Do you remember when Zimbabwe was the country that had a $100 trillion dollar note but it was only worth a few US dollars? Well, last week the Zimbabwean government announced that consumer prices reduced last month to an annualised inflation rate of 3%, while in the US’s Bureau of Labor Statistics announced that the American Consumer Price Index (CPI) rose 0.5% in February: taking the country up to an annualised inflation rate of 6%

Similarly, we have just learnt from the Office of National Statistics that the UK’s Consumer Prices Index annual rate of inflation went up from 4% in January to 4.4% in February. Inflation in the country’s Retail Prices Index (RPI) rose from 5.1% in January to 5.5% in February. In other words, the highest official rate for more than 20 years.

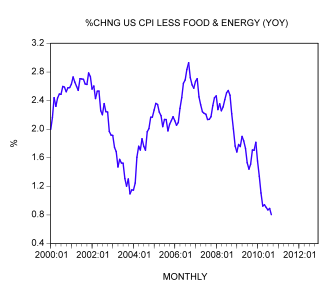

Now, for all you enthusiastic Keynesian types out there don’t worry. This has nothing to do with governmental printing presses or any of your marvelous policy procurements. You see, the increases in inflation have been purely driven by “volatile” food, energy and clothing costs, and in no way reflect fundamental and longer-term “underlying trends”.

US petrol up 4.7% (an annualised rate of 56%)? Irrelevant. US public transport up 1.9% (an annualised rate of 23%)? Not important. Food consumed by American households up 0.8% (to an annualised rate of 10%)? Well, such is life in a ‘volatile’ world.

The only thing is that unlike the UK and the US, Zimbabweans have clearly discovered the secrets to a more stable and tranquil world. Yes, that’s right, much less volatility there. That explains it.

An amusing piece, but one cannot help wondering how reliable the Zimbabwean government’s estimate of inflation is?

last week the Zimbabwean government announced that consumer prices reduced last month to an annualised inflation rate of 3%

Does anyone believe this? UK stats are open to criticism by a free press and other media outlets. Not so Mugabe’s dictatorship.

Or have I missed sthg?

on the premise that you trust the UK government figures????

Doh!!!!!!!!!

Like so many other government functions, there is no need for a government price report. A commodities index such as the Rogers index, which tracks a basket of 35 different exchange-traded physical commodities, can provide the same information. The Rogers index rose 35% in the last 12 months. ( (http://bit.ly/eu8vOA)

Governments issue price reports because government benefits, such as social security, are based on those reports. Recently the US government didn’t raise social-security/slavery benefits after reporting no increase in its CPI calculation. How convenient! (http://aol.it/cxCB2U)

Zero increase in prices when all commodities have dramatically risen in price. How could this be? The government adjusts the CPI model when contributory prices rise. During the housing boom, housing prices were replaced by rental prices. (http://conta.cc/gNY4sF)

The only way to know whether Zimbabwe prices are rising is to track an index of prices for goods denominated in Zimbabwe dollars.

Actually, since prices are a reflection of inflation, and inflation is a monetary issue, the best measure of inflation would be knowing changes in the quantity of money. The US *stopped* reporting the “M3” money quantity in 2006, just before Shadowstats, the monetary watchdog activist, asserts M3 rose by upwards of 20% per year around 2008. http://bit.ly/5UBZcC Frankly, i wouldn’t even believe an M3 government report even if there was one.

Is there a Zimbabwe version of ShadowStats tracking that local money quantity?

Increase in the price of raw commodities doesn’t directly imply an increase in consumer price, or even many producer prices (since producer prices are of finished producer goods). What it does imply though is that the Cantillon effect is beginning once again in the inflationary direction. Some prices are rising and in time the effect of those rises will spread out and prices more generally will rise, consumer prices and producer prices will rise in the future.

Advanced in consumer product production will lower prices, and this could balance out any increases in raw commodities prices. The iPad2 might be an example. Producer prices rose, but better production methods reduced the cost of production, so Apple could sell the iPad2 for the same price. However, the iPad2 price would have been lower if not for the devaluation of the dollar due to increases in the money quantity, and this is the point that Fed Reserve chief Dudley didn’t mention when raving about the constant iPad2 price. (http://bit.ly/eTD1jJ – don’t miss the funny comments)

The raw commodities index shows the forthcoming consumer price increases. Consumers can use it as a second warning about inflation, while the first warning is a change in the quantity of money. In contrast, producers must look at changes in the quantity of money when deciding whether to hedge/exit a national currency.

Regarding the Cantillon effect, the price of goods favored by those who receive government funds will rise first. This would include products used by weapons companies, meaning metals rather than agricultural or clothing products.