A new white paper resolving Gibson’s paradox is posted on GoldMoney’s site, here:

https://www.goldmoney.com/

The full ramifications will take further analysis and thinking, but the immediate implications appear to be:

* It shows that in a free market commodity prices rise and fall in phase with interest rates, and not, as commonly supposed, the opposite way round.

* It causes us to rethink the relationship between borrowers and savers. In a free market it is borrowers that set the rate.

* It undermines the quantity theory of money, as originally proposed by David Ricardo in 1809 and further refined by Irving Fisher and Milton Friedman.

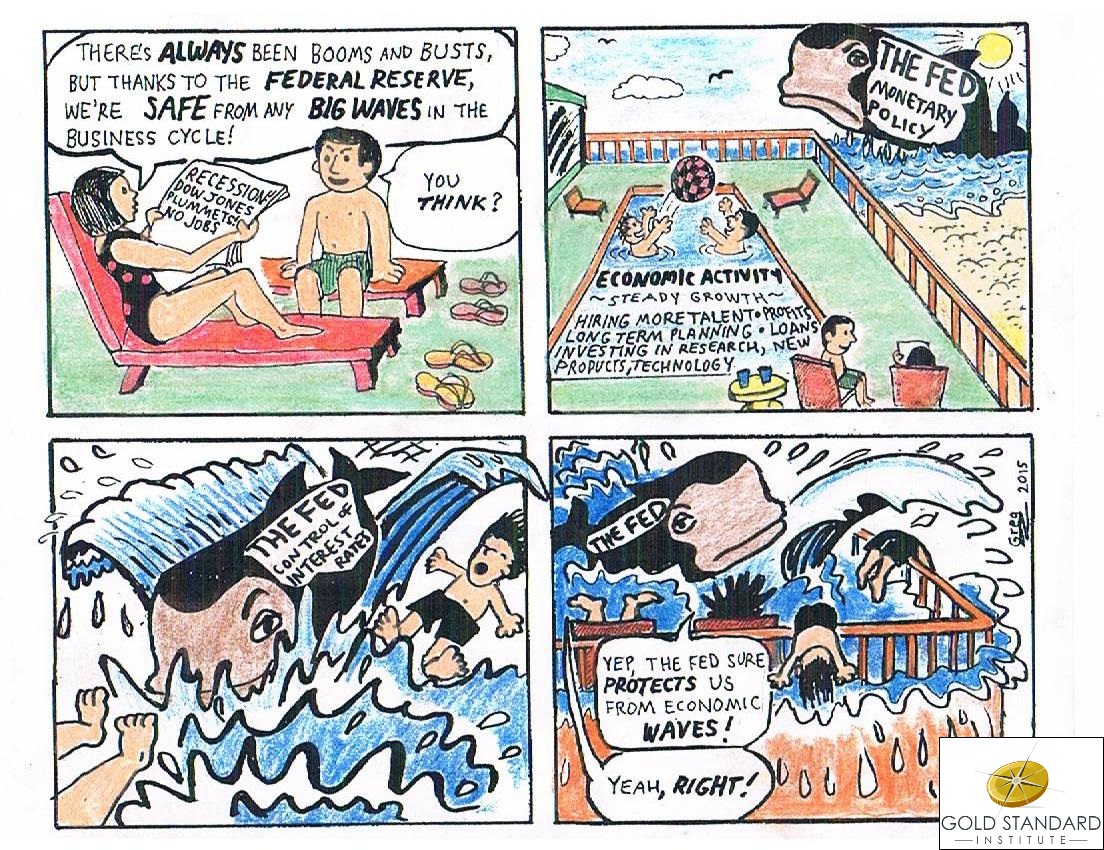

* It throws into doubt the whole basis of central bank monetary policy.

* It is wholly consistent with Say’s law, reaffirming its validity.

I strongly urge everyone to read it.

Regards

Alasdair Macleod | Head of Research