Most experts are of the view that as the economy gains strength the Fed must step in at some stage and introduce a tighter stance in order to prevent the rate of inflation getting out of control.

Why however, should economic growth be positively associated with a general increase in the prices of goods and services?

Let us examine how prices in general could go up. The price of a good is the amount of dollars paid per unit of this good.

Therefore, with all things being equal an increase in the quantity of dollars in the economy must lead to a general increase in the prices of goods and services.

Now, when we talk about economic growth what we mean by that is an increase in the production of goods and services that people require to support their life and wellbeing.

Obviously then, for a given amount of money an increase in economic growth i.e. an increase in the amount of goods and services, must lead to a decline and not to an increase in the prices of goods and services in general. (We now have more goods for an unchanged amount of dollars).

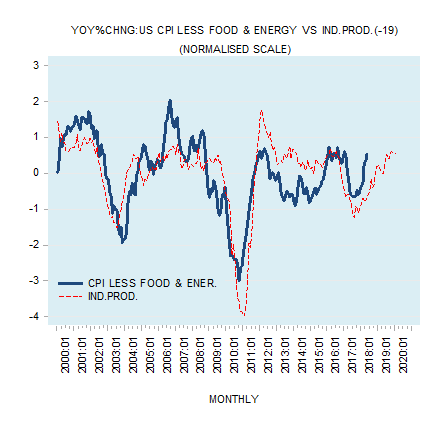

Therefore, if what we are saying is correct, why are the yearly growth rate of the consumer price index adjusted for food and energy (the core CPI) and the lagged yearly growth rate in industrial production are moving in tandem (see chart below)?

Does the positive correlation between the growth momentum of the core CPI and the lagged growth momentum of industrial production make sense?

Why should more wealth, which raises people’s living standards, also generate bad things – such as a general increase in prices of goods and services?

We suggest that the positive association between economic activity and price inflation is not because of an expansion in real wealth but because of an expansion of the money supply.

Real economic growth cannot be quantified – it is not possible to add potatoes to tomatoes to obtain a meaningful total that is required to calculate real economic growth.

So-called economic growth is established from the monetary turnover, which is deflated by a dubious price deflator. This means that what is labelled as economic growth is in fact the growth rate of a distorted monetary turnover data, which is erroneously called total real production.

According to mainstream thinking the stronger the monetary pumping is the stronger the pace of spending is going to be and consequently the stronger monetary income and the so-called real economy is going to be. In this framework, more money means more spending and this leads to stronger economic growth.

We suggest that more money only undermines the process of real wealth generation. This means that more money is bad news for the production of real wealth.

Consequently, with more money and less wealth this means more money per unit of goods i.e. a general increase in prices. Observe that what we have here is an increase in the monetary turnover on account of monetary pumping, which is presented as a strengthening in real economic growth, and an increase in general prices on account of the monetary pumping.

Hence, it is not surprising that we observe positive association between the so-called strong economic activity and price inflation. Note again that the so-called strengthening in economic activity reflects the strengthening in monetary pumping. In fact, what we have here is a situation wherein monetary pumping is positively associated with a strengthening of price inflation.

From here, we can deduce that it is erroneous to suggest that a stronger economic growth must lead to higher price inflation. As we have seen, on the contrary, stronger economic growth for a given money supply must lead to a fall in prices.

Observe that the fall in prices is the manifestation of real wealth expansion. It means that every holder of dollars can now have access to more real wealth i.e. goods. Hence, a fall in prices whilst real wealth is rising is great news.

Now, as long as the machinery of wealth generation is still functioning Fed policy makers can get away with the illusion that they can grow the economy.

Once however, the wealth generation machinery severely damaged because of the Fed’s relentless tampering (also called ‘counter cyclical policies’) the illusion that the Fed can help the economy is shattered and the economy sinks deeply into a black hole.

Any attempt by the Fed to revive the economy by means of massive pumping only makes things much worse.

Conclusion

We suggest that it does not make much sense that genuine economic growth can lead to general price inflation. The positive association between economic activity and price inflation is not because of an expansion in real wealth but comes in response to the expansion in money supply.