Editor’s Note: The following history of fractional reserve banking, by Colin Lloyd, was kindly written especially for The Cobden Centre.

William Hogarth – The South Sea Bubble

The South Sea Company was founded in 1711. The company was part of the treaty during the War of Spanish Succession, which was traded in return for the company’s assumption of debt run up by England during the war. The South Sea Company collapsed in 1720.

- Central banks appear more powerful than at any time in their history – has something changed?

- Not really – because of their role in government debt management and fractional reserve banking, central banks have always possessed this power

The main driver of stock market performance, since the 1980’s, has been interest rates. It will continue for the foreseeable future. Its influence has increased inexorably over the past thirty years but the mispricing of the market rate of interest has been a distorting and destabilising factor for much longer, in fact, since the invention of the central bank.

In the first part of this article I will look at the development of central banking with specific reference to the Bank of England. In part 2, I go on to suggest that the long run effect of government borrowing, at lower rates than corporate borrowers, increases pro-cyclicality, crowds out more economically productive private investment and, even as it reduces absolute interest rates for all borrowers, drives rates further below the “natural rate” leading to malinvestment.

Part 1, however, is predominantly an attempt to learn from history. You may detect the occasional “inverse déjà vu” – the unconventional monetary policies of the last few years have even more egregious precedents.

A brief history of central banking

Medieval Banking

The Bardi, Peruzzi and Acciaiuoli companies of Florence were the first true banks of the modern era. Their raison d’etre was to act as correspondents for trade between different geographic regions – the time, cost and risk associated with moving gold or silver was considerable. The first bankers were truly the “servants of industry”. These companies thrived at the beginning of the 12th century but were declared bankrupt in 1345 after lending too freely to impecunious sovereigns, not least, Edward III of England.

Edward III grandfather, Edward I, had expelled the Jews from England only fifty years earlier (1290) and bankrupted the Ricciardi of Lucca – an Italian merchant society – from whom he had been borrowing at around 15%. The Ricciardi were caught in a liquidity squeeze in 1294 when war broke out between England and France – Edward I attempted to drawdown on his overdraught facilities to fund his campaign and found that the Ricciardi’s could not deliver the cash. Perhaps Bardi and Peruzzi thought a diverse pool of sub-prime loans had a better credit rating than each one in isolation. It is estimated that they were earning up to 40% interest on their loans. Clearly Edward III was the Junk Bond King of his day.

Other small banking institutions grew up in other Italian cities such as Genoa, Venice. These early banks acted principally as safe depositories although they did engage in a limited amount of fractional reserve lending (1) despite this being strictly illegal. Lombard Street in London derives its name from the Italian bankers who operated in that part of the city in the 12th and 13th century.

After bubonic plague swept across Europe during the 1340’s and 1350’s, wiping out more than 30% of Europe’s population – by conservative estimates around 25mln died – trade diminished, prices fell and average wages rose. By the 15th century Europe’s population had fully recovered and the Medici Bank (1397-1494) in Florence – which had branches in Rome, Milan, Venice, Geneva, Avignon, Lyons, London and Bruges – and other smaller enterprises, had taken the place of the earlier banks. Monte dei Paschi di Siena (founded 1472) is the only surviving bank from this period. To avoid the risks of bankruptcy these new institutions were established in a form similar to a modern holding company with trading subsidiaries and limited liability.

European finance developed slowly due to the Catholic Church’s prohibition on usury. This had begun with a prohibition on the clergy lending money at the Council of Nicea in AD325. Later in the 4th century the prohibition was extended to the laity. Enforcement gathered momentum and usury was declared illegal during the rule of the first Holy Roman Emperor, Charlemagne (800-814). It reached its zenith in 1311 when Pope Clement V made the ban on usury absolute and declared all secular legislation in its favour, null and void. We are, therefore, indebted to Arabic financial practices, designed to circumvent Koranic laws relating to the payment of interest, for the invention of the Letter of Credit and the Bill of Exchange.

In Northern Europe, trade finance grew with the success of organisations such as the Hanseatic League (1358) and the Company of Merchant Adventurers (1551) but Letters of Credit and Bills of Exchange gained new prominence during the “age of discovery”. Companies such as the HEIC – Honourable East India Company (established 1600) and the VOC – Dutch East Indian Company (established 1602) dramatically increased demand for banking facilities.

The arrival of the Central Banks and the 18th century

Although some would argue that The Bank of Venice (1157) considerably pre-dates it, the general consensus is that the world’s first central bank was the Sveriges Riksbank. Originally called the Riksens Standers Bank – Bank of the Estates of the Realm – it was established by the Swedish parliament in 1668, after the collapse of Stockholms Banco in 1664.

Following the “glorious revolution” in England, when James II was deposed in favour of William and Mary (1688-89) government finances were in disarray. Modelled along the lines of the Amsterdam Wisselbank (founded 1609) rather than the state run Riksbank, the Bank of England received its royal charter in 1694. This had been the thirty eighth proposal for a central bank presented to parliament since 1600.

The table below shows the interest rates on Crown or Government borrowing during the 17th and early 18th century. I have ignored the “Forced Loans” during the reign of Charles I as these were really a form of taxation. For comparison I have outlined the prevailing rate for corporate loans, mortgages and, since the data is much more extensive, the income derived from rental yields – tenants had little security of tenure at this time:-

| Year | Borrower | Rate | Notes | Loans | Mortgages | Rental yield | Usury Maximum |

| 1604-1605 | James I | 10% | from the Fishmongers | 7.74% | 5% | 6.07% | 10%* |

| 1611-1612 | James I | 10% | Secured by duties | 7.86% | 5% | 5.85% | 10% |

| 1617 | James I | 10% | Secured by bond | 7.86% | 5% | 5.85% | 10% |

| 1625 | Charles I | 8% | Secured by Crown revenues | 7% | 5% | 6.26% | 8% |

| 1640 | Charles I | 8% | Usual Rate | 6.74% | 5% | 5.78% | 8% |

| 1660-1670 | Charles II | 8% | 5.47% | 4% | 5.40% | 6% | |

| 1665 | Charles II | 8-10% | Secured by taxes | 4% | 4% | 5.40% | 6% |

| 1660-1685 | Charles II | 10-20% | 5.55% | 4% | 5.38% | 6% | |

| 1680 | Charles II | 6% | Secured by revenue | 5% | 5% | 5.30% | 6% |

| 1690 | William III | 10-12% | Secured by revenue | 5.26% | 5% | 5.00% | 6% |

| 1690 | William III | 25-30% | Unsecured | 5.26% | 5% | 5.00% | 6% |

| 1692 | Government | 10% | First Issue | 5.26% | 5% | 5.00% | 6% |

| 1693 | Government | 14% | Second issue | 5.26% | 5% | 5.00% | 6% |

| 1694 | Government | 8% | BoE loan secured by duties | 5.26% | 5% | 5.00% | 6% |

| 1697 | Government | 6.30% | Secured by Excise duties | 5.26% | 5% | 5.00% | 6% |

| 1698 | Government | 8% | Secured by Excise duties | 5.26% | 5% | 5.00% | 6% |

| 1707 | Government | 5% | Secured by Crown revenues | 5% | 5% | 4.94% | 6% |

| 1728 | Government | 4% | Secured by Coal duty | 4.86% | 5% | 4.39% | 5% |

| 1731 | Government | 3% | Secured by Excise duties | 4.67% | 5% | 4.07% | 5% |

| 1739 | Government | 3% | Sinking Fund | 4.67% | 5% | 4.07% | 5% |

* Henry VIII introduced the first maximum rate in 1545.The Usury law was finally repealed in 1854.

Source: A History of Interest Rates – Sidney Homer, Richard Eugene Syllaand, English Institutional Evolution – North and Weingart, The Agricultural Revolution and the Industrial Revolution:England, 1500-1912 – Gregory Clark, University of California, Crown revenue and the political culture of early Stuart England – Simon Mark Healy (Birkbeck)

The average interest rates for each period are used to calculate the spreads shown in the table below. The largest change (6.45%) is between Crown/Government borrowing and mortgage rates. I have also shown the impact on the loan, rental and mortgage rate during the pre-Bank of England and post-Bank of England periods:-

| Year | Gov-Loan | Gov-Rent | Gov-Mort | Loans | Rental | Mortgage |

| 1604-1693 | 5.19% | 5.75% | 6.46% | 6.05% | 5.48% | 5% |

| 1694-1739 | 0.33% | 0.31% | 0.33% | 4.95% | 4.64% | 5% |

Source: A History of Interest Rates – Sidney Homer, Richard Eugene Syllaand, English Institutional Evolution – North and Weingart, The Agricultural Revolution and the Industrial Revolution:England, 1500-1912 – Gregory Clark, University of California, Crown revenue and the political culture of early Stuart England – Simon Mark Healy (Birkbeck)

Government borrowing costs fell dramatically (6%) the cost of corporate loans and rental yields also declined (1.1% and 0.84% respectively) whilst mortgage rates remained unchanged. If the decline in borrowing costs were solely the result of innovations in finance and capital deepening, interest rate reductions should have been more evenly distributed. This development looks much more like an incarnation of what would become known as the Cantillon Effect:-

When money first appears, it is channelled into the economy only to some actors or into industries previously selected by the central authority, the new money increases the spending availability and purchasing power of these initial actors, increasing their well-being and purchasing capacity without any price increase at first.

The first two English government borrowings, of £1mln each, secured against the duties on beer, liquor and salt, took place in 1692 and 1693. The interest rate was 10% and 14% respectively. As the tables above reveal, these rates were not dissimilar to the borrowing cost for the English Crown throughout most of the previous century. Elizabeth I and Henry VIII had borrowed at similar rates the century before.

It must have been galling to William III, that the Dutch government was, at this time, able to borrow at 3%, despite being in the middle of the Nine Years War with neighbouring France (1688-1697). British Trade bills also achieved better rates than the government could achieve, changing hands at between 4.5% and 6%. Even the longer dated obligations of “merchant adventurer” institutions such as the East India and Royal Africa companies carried a rate of 6%. Government bonds did not yet represent the risk-free rate – hardly surprising since the incidence of crown default on both interest and principal during the previous centuries had been execrable.

When, in 1694, the private founders of the Bank of England, raised £1.2mln by subscription and leant this to the government, at 8%, in exchange for certain privileges, the government was delighted. Essentially they had borrowed at 6% below the previous year’s rate. The government quickly became enthralled with the alchemists at the Bank of England. Borrowing costs for the government fell further, hitting 5% in 1707 and the “National” debt spiralled to £20mln by 1708.

Amid concern about how to finance the cost of another war – rather than how debt should be repaid – a British government commission was convened in 1710. It proposed an elegant solution to the problem – another lottery. The first one, under the auspices of the Bank of England, had not been a success. This time, because the tickets were sold to the directors of the Hollow Sword Blade Company – in reality an early “shadow bank” – it was a success.

The commission’s investigation revealed that outstanding debt only amounted to £9mln – a figure which required some creative accountancy. Edward Harley, the brother of Robert Harley, at that time Chancellor of the Exchequer, and John Blunt, a director of the Hollow Sword Blade Company, nonetheless, made an outlandish proposal. It was that all holders of the government debt be required to surrender it to the newly formed South Sea Company, receiving shares to the same value in return.

The concept of this debt for equity swap is credited to William Patterson, one of the founders of the Bank of England. He had dubious credentials, having been an instigator of the Darrien Scheme – a financial disaster which had led to the collapse of the Scottish economy and, eventually, the Act of Union of 1707. Despite Patterson’s reputation, the proposal instantly met with British government acclaim.

The government would pay 6% annually, plus expenses, to the South Sea Company, the proceeds of which would be distributed as a dividend to shareholders. The company would also be granted a monopoly on trade with South America – even though the majority of the region was controlled by Spain, with whom Britain was at war. This was an even better deal for the British government than their borrowing from the Bank of England. They were now borrowing unsecured without any obligation to repay the principal – in effect a perpetual loan.

A crisis would probably have occurred earlier had the war of the Spanish Succession not ended in 1713. When hostilities with Spain resumed in 1718, the South Sea Company’s South American assets were seized. Undeterred by the sequestration of its assets, James Craggs, one of the directors of the company and also an influential MP, proposed a new scheme to convert government annuities, issued after the 1710 lottery, into South Sea stock.

With the Jacobite Rebellion to pay for, the British government needed to reduce the cost of its borrowing. Under the new conversion scheme the government would pay the South Sea Company 5% – roughly half the rate they were currently paying on existing debt. Of the £2.5mln of annuities available for conversion £1.6mln were taken up. The public was undoubtedly influenced by news of fortunes being made in France by the Scottish financier John Law, the Banque Générale Privée and the investors in the Mississippi Company.

By the end of 1719 total British government debt had reached £50mln. £3.4mln was held by the Bank of England, £3.2mln by the East India Company and £11.7mln by the South Sea Company. Only £16.5mln was held privately of which £15mln was in maturities of 22yr to 87yr. The government finances should have been much improved, but the cost putting down two Jacobite uprisings (1715-16 and 1719) on top of a plethora of European wars, meant that the debt to GDP ratio continued to rise, from 55% in 1713 (£29mln) to 85% in 1721 (£50mln).

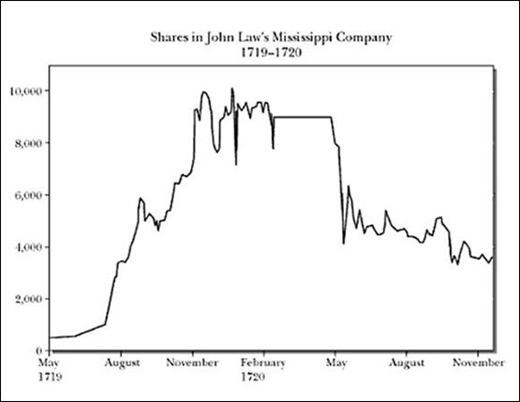

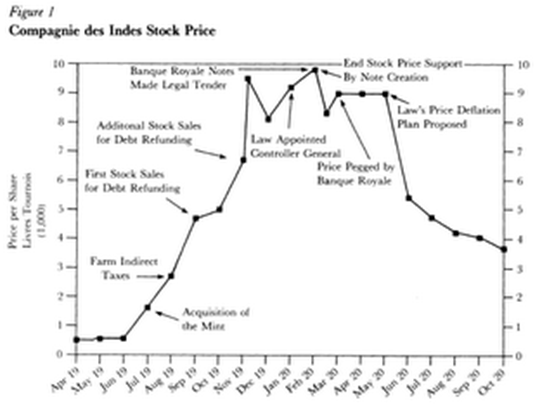

What happened to the South Sea Company next, is typical of many financial bubbles – ascent, collapse and recrimination. The charts below follow the rise and fall in the share prices of the Mississippi Company, the French East India Company and the South Sea Company during the bubble of 1719 and 1720:-

Source: HenryThornton.com

Source: Garber, Thong

Source: Larry Neal, Rollins College

After the bursting of the South Sea Bubble, the British debt to GDP ratio declined to a low of 63% by 1739 – entirely a function of economic growth, the level of outstanding debt was unchanged at £50mln. The ratio began to rise once more with the War of Jenkins Ear (1739-1748) War of the Austrian Succession (1740-1748) Seven Years War (1754-1763) Russo-Turkish War (1768–74) American Revolutionary War (1775-83) Fourth Anglo-Dutch War (1780–1784) and finally the French Revolutionary Wars (1792-1802).

The wars of the 18th century put such a strain on British resources that a “Restriction Period” had to be introduced in 1797, after which, notes could not be exchanged for specie. This non-convertibility remained in place until 1821. By the end of the Napoleonic Wars, in 1815, the National Debt stood at £850mln – 227% of GDP.

The growing power of the central bank – the 19th and 20th century

The post-Napoleonic period (1821-1844) saw Bank of England notes gain greater currency, as many less well financed institutions failed. This culminated in the Bank Charter Act of 1844 which granted the Bank of England a monopoly on the issuance of bank notes in England and Wales.

In the Bank of England – History of the Bank of England they explain that this was not a carte blanche control of issuance:-

(the) Act prevented the Bank from issuing new notes that were not matched by an increase in its gold reserve. The fiduciary issue – that is, the part of the note issue not backed by gold – was frozen at its 1844 level. And to make the status of the currency more visible, the Bank was required to publish a separate balance sheet for its note-issuing activities.

Under the terms of the act the Bank of England was obliged to withdraw from commercial banking. It had become the de facto guardian of the gold reserve. This was a natural progression towards its role as, what Sir Francis Baring had, as early as 1797, dubbed, “The lender of last resort”.

The 19th century saw a series of banking crises – most notably Overend and Gurney in 1866 – which prompted the publication of Walter Bagehot’s – Lombard Street in 1873. Ironically, Barings itself had to be rescued by a consortium led by the Bank of England during the sovereign debt crisis of 1890.

For Britain, the golden age of the Gold Standard ended in 1914 with the outbreak of the Great War. Between 1925 and 1931 the Gold-Exchange Standard attempted to fill the void, until a worldwide economic depression hastened its demise. In 1945 a new gold-exchange standard was introduced under the terms of the Bretton Woods agreement – a year later the Bank of England was nationalised. The Bretton Woods Agreement collapsed in 1971, since when central banks have had the power to provide infinite fiat liquidity and set domestic interest rates. Since these institutions are now all state owned, one might be tempted to say this is “power to the people”. Be careful what you wish for.

Notes:

- Fractional reserve lending or banking is a system in which only a fraction of a bank or lenders deposits are backed by actual cash on hand.

Additional sources:

Nicholas Mayhew – Sterling (1999) Allen Lane

Phelps, Brown and Hopkins – Economica Vol 22 No 93 (1956)

Rondo Cameron – A Concise Economic History of the World – 3rd Edition (1997) OUP

Excellent! Truly excellent.

“”Notes:

1. Fractional reserve lending or banking is a system in which only a fraction of a bank or lenders deposits are backed by actual cash on hand. “”

As a system, fractionally reserved bank lending, once legally established, is a private cartel with the powers of national money creation through debt contracts that become the banks assets. Banks create assets to lend and collect interest. In perpetuity.

Fractional reserve banking is the privatization of the national money commons, providing wealth and income gathering powers to its private members, to the economic detriment of The Restofus.

Fractional reserve banking has run its course and has also become the major obstacle to economic progress. Thus the monetary policy lever (more debt lending) is not working and cannot work.

Time for some monetary financing BY the government. Without debt.