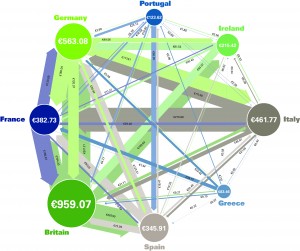

Consider this diagram showing the billions of euros that each of 8 EU countries owes the other.

Whilst the numbers are far from perfect, they give a clear understanding of the extent to which EU debt obligations are interlinked. But why try to raise money to pay someone off if they owe you even more? Why not cross cancel the debts and be left with the difference?

To see how this might work I recently ran a classroom simulation where students did precisely that. After three trading rounds they had managed to generate the following results:

- The countries can reduce their total debt by 64% through cross cancellation of interlinked debt, taking total debt from 40.47% of GDP to 14.58%

- Six countries – Ireland, Italy, Spain, Britain, France and Germany – can write off more than 50% of their outstanding debt

- Three countries – Ireland, Italy, and Germany – can reduce their obligations such that they owe more than €1bn to only 2 other countries

- Ireland can reduce its debt from almost 130% of GDP to under 20% of GDP

- France can virtually eliminate its debt – reducing it to just 0.06% of GDP

The final picture demonstrates the scope for cross cancellation. It is hard to see how such a policy would be possible, let alone desirable, but as a pedagogical exercise I think it is worth consideration. For those interested in more details I have set up a website: http://www.eudebtwriteoff.com. You can also download the full report: The Great EU Debt Write Off (.pdf)

Related articles

- Steve Baker MP: Bailouts are a dead end but bilateral debt cancellation could transform the European crisis – Conservative Home

One question:

by your exposition I tell that you are treating the Bund that I, as a person, have just bought as “German debt held by Italy”, and the BTP that Hans, a German friend of mine, has just bought as “Italian debt held by Germany”?

Why should I compensate my Bund with Hans’s BTP to favour the Governments of Italy and Germany reciprocally? The Bund is not Hans’s debt, and the BTP is now my debt.

Are you mixing individual and States’ positions or have I missed a point?

Interesting idea.

Hi Leonardo – the data is taken from table 9D of the BIS report we link to on the website. We included bank debt as well as sovereign debt mainly because we favored simplicity over realism. If anyone wanted to turn this from a classroom simulation to a policy proposal there’s a ton of data availability issues that would need to be worked on.

AJE you say this is a student exercise but I now see various writers posting about the idea as if it was a practical exercise.

As you said you used combined Government and Bank debt although as Leonardo above points out cancelling public Government owned against private bank debt is a little unfair on the owners of the banks.

A quick bit of research shows total UK Foreign assets of about €90bn. If we guess that at least 50% will be €, the rest being USD, Yen and Gold. Then of the €459bn you use in your scenario becomes only €45bn.

If you look at the website you’ll see that it was indeed a classroom exercise. It was also a simulation though, and I think a few people seem to be confused about what that is. I’m aware of the limitations of the data, but we needed to use similar estimates for all 8 countries. We explained our methods in the paper, I hope it’s clear that we’re trying to encourage better analysis here, not claim that we are definitive. If you can find data for all 8 countries, with sources, I’d be interested to hear more.

This may help:

http://www.imf.org/external/np/sta/ir/IRProcessWeb/colist.aspx

Shows foreign exchange reserves,excluding gold, of:

Greece $1.4bn

Spain $21.9bn

Portugal $3.6bn

Italy $5.1bn

Yeah, so while a worthwhile exercise, the question is what is the lesson learned by your students.

Hope they’re paying attention.

It’s been oft said that experience is the tougher teacher as she gives the test first and the lesson afterwards.

Here we have the test of the lunacy of private bank creation of national monies.

One lesson could be on the need for public-money systems so that “countries” can cross-cancel their debts.

The Euro-factoid outstanding is that the private banks actually get to CREATE their nation’s money out of nothing, ALWAYS as a debt, and lend it to the European brethren “countries”.

Countries face the problem of unemployed, un-housed and non-waged workers.

Those private banks face no such problems.

So, if we want a level playing field, then I suggest we have the Euro leaders read the 1939 Program for Monetary Reform, so that those with the problems can also be those with the solutions.

The math is interesting though.

reciprocal debt-credit relations will always exist, this is not the problem (everyone in the world has his own risk-interest preferences on assets). The ex-nihilo money creation implies the magnification of these relations and flows (especially if money creation stems from public debt increases), not their mere existence.

t’banks wont like it…so it aint going to happen.

I was thinking the other day about why do we borrow money from a bank that generates the credit out of thin air and charges interest for the possible risk of losing something that cost them nothing? The house is the only thing of value in the transaction, (same for car, flat screen tv etc) and your promisory note to repay is then sold, illegally without your permission, on the debt market. Why couldn’t we have a system whereby the credit to buy the house is generated by the deeds? You pay and 15, 20 or 30% deposit, you pay against the house deed account and if you get into arrears someone else can bid for your house and you lose your deposit but take the difference. No interest is charged, therefore you can’t be thrown out by N Lamonts uber fiat foolishness. Banks don’t get a cut. House builders dont need to be in league with banks ensuring ever rising prices. Housing Benefits would drop dramatically because banks don’t need it to be high enough to keep them and the house builder in business at taxpayers expense. You can afford the house of your dreams. You can tell your existing mortgage provider to put it in the coal cellar…..

“why do we borrow money from a bank that generates the credit out of thin air and charges interest for the possible risk of losing something that cost them nothing?”

I think you will find one sided accounting is not allowed. Banks can only lend money from there capital or money they have borrowed from 3rd parties.

The ‘out of thin air’ part comes when that 3rd party borrowed money gets deposited in another bank and they write that as an ‘asset’ and multiply it via fractional reserve banking to 10 times that amount. Hence when banks stopped lending to each other in 2008 the whole Ponzi scheme was exposed.

Let’s say I borrow £100 from a person and then deposit that £100 in a bank. The bank then has that £100 and it owes me £100. That I’ve borrowed the money myself doesn’t matter. It still comes into the bank’s possession quite legally.

I agree that this process increases the money supply. But there is nothing fraudulent about it and money isn’t created “from thin air”.

That assumes everyone is solvent and able to meet their end of the bargain. This is the same problem for the $1.5quadrillion derivative mountain. The values are notional, but when you actually mark each participant to market are they all solvent, and if just one counter-party fails, then the same interconnectedness that is sold as a “netting out” virtue becomes a systemic collapse ? The notional amount becomes actual if just one link in the chain is broken. This is why they cannot let even the smallest minnow fail. It only takes one domino to bring them all down.

Given that current accounting amendments allow the banks to mark their book to model(fantasy) and not to market, I suggest the chances of systemic collapse are rather high.

hey, you do realise that actually where debts are “owed by a country to another country” what it means is that some may be banks leanding to governments or visa versa and so wont cancel as easily,

http://demonocracy.info/infographics/eu/debt_greek/debt_greek.html

on this site, it shows how people who greece owes money tooo are actually made up from quite a few banks . . so not all the debt will wever be cancled as long as bankers are greedy little piles of s**t that sit around playing with figures like noone cares and then get rewarded for it, notheing iis really gonna change,

Theres always gonna be someone who has got all the money being owed to them thinking ” haahaha suckers . . .” because they know they’re gonna get rich