The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true?

Most people define inflation as rising prices. Economists will quibble and say technically it’s the increase in the quantity of money, however Milton Friedman expressed the popular belief well. He said, “Inflation is always and everywhere a monetary phenomenon.”

There you have it. The Federal Reserve increases the money supply and that, in turn, causes an increase in the price of everything, including gold. It’s as simple as that, right?

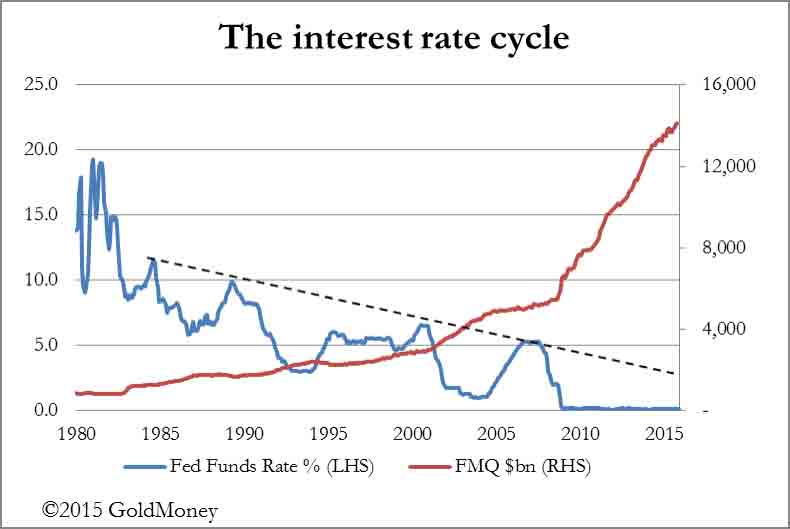

Except, it doesn’t work that way. Just ask anyone who has been betting on rising commodities prices since 2011. Certainly the money supply has increased. M1 was $1.86T in January 2011, and in March it hit $3.15T. This is a 69 percent increase. However, commodities have gone the opposite way. For example, wheat peaked at $9.35 per bushel in July 2012, and so far it’s down to $4.64 or about 50 percent. And the price of gold fell from $1900 in 2011, to $1050 late last year, or 45 percent.

Would you say that inflation is +69%, or is it -45% or -50%?

Most people look at retail prices, not raw commodities or gold. Retail prices have not followed into the abyss. Love it or hate it, the Consumer Price Index registers a cumulative 8 percent gain from 2011 through 2015 inclusive.

Let’s consider an example to help understand why. Suppose you own a coffee shop in a central business district. The city enacts a new regulation that limits the hours for delivery trucks. This forces you to pay overtime wages to your staff to unload the trucks, and of course, the carrier charges more for delivery too.

Next, the city allows poor people to stop paying their water bill. So to compensate, they raise the water rates on businesses. While they’re at it, they raise the fees for sewer, garbage, gas line hookups, fire inspections, and sign permits. The state passes a higher minimum wage law. The building inspector requires that you increase the size of your bathroom to accommodate wheelchairs, and you lose revenue-generating floor space. There are hundreds of ways that government increases your costs.

Is this inflation?

Not yet, costs are up but not prices. Sooner or later, all of the affected coffee shops try raising their prices. Consumers don’t necessarily want to pay more for coffee, so a few shops fail. The survivors are now charging 15% more for coffee. They have their higher prices, at the cost of lower sales volume.

The burden of government bearing down on the coffee business only increases. Every day, three constituencies conspire to drive up costs. We’ll call them the “there oughtta be a law” crowd, the “government needs more revenues” mob, and the “they served 10oz of coffee plus 4oz of ice so let’s sue them” racket.

Regulation, taxation, and litigation drive up price. Friedman was wrong. The rising price of lattes is not a monetary phenomenon (the monetary system is pressuring prices lower right now, and in my theory of interest and prices I discuss why). Rising retail prices are a fiscal, regulatory, and judicial problem.

There is no reason for the price of gold to follow retail, because there is no mechanism that connects gold to these non-monetary costs.

DEVELOPING THE SCIENCE PART OF MACRO-ECONOMICS

No Science develops without the use of proper measurements – let’s say here for the rate of devaluation of money so s not to confuse that with various definitions of inflation.

I agree that inflation, or the devaluation of money is partly a monetary phenomenon. I say partly, because it is not that twice as much money halves the value of money. What if the population doubles?

Prices rise because people are willing and able to pay more than previously and prices in general all rise (not some rise) compared to the price that they would otherwise have been, and people are paying that additional price. In aggregate, prices will be that much higher than they would otherwise have been if money had not fallen in value. That is the offset measure to compensate for the falling value of money.

This can happen if there is enough transaction money in circulation to allow it to happen, because if there is less, people have to wait to be paid. For this to happen one of the prices which must rise is the price of hiring people and paying for rentals and dividends and so forth which form people’s earnings. National Average Earnings, NAE, have to rise. Then people will be able to pay more than they otherwise could provided that they have correspondingly more earnings to spend.

And provided that they are spending that additional amount in earnings.

And provided that National Average Earnings, NAE, have risen by that amount. That takes time.

And there may be exports and imports altering the balance of spending cyclically.

In short it is not possible to measure the exact rate of devaluation of money, or its inverse, ‘inflation across the board’.

And if you could do and if there was none, if money was fixed in value, then the prices of things in the basket of currencies which are used to define inflation would still be falling as efficiency rises / rose.

For this reason it is not a good idea to index-link a fund or savings account to the rate of inflation as published.

For this reason it is not a good idea to make interest rate forecasts based upon real rates of interest. Inflation as published, can be varied by changes in the supply of oil for example but what investors are seeking is to get an income over and above the rate at which the falling value of money can be offset. They seek a rise in value in return for the risk and postponement of not spending.

CORE INTEREST

Call that rate the core rate of interest as I have done in my publications / drafts.

TRUE RATE

Call the excess interest a true rate because it is not the real rate as defined today. It is the real rate of transfer of wealth from borrower to lender but it is not the real rate of interest as defined in text books and dictionaries.

My estimate is that the true rate is approaching 3% p.a. higher than the core rate for prime borrowers in the case where borrowing appetite balances with borrowing restraint. It is somewhere close to where the investment return on investments is the same as the cost of borrowing – the core rate plus the true rate = the nominal rate.

My proxy for the core rate is the rate of growth of NAE, or Average Earnings Growth p.a. which looks to be a candidate (with an adjustment time lag) for the real thing. There is a link between what people spend and what they earn but it is not one to one all the time. It moves in cycles – cycles of savings, borrowing, and importing. the other side being spending down savings, repaying loans, and exporting.

That is my stable economy scenario.

This will all be brought out in my forthcoming papers on the Principles of Macro-economic Design and my ‘Tract(s) on financial stability.’ You can try goggling both. You will find drafts.

If you have no measuring rod or you use the clearly wrong one, you cannot fully develop this science or any other science. And you cannot design an approximately financially stable economy either.

The science of MACRO-ECONOMIC DESIGN requires a proper measuring rod.

Good piece. Made me think. Maybe the point about gold being an inflation hedge is not quite accurate. Maybe it needs to be thought of as a currency failure hedge? Of course this is distorted a bit because gold is not only fundamental global money, it is also a useful commodity. So maybe we should think of the prices of currencies varying in respect of gold not the other way about. So what we’ve seen is the USD strengthening in respect to gold. I admit that it is likely more complex than this.