Bernard Lietaer is an expert in innovative monetary systems. While at the Central Bank in Belgium he co-designed and implemented the ECU, the convergence mechanism to the single European currency system. During that period, he also served as President of Belgium’s Electronic Payment System. In 2012, he was the lead author of Money & Sustainability: the missing link, a publication of the EU chapter of Club of Rome, in which he predicted that “the period 2015-2020 [will be] one of financial turmoil and gradual monetary breakdown.”

You have mentioned previously that almost all of the money in existence is in fact private money, could you please expand on this for those readers who are not familiar with our current monetary system?

Today, more than 97% of all money is created when banks provide loans to governments, businesses or individuals. Therefore, our so called “national” money is really bank-debt money, created by private banks…

Last year, the Bank of England dispelled formally1 the official myth that banks are only “intermediaries” between savers and lenders: they are actually the creators of our official money.

In your experience, do people at central banks take purely private currencies and similar ideas seriously?

The contradictory declarations by central banks about bitcoin or other crypto-currencies seem to give a sign that they take those currencies seriously, but haven’t quite figured out what to do about them…

It seems that monetary reform is becoming a hot issue among young people, especially on the internet, are you sensing that we are close to critical mass in this movement?

More than internet frenzies are relevant: I am afraid we may need for a real awakening to another monetary paradigm is going to be another banking crisis. What we know for sure is that during the next crisis banks will “bail-in” depositors, as was done in Cyprus in 2013, or with the Portuguese Banco del Spirito Santo in 2014. A “bail-in” means that any money deposited with a bank belongs to that bank, except for the part that is insured by government…

How do you see purely private currencies relating to more recent developments on the internet, such as peer-to-peer lending?

Peer-to-peer lending is usually about lending conventional money.

It fills the void left by banks in the financing of small businesses, but it doesn’t affect the currency…

One of the other things we’ve touched on before was the business cycle, and how multiple currencies can be beneficial, can smooth out the business cycle. Maybe, because you’ve got, it sounds like, quite a complete theory on this and how it could work–

Not just a theory, we also have a great case study that has been proving this in the field for over 80 years.

In Switzerland?

Yes, we have had for 80 years a dual currency system operational in Switzerland: besides the official Swiss Franc, the WIR complementary currency has been circulating since 1934. It is used by about 20% of all Swiss businesses.

Several macro-economic studies have proven that – contrary to what people expect – this second currency contributes significantly to the stability of the Swiss economy because it is spontaneously countercyclical. The Swiss data is of great quality, and was the basis for three peer-reviewed articles by Professor John Stodder that proves this.2 While conventional money is procyclical and requires central banks to try to stabilize the economy, the WIR case demonstrates that having a business-to-business currency circulating in parallel with the conventional money actually helps the central bank in stabilizing the economy!

In terms of the number of different currencies then, is there an optimal number? Or does it become more stable with more currencies up to a certain point, or with diminishing returns to each new currency? How would that work?

Our work3 has demonstrated that structural stability of a complex flow network that there is a “window of viability” that requires a range between a minimum and maximum number of currencies. We are sure that a single currency is insufficient to maintain structural stability in the long run. That’s one of the reasons why reforms that aim to replace a private monopoly to one run by the state is not the answer. The risk one runs with a monetary monoculture is systemic crashes.

At the other extreme, we also shown that one can have too much monetary diversity, i.e. have too many complementary currencies in the same market. The risk in that case is one of stagnation.

Is there a reason to prefer a complementary currency strategy instead of a monetary reform?

The usual monetary reform ideas are, by definition, high risk, because they can be implemented only on an all or nothing scale. You can’t start a monetary reform in a part of England or of the UK, or in a specific town. With the complementary currency approach, you can. In fact, it’s the way it invariably takes place. You could have a region, or a city, starting the implementation of a specific complementary currency. This is a lot less risky than trying to go all or nothing at the scale of a whole country.

How do you think local private currencies relate to things like Bitcoin, or the more global digital and cryptocurrencies?

Bitcoin is more a speculative tool than a medium of exchange. While local currencies are typically mainly a medium of exchange.

With the ones that exist so far, obviously including Bitcoin and some of the other variants, such as the local ones, there doesn’t appear to be credit markets yet, for most of these currencies. Do you think that’s a technological obstacle? How do you see that developing? I think credit markets will probably be quite crucial to any currency.

Credit markets are important when one is dealing with the third classical function of money, i.e. the function of store of value and of investments. That is why they are particularly relevant for business-to-business systems or in real estate. In the case of the WIR, for instance, the credit role is a significant one: construction and real estate are the sectors in which the WIR plays the biggest role.

In contrast, for currencies designed to deal with social issues, what’s the point of accumulating thousands of hour credits, for instance? If your objective is to create social capital in a community, credit markets don’t make sense. It’s not the way human interactions operate. As was documented by Michael Hudson and David Graeber4, relationships based on debt have driven enslavement, the opposite of what social capital aims at achieving.

The WIR seems quite a good model, almost an ideal currency for things that could be looked at in other parts of the world?

I have an even better model to recommend than the WIR. My interest in the WIR is due the fact that it is the only case where we have quality data over 80 years. There’s no other system that has provided as much data, over as long a period. This is particularly important to evaluate long-term macro-economic impact.

The Commercial Credit Circuit (C3) – a convertible version of the WIR – is the one I would recommend as more interesting than the WIR, because it is a B2B complementary currency that is convertible into conventional money. This makes it possible for governments to accept it in payment of taxes.

Most government public procurements need to be open to all businesses. If the Swiss government wants to buy cars, say, they have to be able to buy them from everybody. And only 20% of Swiss businesses are members of the WIR system. A convertible WIR currency would solve that problem, and enable governments to participate directly in the complementary currency system. That is why I recommend the C3 model, as an improvement on the WIR.

Right, someone at the Federal Reserve in America mentioned that exchanges like Ripple are now a crucial area for private currencies,

Yes, but Ripple requires that someone makes a market in the currencies involved. ie. convertibility between the two currencies is a pre-condition. In other words, they are connecting market makers, they are not creating convertibility where none exists.

Would those market makers, should it be kept private or do you foresee that the state could play a role in that?

Ripple is a private payment system, and I don’t see why it couldn’t remain so…

Last time, we touched on the Bank of England document. Even economic textbooks used in universities talk about the multiplier model as opposed to endogenous money. With your experience working within central banks and with a lot of central bankers, are central bankers themselves and people in treasuries aware of endogenous money? To what level do they understand this versus using the textbook models?

Economists who work at central banks have been trained in believing the same monetary mythology as most economists. But the information about endogeneous money has been available: it has actually been available for more than a century! 5. It all depends on the degree of curiosity of each person.

It was a courageous gesture for a central bank like the Bank of England to go on record about the reality of money creation by private banks. The only other case I know about such an ideological reversal of views happened in Brazil, where after initially rejecting the idea of complementary currencies, an investigation by the central bank concluded that complementary currencies can solve social problems, that conventional money doesn’t do very well. And that they don’t pose any threat to the management of the official currency.

But there’s been so many papers, I remember Tobin and various others talking about endogenous money. It just seems quite strange what they’ve been teaching in economics textbooks, during my economics degree the multiplier model was taught straight from the textbook. It seems quite bizarre, really.

Well, yes. That’s been going on for a long time…

I know.

We got much deeper academic thinking in the monetary domain in the ’30s than today. There was clearly more debate about money during the Great Depression than has been the case today…

The Chicago Plan, and so on.

The Chicago Plan was fully developed at that time. It would involve making it illegal for banks to create money. Their role would be reduced to the role of money brokers, and governments would issue the currency (as many people still believe).

Out of interest, what are your thoughts on fractional reserve banking? Or in a sense what we have now is not even fractional reserve, it’s zero reserve. What are your thoughts on the Chicago Plan versus what we have now?

One can classify monetary problems in three categories: banking crashes, sovereign debt crises, and monetary instabilities. The Chicago Plan would solve the first two of of these systemic problems: it would solve the problem of banks getting overleveraged, and it would also solve the government indebtedness problem. However, it would not solve the currency instability problem. We would still have currency crashes like we would have had, say, in Russia. Under that plan, they may even be more frequent than today. Basically, the Chicago Plan somehow assumes that governments are more reliable than the private sector in managing the currency, and I’m not convinced that assumption is valid.

The recent Zimbabwe case is an extreme example of governmental abuse of a currency. Government took over the central bank and ordered it to print money until the currency became valueless.

Touching on that topic, do you have sympathies with the gold standard, or any other commodity standard that would obviously restrict the amount of money that can be created?

One of my recommendations — the Terra currency — is a 100% commodity backed currency. In that system, a basked of a dozen commodities would play the same role as what gold used to do. Gold is actually one of the commodities in that basked. See the point?

Yes.

Let me emphasize that the Terra would be part of what I recommend as a monetary ecosystem, i.e. just one of the currencies in such an ecosystem. Terra is a global business-to-business currency that would make it profitable for multinational businesses to think long term.

One of the issues that I touched on with Martin Wolf when we were talking about cryptocurrencies, he mentioned the idea that actually central banks may well move towards more of an algorithmic model. There could even be open source central bank algorithms in the future. Could you foresee anything like that happening that central banks would move more towards those types of technologies?

Milton Friedman suggested a very simple algorithm: make central banks increase the money supply by 3% per year. One doesn’t really need a more complicated algorithm than that…

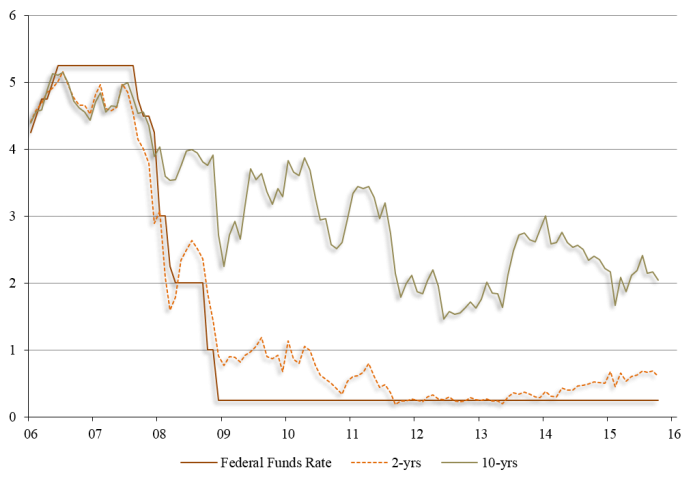

However, even before anything as simple as that can be implemented, there should be more coordination among central banks. Indeed, under a regime of floating exchanges as we have today, when the Federal Reserves pumps additional dollars into the system, the result can be a real estate boom in the South of France fuelled by purchases by Russians. The dollars created by the Federal Reserve do not stay necessarily in the US, but can spill over anywhere else in the world, and create a bubble there…

Relating to that, in some of the positive money interviews that are on YouTube, some of the economics professors have mentioned that it is very much in the interest of the banks that this idea of endogenous money has been kept in the dark. How would you– to what extent do you think the major banks are aware of how the monetary system works but would want to keep it private?

I have never met anybody who has a monopoly of anything who wouldn’t like to keep it, or is not going to fight to keep it. Whether it was when national television or radios enjoyed a monopoly, or in telephones, or Bill Gates with his software. In other words, to what extent specific bankers know the real story is a minor point, isn’t it?

Yes.

Whether they believe what they’re saying, or whether they just claim that they believe what they’re saying, does it make a difference?

1 Bank of England: Money in the Modern Economy (Quarterly Report Q1 2014)

2James Stodder, “Complementary Credit Networks and Macroeconomic Stability: Switzerland’s Wirtschaftring”, Journal of Economic Behavior and Organization, vol. 72 (2009), pp. 79-95. See also James Stodder, “Reciprocal Exchange Networks: Implications for Macroeconomic Stability”, paper presented at the International Electronic and Electrical Engineering (IEEE), and the Engineering Management Society (EMS), Albuquerque, New Mexico, August 2000.

3 Robert E. Ulanowicz, Sally J. Goerner, Bernard Lietaer and Rocio Gomez, “Quantifying Sustainability: Resilience, Efficiency and the Return of Information Theory”, Ecological Complexity, vol. 6 (2009), pp. 27-36. Bernard Lietaer et al. “Is Our Monetary Structure a Systemic Cause for Financial Instability? Evidence and Remedies from Nature” Journal of Future Studies (February-March 2010, special issue on the financial crisis).

4 David Graeber: Debt: the first 5000 years (New York: Melville House, 2011)

5 One of the earlier descriptions is Mitchell Innes, “What is Money?”, Banking Law Journal, vol. 30 (1913), no. 5, pp. 377-408.

First I ever heard of the WIR, need to study that. But no mention that Hong Kong has three competing (maybe 4) currencies, all issued by private companies, as was once the normal?

Hard to divine the intent of the question when the definitions are slippery:

***do you have sympathies with the gold standard, or any other commodity standard that would obviously restrict the amount of money that can be created?***

you said “money” … don’t you mean currency? The money is the gold and silver, the currency is either warehouse receipts or fractional reserve.

Or do you mean to address a notional problem of a shortage of currency in which trade is suppressed? If the latter, I don’t think you’ll find an actual case in history of the same, if the question contains accurate definitions.

Graeber is half right, credit is critical in a prosperous economy, for the extractors extend credit to the processors, processors to material makers, material makers to manufacturers, manufacturers to retailers, retailers to customers, all at no interest. Contemplate the vast amount of trade done in this regime, in place a mere 40 years ago. The fact that banks, as finally admitted by the B of E, lend asset-less backed credit, wiped all that good credit out, after Nixon closed the gold window in

’71, leaving interest bearing bad credit, is a problem. There is never a shortage of currency, only the wiping out of the trust systems (private credit) among merchants in an economy.

The endogenous monetary system is anything offered by a state. The state currencies are the problem, the natural systems lead to peace, prosperity and economic justice.

John Spiers

All inflation is theft, so how come a worldwide coordination of 3% good idea?