The conduct of the Bank, in inflating the currency, produces a rise of prices. The prices of all commodities gradually rise; that begets what is thought prosperity; it is in fact unhealthy excitement; this causes an extension of our commerce and manufactures; it causes an advance of prices abroad, in consequence of the advance in this market, which is the regulator of the prices abroad, and that begets a general system of overtrading. This overtrading inevitably leads in the end to discredit, and panic to a greater or less degree.

— Richard Cobden, Parliamentary Committee of Inquiry into Banking, 1840

However firmly we hold to the view that the hypertrophic, state-coddled, fractionally-based financial markets in which we must operate are not exactly the embodiment of dispassionate rationalism in their workings, it is nonetheless true that, over time, commodity prices can be shown to trace out a path not wholly divorced from that followed by the real-world processes which utilise them—especially industrial production and the internationally-dispersed network of outputs best reflected by global trade flows.

In making a claim for the influence of what might be broadly termed ’fundamentals’, this is not to assert the patently indefensible proposition that commodities—much like stocks, bonds, houses, classic cars, vintage wines, or antique furniture—are not also subject to alternating waves of avarice and abhorrence—the ‘temperamentals’, if you will—which may occasionally swamp the underlying pull of such mundanities as supply, demand, and inventory.

In fact, given our global system of unanchored (and frequently unhinged) money and credit, even this ostensible distinction between price movements supposedly soundly based on metal in the warehouse, or barrels at the refinery and those caused by the wilder, speculative herding founded on chart patterns, leveraged groupthink or blind computer algorithms is much less definitive than it appears.

If hot money and overabundant finance can sometimes be shown not to be pouring directly into purchases of cotton or copper or crude oil as mere gaming counters in the global casino, these evil twins will, nonetheless, be feverishly driving economic activity into channels of commodity-consuming activity which, both in their form and scale would not otherwise be taking place.

This logically implies that the commodity ‘fundamentals’ – as well as the equity, the currency, and the bond ‘fundamentals’ – still rest, albeit at one remove on this occasion, upon the very same malign effects of monetary laxity, budgetary overstretch, and misdirected enthusiasm as before.

That said, we cannot stand on the sidelines in a huff of purism. Since we must always be aware that the field of battle is not the pristine sandbox of the officer training school, but rather a dead ground-riven labyrinth of swamps, ravines, and gullies, this implies that if we are to contend at all, we must trade, invest, and practice our entrepreneurship amid the far from perfect conditions we have been given, sticking to our principles but being pragmatic enough to tailor them to the circumstances which confront us.

So, let us not here debate the merits or the long-term sustainability of what we might here term the ‘Globalised Asia’ model, let us just accept that it is, for better or for ill, the dominant feature of our world.

Whether their leaders’ coy mercantilism or the cynical machinery of exploitation which funnels their vast pools of captive savings into the blind service of the great, native industrial combines will ultimately squander the admirable energy and technical prowess of these most assiduous of peoples, only time will tell but, until the wax melts on the wings of these oriental Icaruses, theirs has irrefutably become the main voice in the fundamental pricing of commodities.

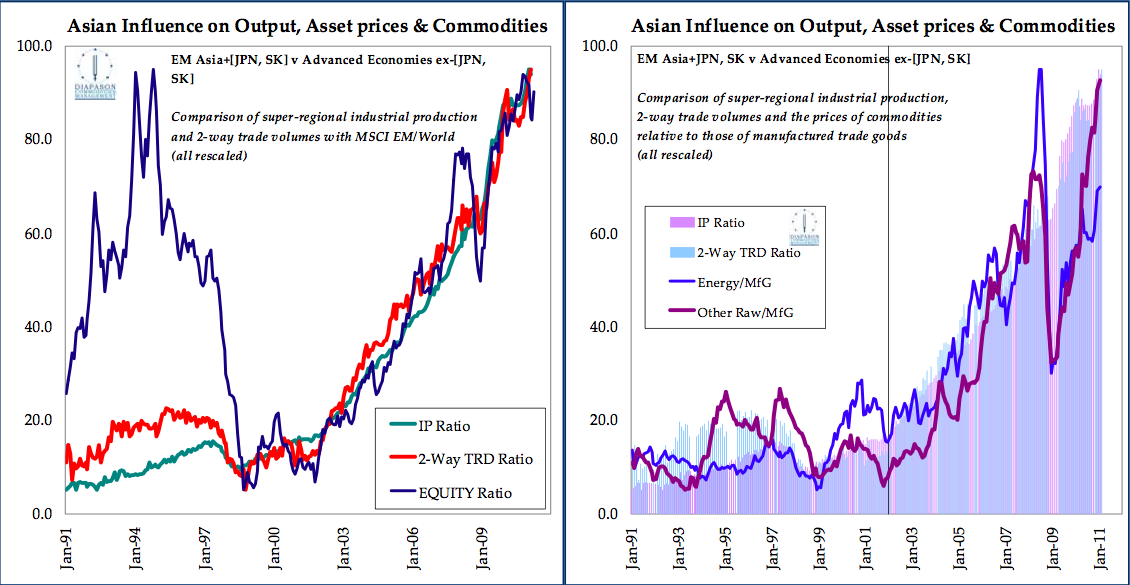

Indeed—to the extent that we trust an aggregate of aggregates to paint an accurate picture of the world—not only are growth rates of industrial output and 2-way trade volumes rising faster in Asia than in the Euro-American West, but, having fallen less far in the Bust and having recovered better in the meanwhile, their absolute magnitude also appears to be greater.

Thus, if we can argue that commodities tend to follow global developments in these two key metrics, we must also take cognisance of the fact that, at the margin, these latter are being dominated by events taking place on the eastern edge of the Pacific.

In fact, for those more traditional asset managers who have come to favour emerging market equities over the more traditional kind (a switch which has paid an annual 13.5% total return premium over the last decade), this is hardly the most stunning of news since the ratio between the two groups of stocks has been a facsimile of the output and trade ratios between the two regions over this same period, though whether this is an accurate guide to the creation of genuine shareholder value or simply an artefact of market perceptions is a question upon which it is not our purpose here to comment.

Furthermore, this has brought about a pronounced shift in the relative pricing of raw inputs and finished manufactures, reversing the previous two decade decline of the former vis-à-vis the latter into a steep, sustained rise in the ratio between them.

If we consider that much capital investment and technological know-how has been transferred to the Asian export hubs in the past ten years, there to be mixed with cheaper labour, arguably underpriced currencies (especially after the mid-90s devaluation in China and the Asian Contagion which shortly succeeded it), and a range of overt and covert financial and fiscal—as well as material—subsidies and couple this with the fact that such centres have been the nuclei upon which a much more wide-ranging local development of industry and infrastructure has crystallised, then the re-ordering becomes fairly self-explanatory.

A glut of cheap, finished goods on Western markets (still their biggest exhaustive consumers if no longer, alas, the Lords Paramount of their creation) has therefore had as its counterpoint a greater degree of scarcity of the commodities which both go into their fabrication and upon which the incomes generated along the way have been later spent.

The Raw and the Cooked

While this situation persists, it implies that commodities should continue to enjoy robust demand and advantageous pricing power, amid a struggle to maintain an adequate supply—fully incentivised though this may be—and with a level of inventory cover which becomes rapidly depleted when the engine is firing upon most (if not all) of its cylinders.

In the case of industrial metals, the trends in demand are clear and if stock:use ratios are still markedly cyclical (as well as subject to the vicissitudes of the individual metal), the general pattern toward lower and lower cover is also fairly apparent. As the example of steel also shows—not only the world’s second most traded commodity after oil, but also one of the least subject to signal pollution from financial markets—the effect on price is also evident.

In energy, matters are even less equivocal. Here, Asian usage is fast approaching 40% of the world total and its share is growing at such a pace that, if nothing interrupts the trend between now and then, the region will account for a majority of global uptake as early as 2020.

Put another way, over the ten years to 2009, BP estimates that world energy use increased by roughly a quarter. Asia-Pacific accounted for four-fifths of that increment, with China alone responsible for three-quarters of the region’s contribution.

For all those in the West about to ruin both their finances and the view from their windows by littering the landscape with banks of appallingly inefficient windmills and uneconomical solar farms, in pursuit of the hysterical Gaian cult of carbophobia, it should be a chastening realisation that almost half the total rise in demand was satisfied by burning coal—85% of that addition emanating from China—a surge which took the fuel’s share to a 40-year high of 29% of all use, largely at the expense of oil.

Given the inevitable, post-Fukushima backlash against nuclear energy (a revulsion, again, felt most keenly among those countries fortunate enough to have largely forgotten what it is like to be without a reliable supply of electricity), the call on hydrocarbons can only be the greater and, should China become serious about cleaning up its own environment (a desire richer nations progressively have the luxury to accommodate), it would seem that natural gas—conventionally-sourced, coal-bed, shale, or liquefied—might be called upon to advance its contribution from the vicinity of 23%, at which point it has been stuck for over a decade past.

Of course, what is true for energy is also these days partly true for agriculture, not just because Asian populations are both growing and moving up the protein chain away from a bland, but relatively efficient diet heavily dependent on staple crops, but because the combined effect of governmental mandates to burn what could otherwise serve as food and fodder in fuel-thirsty vehicles have reached the point where nigh on 40% of the US corn crop is misused in this manner, an amount fully 2 1/2 times the country’s exports (which themselves make up around 55% of the global total) and approximately equal to shipments from the two next biggest sellers, Argentina and Brazil, combined.

With yields per acre for wheat, barley, and oats showing signs of stagnation this past 10-15 years, across several key growing regions, and with rice yields in China growing at far less than half their previous trend rate, the easy pickings from the Green Revolution may already have been harvested meaning that, barring a sea change in attitudes to both GMO technology and biofuel boondoggles, the so-called ’war for acres’ looks set to remain intense.

As a consequence, here, too, does pressure on stock:use ratios seem bound to persist, reducing the cushion we all need to protect us from the capricious buffeting of meteorology and man-made malfeasance, a feature which not only tends to keep prices elevated, but also makes them far more subject to sudden spikes and the optionality of sharp backwardations.

What we have already argued for emerging market stock markets and their co-movement with commodities has also become increasingly relevant to developed world stock markets, too, as surges of growth optimism—or, more crudely, waves of ‘Risk On’ activity push commodity prices higher in concert with equities. This has been true in spades ever since the collapse of AIG/LEH when r-squared between the two has amounted to no less than 0.93.

At the same time—continuing a pattern which has held ever since the twin Russian/LTCM panic of autumn 1998 first sold the great asset market put/moral hazard call to the world’s largest financial players and their swarms of leveraged pilot fish—bond yields (for example, those on 10-year US T-Notes) have tended to follow equity markets (e.g., the S&P500) up and down, as can be seen in the diagram opposite.

Now, it may not seem that significant, but what we have here is a veritable revolution for, over a much broader sweep of modern financial history, bond yields have tended to move contrary to equities (and, hence, bond prices in concert with them) while commodities—’real’ assets, if you will—have tended to move in opposition to this financial Tweedledum and Tweedledee.

Intuitively, what this implies is that investors have long been happy to assume that growth—for so long as inflationary pressures are not intruding too insistently—means greater wealth, a more abundant capital stock, hence lower nominal discount rates and so lower capitalization rates and, ergo, higher financial asset prices.

But, as Hayek once said, if labour competes with capital in the productive structure, then commodities compete with both (though, strictly, what he meant by this was end-consumer goods). Let commodity prices rise too sharply in this era, therefore, and the whole virtuous circle would be unwound, whether because of a voluntary repricing of future earnings streams to take account of their shrinking real value or because of actual or anticipated tightening of liquidity, either as the result of a likely drain of metallic or foreign exchange reserves, or thanks to central bank action taken to forestall these and/or cool the economy down.

However, after the so-called ‘Great Moderation’ of the 1990s and early 2000’s when many pundits, gurus, and soi-disant futurologists were happy to declare not just the ‘end of history’ but the ‘death of inflation’, this paradigm was slowly abandoned.

The exquisite technical prowess of our pecuniary masters at the central banks had seemingly allowed them to fine-tune the vast, unknowably complex, organic interaction of the free market, while—in a kind of perversely back-to-front re-interpretation of the phenomena we have already discussed—the outsourcing of so much effort to the emerging markets meant that commodity prices had largely lost their bogey-man status since their rise was merely the obverse of the subdued trend in the far more closely-scrutinised price of manufactured goods being delivered in all their 560 million TEU-a-year profusion to the ports and railheads of grateful, Occidental instalment buyers.

Thus, commodities were increasingly not seen as harbingers of inflation (strictly, as we shall discuss, the tangible vectors of what is only ever a strictly monetary pestilence), since inflation had been utterly vanquished, but as co-participants with equities in the growth of this Brave New Era of effortless prosperity founded on ever-increasing debt levels among the chronically underproductive. As for the ostensibly ‘risk-free’ bonds, well, who really needed them when there were so many gains to be made moving out the credit spectrum into not just the blues and purples, but the far ultra-violet and even beyond?

Such instruments were no longer part of a proper investment portfolio—they were merely a convenient parking space whenever the market hit a speed bump—for, in a world where central bankers were deliberately turning themselves into easily-predictable, 25 bps-a-time up and 250bps-a-time down facilitators of ‘the search for yield’, only ’men without chests’ could hew to the merits of a relatively certain, (if secularly-depressed) stream of income on boring, old AAA governments when there was so much more fun to be had using incalculably arcane (and often decidedly deceitful) derivative structures to fund incontinent welfare dispensers, greater-fool housing bubbles, value-destroying LBO merchants, and asset-stripping private-equity vultures.

If only things were truly that simple for, as people are only now dimly beginning to rediscover, the Credit Cycle IS the Business Cycle and the Business Cycle is nothing if not an Inflation Cycle.

Here be Dragons

If easy money starts by stimulating growth, it also starts the insidious process of distorting prices in such a manner as to mislead both entrepreneurs and those who invest in them, bringing about a capital misallocation which is no less widespread for all that each specific cycle tends to see the worst excesses concentrated in its own, individual sector.

As we never cease to underline, it is NOW that we lose our money and squander our wealth, by making mistakes here, during the Boom: we merely recognise these errors—and, ideally, realise them and rectify them – during the travails of the Bust.

By attempting to subvert this cleansing process through the inflation of a new bubble of false asset pricing on the ruins of the old—a development the Fed has explicitly been trying to engineer—is not to break the cycle, but to intensify it, as each intervention becomes more radical, less well thought-out, more plagued with unwonted side-effects, and more rapidly self-defeating than the last, the whole bringing about an increasingly costly and accelerating hysteresis of ‘Stop-Go’ capital destruction.

Thus, if the Ghost of 1933 got us into this mess—i.e., the mainstream’s fervent adherence to a largely mythical narrative of the Great Depression, centred on Roosevelt as Messiah—the Spectre of 1937—an alarmist rendering of the dire consequences of a ’premature’ interruption of gross market interference—has guaranteed that the Fed will only make matters worse.

But where can an inflation arise when we have unsold homes, partly-idled assembly lines, and large numbers of men and women still without work? Are we not confronted with an ‘output gap’? And does the persistence of such underemployed resources not testify to the fact that monetary policy is ultimately ineffective—that we face a ‘liquidity trap’—and that its implementation has been too timid, rather than too intemperate?

No, no, and thrice no! For the lack of a bidder for such capital assets and human resources (at least, the lack of a bidder willing to pay the price acceptable to their owners or to pay one sufficient to discharge the obligations incurred during their acquisition or production) is the starkest possible testimony to the mass miscalculation induced by easy money during the Boom.

If we all borrowed money to construct a profusion of neo-gothic follies, borrowed more in the course of buying and selling such monuments of inutility back and forth to one another, and borrowed yet more to be able to spend some of the resultant illusory and thoroughly notional gains on the trappings of an affluent lifestyle, it is little wonder that—once the madness passes—these edifices sell for little more than the cost of materials salvageable from their otherwise useless bulk.

To argue now that, should we flood the land with newly-printed money and that this will restore these monumental vanities to their previous price, before it has first driven up all the prices of things people actually still want to buy, is to practice self-delusion on the grandest scale.

Somewhat more subtle, but equally decisive, is the fact that the happenstance of stonemasons and scaffolders being out of work in the Bust (and angle-grinders and construction cranes being found everywhere in profusion) does nothing to alleviate the scarcity of dairy herdsman or car mechanics, each of whom may find a much greater monetary demand for their highly-specific efforts as a result of the policy of inflation, even as the skills and equipment of their less fortunate neighbours go largely unwanted.

Egalitarian socialists and aggregate–loving macroeconomists may both deny this, but the capital stock is not homogeneous—and so is not costlessly interchangeable. Neither are innate human abilities, nor their overlaid training and experience, a matter of indifference to their hopes of securing work. Inflation may therefore swirl straight past such glaring, post-Boom ’output gaps’ as attract so much intervention, while furiously funnelling into a spate where entrepreneurs have not adequately prepared to meet such a cash-engorged upwelling of expressed demand.

Finally, the idea that to destroy the allocative ability of markets for capital means by suppressing interest rates, subsidising asset prices, and condoning false accounting is in some way a panacea (because it will delude people into making the very same misapprehension of their means as was the initial cause of their woes while allowing the marooned owners of over-indebted property to offset their very real legacy of losses with new, fictional gains) is also to risk burning down the entire house lest the embers in the grate of an unoccupied room flicker and go out, untended.

Burning Down the House

So where has the inflation come from? From the usual place, of course—central and commercial bank creation of demand deposits though one difference since the Crash has been the degree to which this has been accomplished not as a counterpart to lending to a booming private sector, but by financing (monetizing) the vast Keynesian deficits which are piling a Pelion of corporate welfare upon the Ossa of the Provider State, in terms of debt levels.

To be clear, central banks do not always lead the expansion, but they (and the other regulatory authorities) must always accede to it, if only by refusing to set binding reserve and capital requirements upon the commercial banks who are then responsible.

Conversely—and this is a point which seems to have escaped most of the ‘pushing on a string crowd’—they can easily compensate for any lack of vigour by those same commercial banks during the Bust by creating base money through the act of drawing cheques upon themselves in order to purchase whatever assets they please. This is particularly simple when those ‘assets’ are issued in abundance by a Treasury doling out monies in a measure wildly beyond the sum of its tax receipts.

Where the common herd has gone badly wrong (again) is in forgetting the truth that Leland Yeager long ago encapsulated , viz., money does not have to be borrowed into existence, since it can be spent into existence right up to the point where the malign effects of all that unbacked spending lead people to distrust it sufficiently to refuse to accept it as a medium of exchange, a final repudiation which sounds the death knell for what has by now become a hyperinflation.

In fact, a glance at what the central banks and their favoured coterie of TBTF clients have been up to these past 2 1/2 years shows that – yes, Mr. Chairman – the blame rests squarely with them and with them alone.

Easy money at home thus all too readily becomes easy money abroad, whether via the willing acceptance of FX risk in the ‘carry trade’ or via the move to absorb trade surpluses by issuing the home currency against export (as well as FDI and portfolio) receipts. If you really wanted to be perverse about it, you could even think of this as somehow comprising a ’saving glut’, or in one infamous, pre-Crash reductio ad absurdum, a ’global asset shortage’.

One often overlooked reason why inflation proves to be so damaging is the change in prices it brings about (an effect which today is confused with its cause) is never the same for all goods and services. Thus, inflation is not simply a matter of all boats being gently lifted, allowing a painless continuation of government aggrandisement, smoothly bilking the savers who are the bane of the Underconsumptionist world view, fattening up stock brokers and investment managers rich on the fatty flesh of beta, and keeping the workforce contentedly at their lathes and laptops as the soothing breeze of money illusion lulls the Lumpenproletariat into temporarily abandoning the historical pre-ordination of the class struggle.

Rather, the higher any generalized index of prices rises in a given period, the more variable do its components become. Prices—relative prices—become more erratic in their behaviour leading to wide and often unhedgeable disparities between input costs and realized selling prices. Plotting the spread around the overall index of changes in 72 sub-components of the Personal Consumption Deflator offers an insight into just how violent this arbitrary election of economic winners and losers under inflation can become.

Indeed, this contention was borne out last month by a Duke University-CFO Magazine poll of American executives in which they posed the topical question what would be the projected outcome if US CPI were to accelerate from its current level to a ‘surprise’ 4% (in truth, not such a diabolus ex machina given that, over the past ten months, the measure has already been running at that pace on an annualised basis and has even quickened further, to an equivalent of 6%, over the last four). The answer should be a sobering one: profits would be cut in half.

As price rises grow larger and come faster, margins become more uncertain and, the empirical record shows in our chart of prices paid and received in the Philadelphia Fed survey, less attainable on average. As entrepreneurial judgement becomes more and more sorely tested, as our other charts show, both real free cash flow and real returns to capital also shrink (it may come as a chastening truth to learn that, over the last six decades, the aggregate, median, real return to the universe of US non-financial corporations which appear in the Flow of Funds data is, in any case, not significantly different from zero).

At the same time, the degraded informational content of money (a crucial property of the medium of which the mechanical macromancers have absolutely no concept)—not just between goods, but across the choice-filled time which stretches between present and future goods—begins the savage process of reducing investment horizons, raising societal time preference and with it the discount rate. The upshot of this is that the multiple attached to those less certain earnings also starts to contract and, as any equity analyst will tell you, multiple expansion is what drives the greater part of stock market returns in good times and bad.

Granted, inflation may at first boost nominal revenues, some of which increment will be converted into higher nominal – and sometimes even real – earnings. Granted, too, that it may initially price people back to work in those industries temporarily favoured by its caprices – most notably those in exporting or import-competing branches, on the not always certain assumption that the currency translates the growing domestic surfeit of money into an internationally-perceived one, too.

However, inflation also greatly hampers economic co-ordination (of the bottom-up, wealth-creating, spontaneous kind, not stultifying, top-down, state dirigisme) and confounds entrepreneurial calculation: it is nothing less than an engine of immiseration.

Inflationists are typically ignorant of the fact that the complex, multi-stage, labour-divided, task-specific, dynamic whole which is a modern economy intimately relies on much more spending than is captured in the flawed totem of GDP. They are further unaware that much of that spending is highly discretionary—that the bulk of it, in fact, represents gross capital formation via saving—if we define saving as making an outlay not to consume what is acquired finally and exhaustively today, but with the aim of giving rise to a greater income tomorrow, most routinely done by adding value in the course of a productive/entrepreneurial process.

It may be so much a part of the routine of economic life as to seem unexceptionable, but every time a businessman devotes some part of his cash revenues (usually the great majority, in fact) to merely continuing the cycle of production which he oversees and not only to expanding it or changing it, he—every bit as much as the figurative widow prudently putting aside her hard-spared mite—is making a highly individual, non-predestinate, inherently revocable choice to forgo the personal enjoyment of that revenue now in the hope that his immediate sacrifice will bring him greater deferred rewards in the days to come.

Let anything interfere with either his ability or his incentive to do that and the consequences are not only profound but, given the intricacy of the networks of decision-making and mutual interdependence which link the material interests of parties who, on the whole, are entirely ignorant of each others’ existence, their ramifications can spread far and wide—and in a non-linear fashion—to boot.

The key feature of this dense, reticular system of mutually-beneficial interaction is that it in no way relies upon any centralised control function—indeed, for all the weasel words of the rag-bag of anti-market intellectuals, from Krugman and Kaletsky to Stiglitz and Soros, every time the attempt has been made to impose one, the result has been to unleash at least three of the four horsemen of the Apocalypse upon the unfortunate victims of the Planners.

But what is essential is that the results of one individual’s actions are faithfully transmitted to all the others who in some way overlap with his expressed combination of means chosen in the attempt to realise his own unique and subjectively-ordered menu of ends, for then they can adapt to the change in a fitting, lowest-cost manner. For this we need nothing more or less than an effective price system so that each man’s ‘votes’ can be fairly counted and the material goods being offered can best be matched up to the bids being made for them. That pivotal property, in turn, is critically bound up with maintaining—insofar as is possible—the integrity and stability of the medium which transmits the prices, i.e., the money in which they are denominated.

To the extent that, in their primitive adherence to the toilet-flush hydraulics of their facile, consumer-demand model of the economy, the Bernankes of this world adulterate that money and deliberately contribute to its inconstancy, they—more than Robert Oppenheimer, even—are the modern-day Krishnas, the Shatterers of Worlds before whom we should tremble.

Changing of the Guard

From a practical perspective, what we have argued above is that while commodities have traditionally moved in antiphase to financial assets—i.e., to both bonds and stocks—which have themselves largely moved in step with one another, the last decade or so has seen a switch to the rough coherence of commodities and equities and their joint opposition to bonds, either as part of a ‘growth’ enthusiasm or as a mark of a more general appetite for ‘risk’ in an environment of artificially low interest rates.

If we are correct in the assumption that today’s horribly misguided economic dogma and the deep-rooted nature of the rickety collectivism, whose triumph over rugged individualism it has served to finance, will not be abandoned this side of a complete economic and social breakdown, then it seems likely that, as the spiral of growing indebtedness and state-dependence leads to progressive productive enfeeblement, commodities will eventually come to function as the mercury in that thermometer by which we will be able to check the progress of the monetary malaria we are in imminent danger of contracting.

Just as the medical disease is characterised by alternating bouts of fever and chills, interspersed with periods of remission, so too will be the dire economic reality we can envisage becoming our lot. Though commodities will be anything but a one-way bet in such a world—particularly during the painful transition away from the current regime in which they have been acting as quasi-equities—they are, however, likely to re-assume the part of antithesis to equities and hence to perform the dual-role of being both heralds of, and partial protectors from, the increasingly abrupt inflationary outbursts which seem set to define the next few cycles of Boom and Bust.

In this possibility lies perhaps the principal rationale for continued investment in them in the years to come.

This article was extracted from Sean Corrigan’s ‘Tangible Ideas’ report for Diapason Commodities Management, May-June 2011. For the full set of graphs supporting his analysis, please download the original PDF.

Informative and, I must say, beautifully written.