About a year ago, Stan Sorscher, Labor Representative, Society for Professional Engineering Employees in Aerospace, published a frighteningly important blog at The Huffington Post (where I also blog on a regular basis) headlined “Inequality — “X” Marks the Spot — Dig Here.”

It was as important for what it gets right as for what it misses.

Sorscher writes:

In 2002, I heard an economist characterizing this figure as containing a valuable economic insight. He wasn’t sure what the insight was. I have my own answer.

The economist talked of the figure as a sort of treasure map, which would lead us to the insight. “X” marks the spot. Dig here.

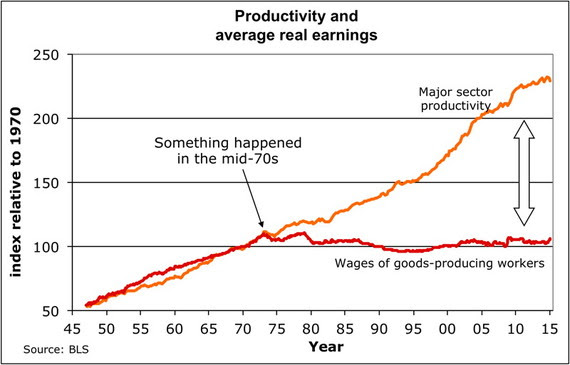

This figure tells three stories. First, we see two distinct historic periods since World War II. In the first period, workers shared the gains from productivity. In the later period, a generation of workers gained little, even as productivity continued to rise.

The second message is the very abrupt transition from the post-war historic period to the current one. Something happened in the mid-70’s to de-couple wages from productivity gains.

The third message is that workers’ wages – accounting for inflation and all the lower prices from cheap imported goods – would be double what they are now, if workers still took their share of gains in productivity.

[…]This de-coupling of wages from productivity has drawn a trillion dollars out of the labor share of GDP.

Economics does not explain what happened in the mid-70s.

It was not the oil shock. Not interest rates. Not the Fed, or monetary policy. Not robots, or the decline of the Soviet Union, or globalization, or the internet.

The sharp break in the mid-70’s marks a shift in our country’s values. Our moral, social, political and economic values changed in the mid-70’s.

The author is exactly right regarding “X” and exactly wrong in getting cause and effect backwards. At “X” Marks the Spot, he notes “[s]omething happened,” and the wages of goods-producing workers flatlined, never to recover. He is right and perceptive in this too little appreciated fact.

Yet he attributes this to some kind of mystical “shift in our country’s values. Our moral, social, political and economic values changed in the mid-70’s.”

As it happens, “X” correlates with Nixon shutting down the Bretton Woods gold standard in 1971 and the epic failure to get it fixed and restored in 1973. The drag, after a modest lag, filtered into the working economy. The rest is persistent stagnation for median families.

It was the destruction of the (dilute) gold standard which precipitated the death, or at least long coma, of the American Dream. That, in turn, caused the ensuing degradation “in our moral, social, political and economic values” as America turned Hobbesian.

Keynes, the great economic icon of the left, understood how subtle and insidious the processes at work during an earlier instance of monetary disorder. In his 1919 classic The Economic Consequences of the Peace, Keynes wrote:

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become ‘profiteers,’ who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Copernicus, who kind of invented (or anticipated) the gold standard — and really was a pretty bright guy, earning the grudging respect even of right wing Flat Earther geocentrists — made a comparable point in his Essay On The Minting of Money (whose modern translation I commissioned and served as lead co-editor):

ALTHOUGH THERE ARE COUNTLESS MALADIES that are forever causing the decline of kingdoms, princedoms, and republics, the following four (in my judgment) are the most serious: civil discord, a high death rate, sterility of the soil, and the debasement of coinage. The first three are so obvious that everybody recognizes the damage they cause; but the fourth one, which has to do with money, is noticed by only a few very thoughtful people, since it does not operate all at once and at a single blow, but gradually overthrows governments, and in a hidden, insidious way.

The GOP is beginning to come around to the gold standard. The academic (though not the ethnic or labor) left remains resistant.

Getting the gold standard wrong could be catastrophic. In getting the gold standard back in place the right way — a way that will be at least, and preferably more, beneficial to labor than to capital — it would be invaluable for the left to begin to come to terms with the crucial role the gold standard played, and again can play, in restoring a climate of equitable prosperity.

Therefore, I respectfully ask that progressives open their hearts to exploring the possibility, just the possibility, that the gold standard would go a long way toward restoring both economic prosperity and economic justice for all — the American Dream. America, and the world, greatly would benefit from participation from the Donks in making sure that the Pachyderms don’t do a wrongheaded pro-Ebeneezer Scrooge version of the gold standard.

Help us write a wonderful pro-Bob Cratchit version that will restore justice as well as prosperity.God bless us every one! (Including you, atheists!)

If we get this right, afterward there still will be much to argue about. We can have merry and spirited arguments as to whether all the extra tax money pouring in from all those new great jobs and businesses should be spent on family leave or abolishing the estate tax.

The thing is… if we get the gold standard right there will be plenty of money to do both. And more. According to a grounded assessment I made a few years ago at Forbes.com there’s probably at least $6 trillion (with a T!) of new federal tax revenues hidden in there, without raising tax rates. Visualize federal surpluses!

And there will be maybe 10X that for the private economy. Win-win!

“X” indeed marks the spot! By following Mr. Sorscher’s invitation to “Dig Here” one discovers that therein lies a buried, and lost, treasure chest of gold that can be leveraged to the common good rather than a mysterious “shift in our country’s … moral, social, political and economic values.”

Putting that gold — and yes, Uncle Sam has plenty of it, the most, by far, in the world — back to work in the right kind of way is highly likely, perhaps even certain, to restore wage growth, end privilege-based inequitable income inequality, and restore our moral, social, political and economic values like nothing else possibly could.

This isn’t partisan. Historically, progressive Democrats like Grover Cleveland were as committed to gold as were Republicans like William McKinley. The left is invited to participate.

So, my progressive friends, let’s grab our shovels, and let’s dig together. “X” marks the spot.

There are those on the left who genuinely wish to do good but are perhaps misguided in their methods, but there are those on the left who have a severely misplaced sense of superiority. I don’t think it’s a coincidence that as people’s wealth declines, their reliance on the state and it’s promises increase; thereby increasing state power and control.

This quote by Alan Greenspan of all people pretty much sums up why gold is hated by those who favour state control and power:

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the ‘hidden’ confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.” – Alan Greenspan, Gold and Economic Freedom

This quote raises another worrying observation. Many people appear to know what the problems are but don’t do anything while they have the power to actually do something. What exactly is going on?

In the UK Mervyn King was the governor of BoE for 10 years but waited until he left to write a book about the problems with the banking system.

Lord Adair Turner was Chairman of the FSA for 5 years but waited until he left to write a book about the problems of debt.

Surely with their intellect they would have understood these problems when in office? It would of helped if they publicly raised their concerns whilst in positions of significant influence.

Maybe then something could actually have been done about these issues.

This argument has merit and demerit.

The merit is that the gold standard probably did help.

The demerit is that in the long run a gold standard is not viable and there are better and workable ways to achieve the same ends.These have been ignored and the price may at least partly be shown by that graph. Read on.

FIRSTLY There are reasons why the value of money cannot be fixed. One of the most important is that the level of liquidity needs to be sufficient to avoid a slowdown and to do that there is no known amount of money which must be created. It s better to have a surplus and that leads to the devaluation of money. Even if that was not done deliberately there is no way to know how much money is needed.

SECONDLY Adam Smith was right. If prices (and that includes worker’s earnings among others which are a price to those who pay for them) are allowed to adjust to the falling value of money as well as to other things (I don’t know that he said this but I am saying it) then problems are solved. Money can devalue and we will be no worse off because of that.

This is the new science of macro-economic design which I am championing.

One day the Cobden Centre will wake up and allow me to write essays on this site. In the meantime people have started asking me to provide lessons and give talks to universities, students, and websites. Other websites. They say I am totally logical.

Keynes got one thing right:

Chapter 1 page 1 paragraph 1: In his ‘A Tract on Monetary Policy’, first published by Macmillan in 1923 J, M Keynes wrote:

“If, by a change in the established standard of value [of money], a man received and owned twice as much money as he did before in payment for all rights and for all efforts, and if he also paid out twice as much money for all acquisitions and for all satisfactions, he would be wholly unaffected”

As Keynes observed in his preface and his first chapter, some prices / values do not adjust. He quoted fixed interest. In fact we can re-arrange all financial contracts so that the value is repaid at a manageable rate instead of leaping around as we repay money plus interest instead. And we can remove all value risk from such contacts. Property prices will adjust instead of moving up and down in a crazy way. We can do the same for currencies. We just have to think and work out how.

Instead of dealing with that problem Keynes, and modern economics, decided to try to show that interventions are possible which can help to manage inflation. It is far easier to manage a stable economy, as Cobden people point out, so what he should have done was to ask “Why are some prices, costs, earnings, values, and interest rates, (and let’s add currency values), not able to adjust / not adjusting?”

That is what I have done. I found out why. And how. This is the new macro-economics. It is logical and it is practical.

Then we must manage the stock of money, not try to fix it. There are two components to manage in quantity – base money, and the rest which is mostly pure credit. Since the 1970’s the ratio of pure credit to base money has accelerated (I assume because it is reportedly 25:1) making borrowing essential to maintain liquidity. People do not have the capacity to borrow that much and it favours the wealthy and discriminates against the low wage earner.

THIRDLY The value of money is what people are willing to exchange it for. Let’s not try to tell them how much of anything they can exchange money for. If you fix the price of a harvest you get food mountains. If you try to fix the value of gold you get a shortage of gold.

So let go of that idea and allow people to decide what things are worth and let us supply the needed liquidity in base money firstly and pure credit in moderation. Pure credit does not have to be created by banks. There can be a market in it. And a market price called the rate of interest. Don’t try to manage prices of anything including interest rates and gold.

If workers are getting too little there are ways to rectify that. The world is wealthy enough to share the goodies more evenly. What about a basic wage for everyone? It does not yet need to be as high as was suggested by the Swiss. But it can help as robots take jobs.