For more than two hundred years, practically all of even the most free market advocates have assumed that money and banking were different from other types of goods and markets. From Adam Smith to Milton Friedman, the presumption has been competitive markets and free consumer choice are far better than government control and planning – except in the realm of money and financial intermediation.

This belief has been taken to the extreme over the last one hundred years, during which governments have claimed virtually absolute and unlimited authority over national monetary systems through the institution of paper money.

At least before the First World War the general consensus among economists, many political leaders, and the vast majority of the citizenry was that governments could not be completely trusted with management of the monetary system. Abuse of the monetary printing press would always be too tempting for demagogues, special interest groups, and shortsighted politicians looking for easy ways to fund their way to power, privilege, and political advantage.

The Gold Standard and the Monetary “Rules of the Game”

Thus, before 1914 the national currencies of practically all the major countries of what used to be called the “civilized world” were anchored to market-based commodities, either gold or silver. This was meant to place money outside the immediate and arbitrary manipulation of governments. Any increase in gold or silver money required private individuals to find it profitable to prospect for it in various parts of the world, mine it out of the ground and transport it to where it might be refined into usable forms, and then mint part of any new supplies into coins and bullion, with the rest made into various commercial and industrial products demanded on the market.

The paper currencies controlled by governments and their central banks were supposed to be issued only as claims to – as money substitutes for – quantities of the real gold or silver money deposited by members of the society in banks for safekeeping and the convenience of everyday business in the marketplace.

Government central banks were meant to see that the society’s medium of exchange was properly assayed and minted, and to monitor and police private banks and itself to make sure that the “rules” of the gold (or silver) standard were properly followed.

Bank notes were to be issued or deposit accounts increased in the banking system as a whole only when there had been net additions to the quantity of the commodity money within the economy. Any withdrawals of the commodity money from the banking system was to be matched by a decrease in the total quantity of bank notes in circulation and in deposit accounts payable in money.

Did government’s always play by these “rules”? Unfortunately, the answer is, “No.” But, by and large, in the half-century or so before the beginning of the First World War in 1914, governments and their central banks managed their national currencies with surprising restraint.

If we look for a reason for this restraint, a leading one was that for a good part of this earlier era the predominant set of ideas was that of political and economic liberalism. But we need to remember that at that time “liberalism” meant an advocacy and defense of individual liberty, secure private property rights, free markets, free trade, and limited government constitutional under impartial rule of law.

But, nonetheless, these national currencies were government-managed paper monies linked to gold or silver by history and tradition, and more or less left fairly free of direct and abusive political manipulation, due to the prevailing political philosophy of the time that considered governments as protectors of individuals’ rights to their lives, liberty and honestly acquired property.

Political Paternalism and Monetary Central Planning

However, in the decades leading up to the First World War the political trends began to change. New ideals and ideologies started to appear and gained increasing hold over people’s minds. The core conception was a growing belief in the necessity for and the good that could come from political paternalism. Government’s were not simply to be impartial “umpires” who enforced the rule of law and protected people and their property from violence and fraud. No, government was to intervene into the social and economic affairs of men, to regulate markets, redistribute wealth, and pursue visions of national greatness and collective welfare.

This meant a change in the political philosophy behind the government’s control of the monetary system, as well. In the decades after the First World War, in the 1920s, 1930s, and 1940s, and up to the present, the government monetary managers increasingly became monetary central planners. The central bankers were to manipulate the supply of money and credit in the economy to achieve various goals: stabilize the price level; to maintain “full employment”; peg or change foreign exchange rates; lower or raise interest rates to influence the amount and the types of investments undertaken by private borrowers and investors; and, whenever and however necessary, increase the quantity of money to fund government deficits needed by politicians and interest groups to feed their insatiable appetite for power, privilege and political plunder.

The triumph of Keynesian Economics in the post-World War II period resulted in a near monopoly of academic and public policy advocates who argued that private enterprise was inherently unstable and frequently unfair, and could only be allowed to exist and function in a wider environment of dominating government control. The consequence was a government constantly increasing in size, scope, and pervasive supervision and intrusion into every corner of personal, social, and economic life.

Big Government, Big Spending and the Monetary Printing Press

But big governments cost big sums of money. A little over hundred years ago in America, in 1913, all levels of government combined – Federal, state, and local – absorbed only around eight percent of the nation’s income and output. Today, all level of government seize nearly fifty percent of all that is earned and produced in the United States. That cost of government is even more if we add the financial burdens imposed on private enterprise to comply with the strangling spider’s web of regulations and controls imposed on private enterprisers going about their business.

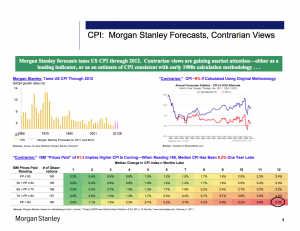

Just over the nearly ten years since the financial crisis of 2008-2009 the Federal government has accumulated nearly $10 trillion in additional debt. At the same time, during the past decade, the Federal Reserve – America’s central bank – had created more than four trillion dollars of new money in the banking system. In other words, the Federal Reserve has, in fact, produced out of thin air a sum of new money equal to four out of every ten dollars the Federal government has borrowed during this period.

The economics textbooks usually sanitize this type of process with a sterile terminology that calls it, “monetizing the debt.” An earlier generation of economists and critics of political paternalism used to call this process paper money inflation and debauchery of the currency: the diluting of the value of the money in people’s pockets through monetary depreciation and currency devaluation.

Political Demagogy, Fiscal Burdens and the Danger of Inflation

As a result of the growth of the modern welfare state, America and the other major Western countries of the world have become, in the words of Nobel Prize-winning economist, James Buchanan (1919-1913), perpetual democracies in deficit, funded in total or in good part by, now, trillions of dollars created by government monetary monopolies – the central banks.

Today, we are reaping the whirlwind of decades of political paternalism and monetary central planning. Nations like Greece and now Puerto Rico have been teetering on the edge of financial bankruptcy and debt default. And countries like the United States, which are woven tightly with networks of special interest groups living off the redistributed plunder of other more productive members of society, seem to lurch from one fiscal crisis to another. The current politics of redistributive paternalism seems to offer little way to stop the worsening avalanche of annual deficits and mounting national debt.

The demagogues and political tricksters harangue about “soaking the rich” to fund the unfunded “entitlements” of social security and Medicare through the rest of the twenty-first century. They demand that “big business” pay for the government “jobs to nowhere” that is promised to end the unemployment that earlier and current misguided economic policies have created and prolong.

The politicians of plunder have also taken recourse to that last refuge of every political scoundrel: a call to “patriotism.” It is your duty as a “good citizen” to pay a fair share” in taxes; to cooperatively be subservient and obedient to the demands and needs of government; and to sacrifice your freedom and the fruits of your own hard-earned honest labor for “the national interest” and “the common good.”

It is worth remembering that those in the political arena who claim to know what is in “the national interest” and for “the common good” are the same ones who also assert the right to compel you to conform to their vision of a “just” and “fair” America, regardless of much you may honestly disagree or desire to peacefully go your own way.

A central tool for governments to maintain their authority in society and their control over people’s lives is the ability to make the citizenry accept and use their monopoly medium of exchange. This is a lynchpin in the government’s ability to transfer the people’s wealth and privately produced output to satisfy the “needs” of government spending.

It makes each and every citizen an existing and potential victim of government abuse of the monetary printing press, since paper currencies are no longer in anyway linked to or limited by a market-based supply of a real commodity such as gold or silver. We should not presume that runaway hyperinflations and the accompanying destruction of a society’s medium of exchange only occur in places like 1920s Germany or contemporary African nations like Zimbabwe. That, “it can’t happen here.” It can happen anywhere.

The Bankruptcy of the Welfare State and Redistributive Dependency

The fact is, the modern welfare state is bankrupt. It is bankrupt ideologically; no one really any longer believes that the Interventionist-Redistributive State will bring mankind material happiness or social harmony. Everyone knows that it is nothing more than a vast and corrupt political machine through which, as Frederic Bastiat said long ago, everyone tries to live at everyone else’s expense.

In the process, the productive capacity of the society slowly grinds to a halt, as more and more people turn from productive self-responsibility to redistributive dependency. It also generates a mental attitude and a political presumption of legitimacy to that redistributive dependence that pervades each and every income group and social category throughout the nation.

Most opinion polls show that a fairly sizable majority of the American people think that government is too big, spends too much, and taxes far too excessively. But once the questions turn to “specifics” of cutting particular government programs, it is soon seen how the tentacles of the welfare state reach into virtually everyone’s pocket.

It is not only that government taxes people in varying amounts to feed the redistributive process. It is also the case that there are few people in the land who do not have some type of money, program, or benefit put into their pockets by government. Most people cannot imagine living without their government redistributive “fix.” And, admittedly, breaking people’s addiction to their government benefits, subsidies, protections, and special favors would and will involve serious withdrawal pains.

This also means that the welfare state is rapidly reaching financial bankruptcy, as well. Neither taxation nor borrowing of private savings can or will be able to cover all the costs of current and future government spending under existing interventionist and redistributive legislation and regulation.

The government may very well, therefore, use its most important financial resource to keep moving the wheels of political spending. In the future those in political power may more and more turn the handle of the monetary printing press. And no one should be fooled due to the apparently non-price inflationary environment that has prevailed in the United States and the European Union for most of this last decade. Monetary expansion distorts the structure of relative prices and generates misallocations of capital and labor, even when the general price level seems relatively “stable.” Beneath the “macroeconomic” surface of low or near zero price inflation, “microeconomic” imbalances and misdirected investments may still be setting the stage for an eventual economic downturn.

Hyperinflations and Opting Out of Government Monopoly Money

Time after time, history has demonstrated that when serious price inflations move into disastrous hyperinflations, people first discount and then abandon the government’s monopoly money. They shift into alternative currencies of choice that they consider more stable, more predictable, and more wealth and income preserving that the increasingly worthless pieces of paper money that their own government spews out in increasing quantities.

Now such a monetary disaster is not preordained. It is not written in some “big book” in the sky. Governments and societies have in the past pulled back and stopped short of following a path leading to social and economic ruin. America, too, may yet slow down or bring to a halt the political course it is currently traveling. The future is unpredictable and trends have changed many times in the past.

But . . . forewarned is forearmed. So how might any of us be able to shelter ourselves from the possible coming fiscal and monetary storm? Central to such precautionary actions is to hedge against the possible radical depreciation and or even destruction of the government’s currency.

To the extent that one sees such a danger and has the financial wherewithal to “plan ahead,” individuals should be legally allowed to opt-out of the government’s monopoly money. In other words, every American should be free from the government’s power to compel its citizens to use and accept in trade and in settlement of debts its own monopoly money.

The Road to Choice in Currency

Everyone should be free to choose the currency or commodity (gold and silver, for example) they wish to hold and use as a medium of exchange without legal restriction, penalty, or political prejudice. Greater monetary freedom would not only give every citizen a legal right to protect and secure his income, wealth and market transactions from abusive mismanagement of the government’s monopoly monetary printing press. It could also serve as a check on the degree of such government abuse.

More than forty years ago, in September 1975, Austrian economist and Nobel Laureate, Friedrich A. Hayek, delivered a lecture on, Choice in Currency: A Way to Stop Inflation, in Lausanne, Switzerland, and said:

“There could be no more effective check against the abuse of money by the government than if people were free to refuse any money they distrusted and to prefer money in which they had confidence. Nor could there be a stronger inducement to governments to ensure the stability of their money than the knowledge that, so long as they kept the supply below the demand for it, that demand would tend to grow. Therefore, let us deprive governments (or their monetary authorities) of all power to protect their money against competition: if they can no longer conceal that their money is becoming bad, they will have to restrict the issue.

“Make it merely legal and people will be very quick indeed to refuse to use the national currency once it depreciates noticeably, and they will make their dealings in a currency they trust.

“The upshot would probably be that the currencies of those countries trusted to pursue a responsible monetary policy would tend to displace gradually those of a less reliable character. The reputation of financial righteousness would become a jealously guarded asset of all issuers of money, since they would know that even the slightest deviation from the path of honesty would reduce the demand for their product.”

Taking away from the government its power of compelling the citizenry to accept money that it monopolistically controls and abuses may serve as an important legal and economic change to force the government and those who live at its spending trough to face the reality of the welfare state’s ideological and fiscal bankruptcy before it is too late to avert a complete collapse of the society.

Choice in currency may be a valuable avenue for helping to restore the American tradition and practice of individual rights, free markets, and limited government under the rule of law. And it can be an important legacy for us to leave to our children and grandchildren, so they may, hopefully, live out their lives in liberty for the remainder of the twenty-first century.

Source: https://www.fff.org/explore-freedom/article/government-monopoly-money-vs-personal-choice-currency/

As early as 1850, it was well recognized that “money” claims based on precious metal bullion were less than 5% of all transaction volume – the rest comprised of equally fraudulent bank-credit transfers within the private commercial banking sector (See John Mill). Your description above does not acknowledge this well-known fact – neither does it express a comprehension of the differences between “money-like” claims. Money-of-Account, as a numeraire, versus “money” proper in the form of many various media-of-exchange used for settlement and debt extinguishment.