Editor’s Note: Keith is testifying today before the Arizona Senate Financial Institutions Committee on a gold legal tender bill, which he also helped draft. There is also interest in his gold bonds proposal.

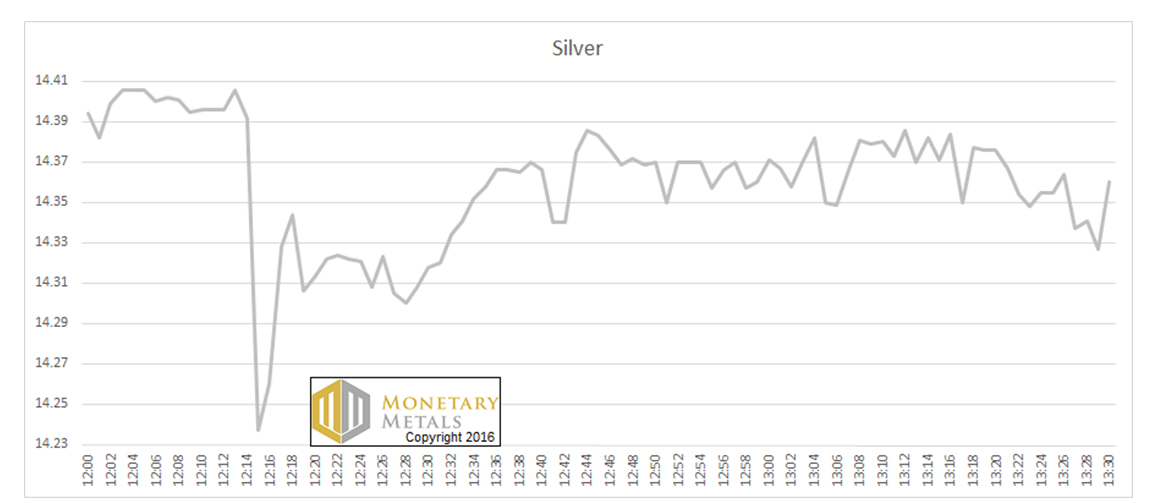

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action.

The Price of Silver, Jan 28 (All times GMT)

If you read more about it, you will see that there was an irregularity around the silver fix. At the time, the spot price was around $14.40. The fix was set at $13.58. This is a major deviation.

Many silver bugs are up in arms about how unfair the new silver fix is. That’s nothing new. They were up in arms about the old one. The old one was supposedly manipulated.

One thing is for sure, tactical manipulations can occur. A gold trader in London was found to have pushed the price down in the gold fixing by a few pennies. He had sold a multimillion dollar option, and he wanted it to expire worthless to avoid having to pay. Right after the fix, he bought back the gold he sold, pushing the price back up to where it was. He took a loss on the round trip of the gold, of course, but saved millions on the option which he did not have to pay.

This is not the long-sought proof that nefarious forces are keeping gold from attaining $20,000.

Anyways, because the silver and gold fixes were deemed to be benchmarks by regulatory changes post the LIBOR manipulations, a new process for the gold and silver fixes was implemented. Before we look at what changed, let’s consider why there is a fix price. Couldn’t they just take the price at 12:00 noon?

No, it wouldn’t work because in a live market there is not just one price. There are always two prices: bid and offer. Which would you use as the benchmark? Either price could misrepresent the current state of the market. What’s more, those prices are just quotes, not executed trades.

To be useful as a benchmark—a price that third party contracts and derivatives can be based on—there has to be a single price based on real executed trades. So they need to get buyers and sellers together, and find the price at which the most metal clears. If there is a better way than that, it hasn’t been discovered yet.

This leads to a question. How do two prices that are supposed to track each other actually, you know, stay matched? This occurs in Exchange Traded Funds that move with an index of stocks (such as SPX or GLD). It occurs in gold futures and spot.

It should also occur between the fixing process and the spot market. What use is a silver fix at $13.58 while the spot price was $14.40? We’ll get back to market action on that day, in a bit. First, we need to look at the force that keeps two prices close to each other.

It is arbitrage. Let’s use GLD as an example. Each share represents a known quantity of gold. Suppose the price of the share rises relative to the price of gold metal in the spot market, and the metal in a share of GLD is $1 per ounce higher. The arbitrageur buys gold metal, creates shares of GLD, and sells them. This tends to pull up the price of gold metal, and mostly pushes down the price of GLD.

Note that the arbitrageur takes no price risk. He is simply acting to profit from a spread (usually a very small one). Arbitrageurs will keep doing this trade, until GLD and gold metal get close enough that the small remaining profit is not worth the effort.

The arbitrageur is motivated, of course, by profit. He is as greedy as the next guy (admit it, if you could demand a 300% raise from your boss, you would). However, his activity is self-limiting. The more he puts on his trade, the more he compresses the spread. In our example, the arbitrageur buys some gold metal and sells some GLD shares, to make $1. That is the initial profit. However, he compresses that spread, perhaps to 50 cents. He can have another go, but then the spread narrows to 25 cents. Soon enough, he walks away (these are illustrative numbers only for this example).

It’s a textbook case of the Invisible Hand described by Adam Smith. The arbitrageur, seeking his own profit, ends up serving other market participants. He keeps two different prices locked tightly together. Everyone else can take for granted that GLD works as it’s supposed to.

For example, suppose you run a small gold coin store. You need to hedge your inventory just as a large dealer does. However, you sell gold one ounce at a time. Big dealers might use 100-ounce gold futures, but you use GLD. You can thank the actions of this arbitrageur.

Now let’s get back to the fix. The old process was conducted by the major market makers in each metal. They got together in one room, and each had major clients on various phone lines. The chairman would put out a price, and the market makers would talk to their clients to determine who wanted to sell at that price and who wanted to buy. Then they add up all selling and buying, and see if there’s a close match. They would keep moving the price until selling matched buying within tolerance. That was the fix price.

There was just one problem, at least so far as the gold bugs were concerned: the market maker. Since the first market maker walked into a coffee house in London where shares were being traded, most people have misunderstood the market maker. Back in the coffee house days, all potential sellers would line up on one side of the room, in order from lowest offer price to highest. On the other side, buyers would line up, from highest bid to lowest.

If one had to sell, that meant taking the best bid presented in the room. Likewise, if one wanted to buy right now, one paid the best offer price. As you would imagine, the bid-ask spread could get pretty wide, and perhaps worse yet, it was unpredictable.

Until the market maker walked in. Unlike all the others, he was both a potential buyer and a potential seller. He had an inventory of both shares and cash. He published a better price if you wanted to buy or sell and as it turns out, he was the only one who could consistently buy at the bid price and sell at the ask price.

Of course, the guy with the best bid price—or what had been the best price until the market maker strolled into the room—was upset. Who is this dodgy bloke? Why is he allowed to mess about like this? Surely it’s unethical, immoral, and maybe even illegal?

In fact, he is serving all market participants (except the few who hoped to sell and make a buyer pay a premium and the equally small few who hoped to buy from someone desperate to raise cash). The market maker is motivated by profit, sure, but in making money he is narrowing the bid-ask spread whilst also reducing its volatility.

Today, the market maker is aka High Frequency Trader, and he uses technology that the coffee house fellows could not have imagined. Nevertheless, he too encounters the same exact suspicion, if not resentment, if not envy and anger.

Now let’s tie this to the silver fix. In the old fixing process, bullion bank dealers could place orders in the spot market during the fix. For example, if the fix price looked like it might settle at $14.30, but the spot price was $14.34, the dealers would buy the fix and sell spot, happy to make four cents.

Many objected to this because it looked like information was leaking into the market. They claimed it’s so unfair, perhaps even a gateway drug to insider trading? If other market participants can’t have this privilege, the bullion banks shouldn’t have it either. And besides, they’re supposed to be just brokers and not trading their own proprietary positions. The truth was that there was nothing stopping other market participants from also trading in the spot market during the fixing process, it was just that the bullion banks’ dealers were more efficient at being market maker.

Well, in part due to the agitation of the gold and silver bugs, government regulators came down on the market makers. They fixed it so that market makers were no longer allowed to arbitrage the fix to the spot and futures markets.

Before you think “yeah, this is what we want,” let’s revisit one of our favorite and recurrent themes, namely: be careful what you wish for.

As it stands today, if the fix price is starting to deviate from the market price, the market makers’ hands are tied. Ross Norman, CEO of bullion dealer Sharps Pixley in London, expressed his frustration with this. “The real problem as we see it is that banks are increasingly unwilling or unable to place corresponding orders where they perceive a mis-pricing because of fears of being accused of abusing a situation and facing the wrath of the regulator or their compliance departments.”

The big clients who participate in the fixing process may be freer to trade. However, they don’t have the same information. Market making is hard because you’re playing for pennies or fractions of a penny, but if you screw up you can lose dollars. The clients may know how many rounds into the fixing process they are, and the order imbalance of each round. But they can’t react as quickly as the bullion banks who are making markets in the spot, futures, and ETF markets, and they don’t know as much about market conditions either. They can’t arbitrage a few pennies. They need a much bigger spread.

A wider spread, much less an unpredictable spread, is to no one’s benefit. For example, the mining companies often sell at the fix price, rather than try to time it (or be accused of breach of fiduciary duty by their shareholders if they mis-time it). How much deviation of the fix price will it take before miners are forced to embrace the next-best solution?

“The large discrepancy between the spot price and the fix is very alarming to us especially that it happened twice in a row,” KGHM head of market risk Grzegorz Laskowski told FastMarkets.

The next best solution, by definition, is less advantageous than the best.