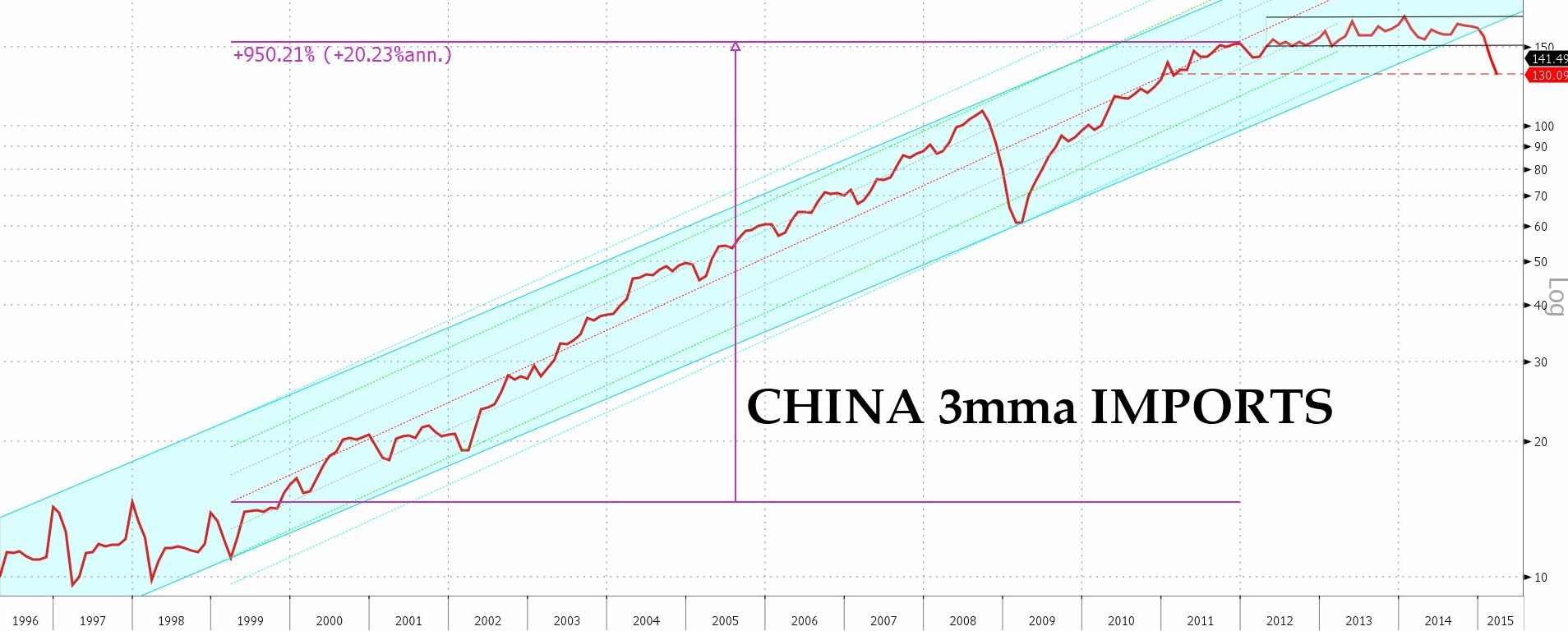

The first hard data release of the month for China was hardly guaranteed to reassure. Two-way trade in USD terms dropped 6.3% in the first quarter from its level of a year ago, the second most severe setback since the Crash and only the third such instance in the whole era of ‘Opening Up’.

From a strictly local perspective, the bad news was mitigated by the fact that exports managed to eke out a modest YOY gain of 4.7% (though that still means they were effectively unchanged from 2013 levels) and so the trade surplus was left at a record seasonal high. For the rest of us, however, anxious as we are to sell more of our wares to China, there was no such comfort. Imports plunged by more than a sixth to a four-year low, registering a drop which, if nowhere near as large in percentage terms, was, when measured in numbers of dollars, equal to that suffered in the global freeze which ensued in the aftermath of the Lehman collapse.

Though it always does to await the full data release for the first quarter – given the inordinate impact on comparisons of that highly moveable feast, the Lunar New Year – these numbers are fully consonant with the evidence presented during the first two months which showed flat non-residential electricity use and rail freight volumes down to seven year seasonal lows.

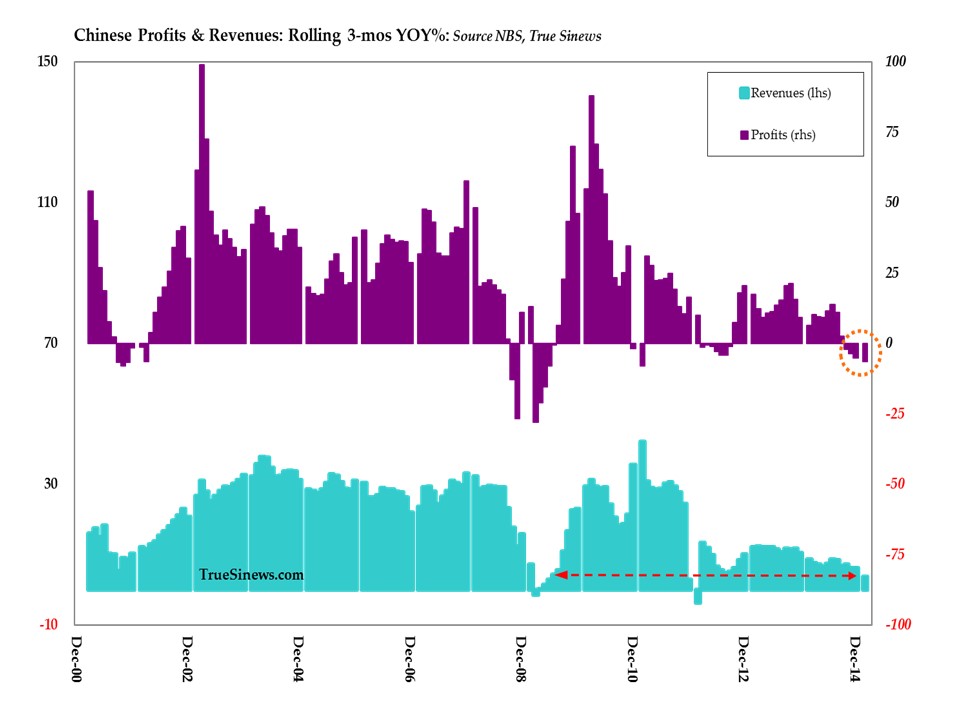

It is undoubtedly the case that the bulk of the pain being felt is concentrated where it should be – up in the dirty, surplus capacity-plagued end of heavy industry and extraction – but, nevertheless, Chinese data show that 12-month running profits have dwindled to zero (if we strip out companies’ non-core – qua speculative – activities) and that for the last three months for which we have numbers they had actually declined in a manner not seen since the world stood still in late 2008/early 2009. Revenue growth was also sickly, while balance sheets continue to swell with debt and receivables.

Granted, private joint-stock companies continue to outperform their state-owned peers – or so the NBS would have us believe – but, even here, core profit growth over the whole of 2014 was a mere 4.2% with turnover up 9.2% (suggesting that margins simultaneously contracted).

In such an environment, you might think that investor spirits would be dampened but, as anyone who has opened a paper in recent days will be aware, that is very much far from being the case.

Indeed, China is currently enjoying the somewhat dubious fruits of one of the all-time great stock manias. The CSI300 composite of Shanghai and Shenzhen equities has double since last July, with the seven-eighths of those gains coming in the last six months and almost a third of them in the past six weeks. With first Y1 trillion then Y1.5 trillion trading days being recorded and with 1.6 million [sic] new trading accounts being opened in the latest week for which we have the numbers, it is easy to see that this has rapidly degenerated into an indiscriminate free-for-all.

Alongside the rise in prices, volumes are up by a factor of 2.7 from the same time last year while margin debt has exploded to more than Y1.6 trillion (~$260 billion) in a classic instance of a credit-collateral tornado of Giffen goods (ones for which demand paradoxically increases, not decreases, as they become more expensive). In fact, it has been reckoned that, at the going financing rate of 8.35%, this means that interest paid to brokers constitutes one of largest, single-sector generators of such income in the entire economy!

Shanghai also managed to raise 50% more new cash via IPOs in the first quarter than did New York to stand, for the first time ever, at the top of the global exchange rankings with a $5.4 billion, 35 company haul, so said Deloitte. Ernst & Young, for their part, reckoned the overall mainland IPO total was nearer $8 billion; Thomson Reuters, adding secondary issues to the pile, counted up $20 billion in total A-share offerings.

While all this has been going on, broad P/E ratios have risen from last May’s 9.8 single-digit rating to the present 20.5 for the Shanghai A-Share and from an already more lofty 24.3 to today’s 49.7 for the Shenzhen equivalent. The Chinese Nasdaq analogue ChiNext – up a mere 85% YTD and by 390% since late 2012 – is currently on an overall rating of 95.7.

In fact, things may be even more overstretched than this broad measure suggests. Analyst Li Daxiao of Yingda Securities was quoted in the local press as having calculated that 43% of all listed companies had a triple-digit P/E; that the median multiple was 83; and that less than a third had a P/E lower than 50 to 1.

Furthermore, the overspill through the newly-instituted Connect link to Hong Kong is already starting to exact a toll, with the Exchange there breaking all turnover records by putting in a total on one day last week only a little shy of HK$300 billion. So overwhelming has the flow been that the pressure on the local dollar has forced the Monetary Authority to do just what you would think they would have been most loth to do, namely add fuel to this inferno, by injecting liquidity lest the peg to the Greenback should be broken on the upside.

Testimony to the spreading mania has been a rash of anecdotal stories, like those of the Kowloon grandmothers who are foregoing their pension-supplementing activities in serving manual worker dim sum lunches out of their tiny kitchens in favour of taking up vigil before the financial news TV channels and constantly harassing their brokers by cell phone to buy them more of whatever is rising fastest.

It keeps them and their student grandchildren from waving their umbrellas too forcibly in the faces of the authorities, one supposes.

More concretely, perhaps the most signal development has been the fact that the quotation for shares in the HK Exchange and Clearing Co. itself has exploded in recent days, surging up by 66% in a mere matter of days in a kind of meta-speculative, supra-ironical move.

And lest you think this would all be exciting disquiet among the powers-that-be and perhaps eliciting some voguish ‘macro-prudential’ counter-measures in the attempt to assuage the people’s raging thirst for risk, you could not be more wrong.

Scared there is too much margin debt at work? No worries – the China Securities Depository and Clearing Co has just announced that, henceforth, ‘Auntie’ need not limit herself to one trading account but can open up to twenty! Afraid that the South (China) Sea Bubble is about exhaust official quotas for trade between HK and the Mainland? Never fret – rumour has it that the end of the month will see HK out increased 50% to Y20bln a day and HK in almost quadrupled to Y40bln!

Meanwhile, the PBoC has been doing its level best to ensure that none of this whirligig tightens the cash markets. We have had a repo rate cut of 10ps, the conduct of several reverse repos, and a Y370bln injection in the form of a Medium Loan Facility or MLF (stop sniggering at the back there, Jenkins!).

Capping a recent run of official press endorsements which have run from the merely placatory to the outright incitative, the People’s Daily gave over a good number of column inches to a puff piece which explained that all this enthusiasm was only a natural expression of the masses’ touching faith in the bold series of reforms being carried out by the all-wise leadership.

In the words of one Li Xunlei, Chief Economist at Haitong Securities: ‘Each dollar coming into the market was a vote of confidence in the future of the economy.‘ Given that this lies somewhere between John J Raskob’s infamous contention that‘everybody ought to be rich’ and Irving Fisher’s spectacularly complacent ‘permanently high plateau’ (both hostages to fortune being issued in the two months which immediately preceded the Crash of ’29), it is hard to suppress a shudder at the hubris involved in that statement.

Apparently, though, we should not quibble about irrationality for the outpouring of enthusiasm is a direct consequence of recently mandated improvements in governance and transparency. Additionally, faith in the benefits of the ‘New Normal’ approach has seen ‘story’ stocks in robotics, solar, the ‘Internet of Things’, rapprochement with North Korea, nuclear power, high-speed rail and others find a justifiably heavy sponsorship. And who would want to miss out on the bounteous harvest to be had from the ‘Along the Way’ policy of building out the terrestrial and maritime Silk Roads by not indulging in a hearty wave of pre-emptive investment? And to think the present plans don’t even include a branch line to the Mississippi!

We have long argued that China could theoretically unpick the worst of its many financial contortions in just two, easy to enunciate if hard to undertake steps. The first would be to follow the example of the great S C Tsiang in the Taiwan of 60 years ago by making the banks forego their lazy and near-exclusive support of state favourites and instead to extend their chosen quantum of market-based credit much more widely to all who deserve it on commercial, not political, grounds. This would instantly make the usurious curb trading and heightened legal peril of what we now call the ‘shadow’ system largely redundant, to the benefit of all concerned.

Secondly, to remove the debt overhang – as well as the dangerous and unstable snowpack of deposits which is its flipside – we have suggested that the state should sell off its mighty portfolio of holdings in land and business and so enact a society-wide debt-for-equity swap not only for reasons of financial stability but in order to expand the scope of private enterprise and thus to eradicate much distasteful cronyism and debilitating, red princeling corruption at one fell swoop.

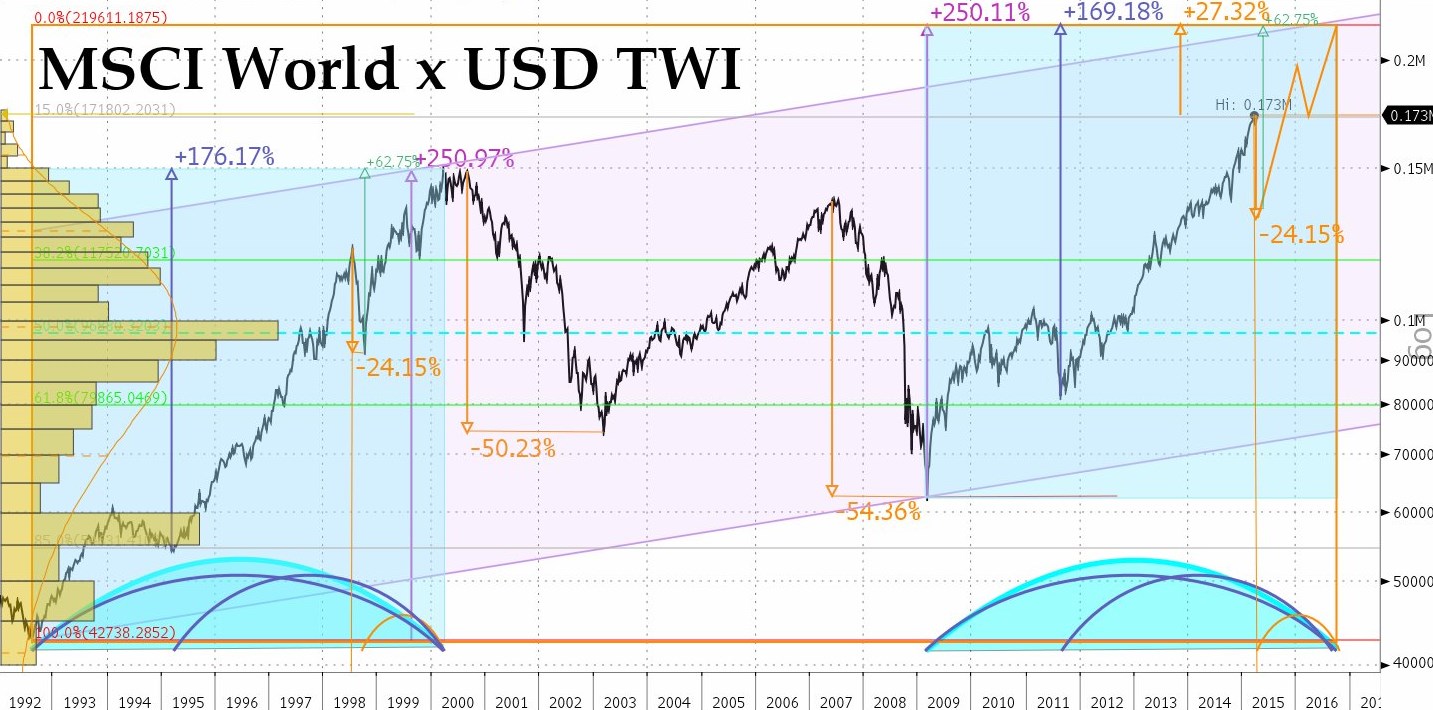

What we cannot endorse, however, is the manner in which such a laudable programme has become fatally perverted, For now the regime has seemingly stumbled upon the idea of promoting a more avid participation in the stock market as little more than the latest means of diverting attention away from a badly flagging economy, in lieu of the crazes for real estate, Bitcoin, and gold which previously served to distract from its traumas.

Thus, rather than delivering a fundamental and well overdue recalibration of the nation’s creaking financial system, policy seems to have evolved into a full scale attempt at replicating John Law’s ill-fated ‘system’ of extricating 18th century France from the ruins of the dead Sun King’s extravagance, one in which that same debt-equity exchange was combined with a monetary supercharging which would see the whole process spiral wildly out of control, finally to crash heavily and to dissipate both the fortunes of rich and the hopes of the poor as it did.

Of course, it is not just Chinese stock markets that are being driven beyond the bounds of sanity by wild-eyed policy measures. Nor will it be just the Chinese who will eventually have to pay the price of such folly but, at the moment, it does appear as if theymay be suffering from a more virulent strain of the pandemic that is afflicting the rest of, too. So, possibly, it will be in their country first that, in Cantillon’s words, ‘this furtive abundance [of fictitious and imaginary money] vanishes at the first gust of discredit and [so] precipitates disorder.’