“..but none of the clocks have any hands..”

“We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know, by the rules, that at some moment the Black Horsemen will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. Those who leave early are saved, but the ball is so splendid no one wants to leave while there is still time, so that everyone keeps asking “What time is it? What time is it?” but none of the clocks have any hands.”

- Adam Smith (George Goodman), ‘Supermoney’

Mother Shipton’s Cave, in the Royal Forest of Knaresborough in Yorkshire, is one of the oldest tourist attractions in the country. Part of it forms a Petrifying Well that, while it sounds terrifying, has the slightly more mundane characteristic, being rich in minerals, of slowly turning anything left there to stone. Visitors tend to leave teddy bears at the site.

Mother Shipton herself, Ursula Sontheil, was widely regarded as a witch. It is said that at her birth, in 1488, there was a smell of sulphur and a great crack of thunder. A contemporary of Nostradamus, she appears to have been somewhat deformed.

She was most famous for her prophecies. It was believed that she could predict the future. She would become known as Knaresborough’s Prophetess. She died in 1561 at the age of 73.

Mother Shipton predicted the dissolution of the Catholic Church under Henry VIII. She predicted the fall of Cardinal Wolsey, and the ascent of Queen Elizabeth. She forecast television and radio, ships made of iron, and arguably the California gold rush.

But probably her most notorious prediction was that “The world to an end shall come, In eighteen hundred and eighty one.” She was clearly off a bit on that one.

Given the self-evident inaccuracy of forecasts of the end of days, their popularity does seem somewhat bewildering. Wikipedia lists literally dozens of them.

Up until now, of course, they have all been the equivalent of the boy who cried wolf.

For as long as we’ve been working in the capital markets, there have also been sceptics warning of the demise of the biggest bond and credit bubble in history. Like the boy who cried wolf, they have all been discounted, and (rightly) ignored.

This time, however, they could finally be justified.

The financial historian and market strategist Russell Napier was recently asked where investors should sensibly invest. Here is his response:

“You shouldn’t own any fixed interest securities. None. Inflating away debt means destroying the purchasing power of fixed income securities. There may be rallies, but fixed income is in a long bear market. Bond bull and bear markets move in about 40 year periods, and we are now into year three of the current bear market. You can lose a fortune in real terms over the long term. Therefore: No bonds. Period.”

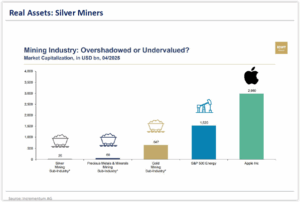

At the same time as we regard bonds as uninvestible given the monstrous build-up of international government debt (no margin of safety, and the existential threat of a fiat or monetary reset), other assets look to us to be unusually compelling, due to a mixture of attractive relative valuation and the possibility or for that matter probability of an inflationary ‘solution’ to the global debt predicament. Real assets in general, and the monetary metals, gold and silver in particular, seem well placed, to us, to make further significant gains in fiat terms. Consider the following chart, admittedly somewhat dated now, courtesy of Incrementum AG. As at April of this year, if you had $3 trillion at your disposal, you could have bought the entirety of Apple Inc. Or for the same amount of capital, you could have bought every listed silver miner 120 times over. Whereas gold tends to be hoarded – not least by central banks, who clearly foresee problems for fiat currency ahead, and notably for the US dollar – silver tends to be consumed, given its myriad industrial uses. Markets don’t often ring a bell denoting extraordinary opportunity, but they seem to be in this case.

Meanwhile, the Gadarene stampede into all things AI continues. But the AI mania is itself only a symptom of a much wider explosion in credit. It all feels very 1929. (And yes, Andrew Ross Sorkin’s recently published account of that fateful year, ‘1929: The Inside Story of The Greatest Crash in Wall Street History,’ is a terrific read.) Doug Noland for the ‘Credit Bubble Bulletin’:

“There is every reason to fear that U.S.-style leveraged speculation has proliferated throughout global finance – every nook and cranny. Clearly, a massive “yen carry trade” funded by cheap Japanese finance has stoked bond issuance globally. I suspect massive speculative leverage has accumulated throughout emerging bond markets. Leveraged speculation also dominates European debt markets. Especially over recent years, a sophisticated global infrastructure developed to profit from leveraged speculation and derivatives trading. Moreover, this historic speculative bubble was stoked over the past year by a global central bank easing cycle.

“A strong case can be made that we’ve witnessed the heyday in global speculative Bubble excess and resulting liquidity overabundance. Importantly, this liquidity onslaught has masked major festering problems – at home and abroad. In a less accommodating market environment, France would today have its back against the wall; markets would forcefully punish Japan and the UK; Greek, Italian and others’ finance would be suspect; EM issues (i.e., Brazil’s corporate debt) would be pressing. If not for liquidity excess, we would have today quite different U.S. economic and Credit environments.”

Both Bitcoin and certain shares of the so-called ‘Mag 7’ tech giants are now showing signs of technical weakness.

Notwithstanding Nvidia’s recent strong revenue data, contrarians will find plenty of nutritious fuel in the complacency of AI market participants with vested interests; amongst others, Noland cites the following headlines:

“AI Bubble Talk is Overblown.” “Softbank Says Skipping AI is Riskier Than Betting Big.” “An AI Bubble? The Bond Market Is Not Seeing One.” “AI Boom vs. Dot-Com Bust: TD Wealth Says Today’s Market has Real Profits, Not Just Promises.” “The AI Bubble is a ‘Rational Bubble,’ Say’s Mohamed El-Erian.” “Ed Yardeni Says ‘Buy The Dip’ In AI Stocks, Calls market Nervousness Healthy Sign.” “AI Isn’t a Bubble – But It’s Showing Warning Signs.” “Microsoft President Brad Smith Says: There is no AI Bubble.” “Goldman Sachs Says We’re Not in an AI Bubble.” “AI Isn’t a Bubble but Rather an Opportunity, JPMorgan’s Erdoes Says.”

Blackrock’s Rick Rieder: “I don’t think it’s an AI Bubble. I don’t think there’s too much froth.” (Bloomberg, Nov. 7)

JPMorgan’s Mary Erdoes: “AI itself is not a Bubble. That’s a crazy concept… We are on the precipice of a major, major revolution in a way that companies operate. So, if you say to yourself, is AI in a Bubble, I feel you have to get very granular on how you’re going to answer that, because in the U.S., we’re starting to gain traction, but we’re nowhere near the ability to have the stuff all to the bottom line.” (CNBC, Nov. 13)

Ares Management’s Michael Arougheti: “We have a long way to go in terms of the economic investment relative to the size of the economy. We can’t bring the supply on fast enough to meet the near-term demand. So, I just feel there’s a lot of hyperbole because the numbers are big and it is that revolutionary.” (CNBC, Nov. 13)

Goldman Sachs’ Brittany Boals: “We did have a conversation about markets and whether or not we think we’re in a Bubble. We do not think we’re in a Bubble, and we pay very close attention to that.” (Fortune, Nov. 9)

BofA semiconductor analyst Vivek Arya: “We believe the recent concerns re AI financing are highly overstated.” (Investopedia, Oct. 9)

“This degree of concentration is, in our view, unsustainable, but this is not the same as saying that we are experiencing a Bubble.” (Goldman Sachs: “Why We Are Not in a Bubble… Yet,” Oct. 25)

Doug Noland:

“I’ll simplify the Bubble discussion: the expansion of finance required for the historic AI and energy infrastructure arms race buildout is increasingly unstable and inevitably unsustainable. In [recent] liquidity abundance and market exuberance, the AI build out appears at least somewhat feasible. But [later], with de-risking/deleveraging knocking on the door, it’s a different unfolding story.

November 11 – Wall Street Journal (Matt Wirz): “Tech giants need so much money for their artificial-intelligence ambitions that Wall Street is developing new ways to get it for them. Details of some of the biggest AI infrastructure deals, including those involving Meta, OpenAI and xAI, are coming into focus, revealing lucrative, innovative—and in some cases risky—funding schemes. Exhibit One is the deal fund manager Blue Owl Capital struck with Meta in their joint venture to build a giant data center in Louisiana called Hyperion. Blue Owl is buying private equity in the deal and is receiving a debt-like guarantee from Meta if the partnership falls apart, an extraordinary protection… Another deal involving OpenAI and Oracle involves a lending syndicate of more than 30 banks… Tech titans are offering sweeteners in their deals because they need to offload risk as the cost of the AI arms race soars, threatening even the strongest competitors. Meta’s market value dropped by around $300 billion in a few days after Chief Executive Mark Zuckerberg warned about higher spending on AI… Banks and fund managers are writing big checks for now, but many are worried about how the complicated deals being signed today will perform when the AI frenzy calms down. Another concern is that each time tech companies take on lots of new debt, their cost of borrowing rises.”

November 11 – Bloomberg (Chris Bryant): “Costing tens of thousands of dollars each, Nvidia Corp.’s pioneering AI chips make up a hefty chunk of the $400 billion that Big Tech plans to invest this year — a bill expected to hit $3 trillion by 2029. But unlike 19th-century railroads, or the Dotcom boom’s fiber-optic cables, the graphics-processing units (GPUs) fueling today’s AI mania are short-lived assets with a shelf life of perhaps five years. As with your iPhone, this stuff tends to lose value and may need upgrading soon because Nvidia and its rivals aim to keep launching better models. Customers like OpenAI will have to deploy them to stay competitive. So while it’s comforting that the companies spending most wildly have mountains of cash to throw around (OpenAI aside), the brief useful life of the chips and the generous accounting assumptions underpinning all of this investment are less consoling.”

Noland:

“It’s reasonable to assume that huge leverage has accumulated throughout the crypto universe. Deleveraging has commenced, and, unlike equities, crypto currencies don’t enjoy the powerful liquidity backstop provided by corporate buybacks. Huge flows into bitcoin and crypto (perceived liquid) ETF structures now face the prospect of destabilizing deleveraging, an abrupt shift in perceptions, and a run from the asset class.

“This AI/tech monster Bubble is an accident in the making. After a parabolic liquidity-induced speculative blowoff, the sector has transitioned to a pre-crisis, hyper-instability phase. Here, we can assume massive speculative leverage – margin debt, options and derivatives-related, hedge funds and such. Millions of speculators across the country embraced bigger balances for Credit cards, personal loans, auto loans, and mortgages to ensure greater liquidity available to play the ever-rising stock market.

“An exceptionally powerful and protracted bull market has at this point thoroughly conditioned retail investors to buy the dip. The hedge funds and broader “leveraged speculating community” have been similarly conditioned. But they have daily market gains and losses, investors and, importantly, leverage. I have a hard time believing that the more sophisticated players haven’t begun – at the margin – the process of moving to mitigate risk and leverage.

“I contend that we’re at peak global liquidity.. Unfolding risk aversion and waning liquidity excess will accelerate Credit market deterioration.”

We have no dog in the AI fight. We use AI services and appreciate their speed, efficiency and utility. But as regards the major players within the sector as potential investments, once again we see insufficient margin of safety, not to mention too much circular financing.

There are far wider problems beneath the surface of the global investment landscape. Our longstanding preference for sensibly priced real assets over questionably priced paper ones should be more than apparent by now. So enjoy the party by all means, but dance near the door.