The US Congressional Budget Office (CBO) said on August 22nd that scheduled tax increases and spending cuts in 2013 would reverse the current modest economic recovery. The CBO and other experts are of the view that large government spending cuts and tax hikes will cause severe economic slump.

Experts hold that without action by Congress to avoid a “fiscal cliff” Americans should expect a significant recession and the loss of some 2 million jobs. The CBO predicts that the real GDP could shrink by 0.5% next year while the unemployment rate could climb to around 9%.

The “fiscal cliff” refers to the impact of around $500 billion in expiring tax cuts and automatic government spending reductions set for 2013 as a result of successive failures by Congress to agree on some orderly alternative method of reducing budget deficits.

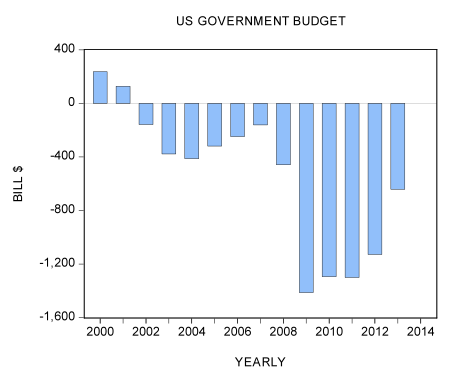

According to the CBO projection the budget deficit could fall to $641 billion in 2013 from $1.128 trillion in 2012.

We suggest that the goal of fixing the budget deficit as such could be an erroneous policy. Ultimately what matters for the economy is not the size of the budget deficit but the size of government outlays – the amount of resources that government diverts to its own activities. Note that since the government is not a wealth generating entity, the more it spends the more resources it has to take from wealth generators. This means that the effective level of tax here is the size of the government and nothing else.

For instance, the government outlays are $3 trillion and the government revenue is $2 trillion – the government has a deficit of $1 trillion. Since government outlays have to be funded it means that the government would have to secure some other sources of funding such as borrowing or printing money, or new forms of taxes. The government is going to employ all sorts of means to obtain resources from wealth generators to support its activities. What matters here is that government outlays are $3 trillion and not the deficit of $1 trillion. For instance, if the government revenue on account of higher taxes would have been $3 trillion then we would have a balanced budget. But would this alter the fact that the government still takes $3 trillion of resources from wealth generators?

According to the CBO data government outlays are expected to fall in 2013 by $9 billion to $3.563 trillion after a projected decline of $40 billion in 2012.

Given that there is a time lag between government outlays and their effect on economic activity it strikes us that it is the cut of $40 billion this year rather than the cut of $9 billion next year that should be of concern to various worried commentators.

We hold that an increase in government outlays sets in motion an increase in the diversion of real savings from wealth generating activities to non-wealth generating activities. It leads to economic impoverishment.

So in this context is it really bad news for the economy if on January 1, 2013 we will have an automatic cut in government outlays? Most commentators such as the IMF and the CBO are of the view that cutting government outlays could inflict severe damage to the real economy.

We suggest that a cut in government outlays should be seen as great news for wealth generators. It is of course bad news for various artificial forms of life that emerged on the back of increases in government outlays.

What about the fact that we will also have an increase in taxes as a result of the expiration of the Bush tax cuts? To the extent that government outlays are going to be curtailed the increase in taxes should be regarded as a monetary withdrawal from the economy. In this sense it is like a tight monetary policy. A tighter monetary stance in this respect should be seen as positive for wealth generators since it weakens various bubble activities that sprang up on the back of past loose monetary policies.

(Conversely, a reduction in taxes whilst government spending goes up is not a tax reduction as such but should be viewed as loosening in the monetary stance. Again, an increase in government amounts to an increase in effective tax. The government has to divert resources from wealth generators to support the increase in spending).

Note that the CBO projection of the future state of the US economy is in terms of GDP. Given that GDP is in fact monetary turnover its ultimate course is going to be dictated by the rate of growth of the money supply. The more money that is pumped the stronger GDP is going to be.

Contrary to the CBO and most commentators, we suggest that what is likely to undermine the growth momentum of GDP next year is the current visible decline in the growth momentum of money supply. In the week ending August 13 our monetary measure AMS fell by $70.9 billion from July. The yearly rate of growth of AMS fell to 6.5% from 12.3% in July. Observe that in October last year the yearly rate of growth stood at 14.7%.

As a result the yearly rate of growth of real AMS (AMS adjusted for CPI inflation) fell to 5.1% in the mid August from 10.9% in July. Based on the lagged by 14 months yearly rate of growth of real AMS we can suggest that the growth momentum of industrial production is likely to weaken sharply from the second half of next year.

Whilst the growth momentum of industrial production and real GDP could be in trouble from the second half of next year the underlying economy however should start strengthening. The demise of bubble activities will be good news for wealth generators.

Against the background of a still weak labour market we suspect that Fed officials are likely to introduce another massive pumping in a few months time. Given the current time lag structure it is unlikely however that more pumping can avoid a decline in the pace of economic activity in terms of GDP from the second half of next year.

Summary and conclusions

According to the US Congressional Budget Office (CBO) scheduled tax increases and spending cuts in 2013 (the so called “fiscal cliff”) could reverse the current economic recovery. We suggest that a cut in government outlays is actually going to be good news to wealth generators. It is, however, going to be bad news for various non-productive activities that emerged on the back of increases in government outlays. In the meantime, a serious threat to economic activity in terms of GDP is posed by a visible fall in the growth momentum of money supply. We suggest that the present fall in the growth momentum of money supply is likely to undermine the GDP rate of growth from the second half of next year.

The terrible thing is – even if Romney-Ryan win there is no real plan to CUT government spending.

Contrary to the media reports (including in the British “conservative” press – such as the London Times) Paul Ryan does NOT plan to “slash” government – indeed government spending would continue to INCREASE under the Ryan plan (just at a slower rate).

Sadly 2013 will see a massive economic decline (due to the bursting of the credit bubble that the Federal Reserve has been pumping up to try and get Barack Obama reelected).

The Keynesians will demand even more government spending – but actually there will be a desperate need to cut government spending.

And neither Romney or Ryan have a plan to actually CUT government spending.

Interesting. I’ve always said that the only true tax cut is a cut in government spending. Government spending leads future taxes as it were.

Its remarkable that five years in to this recession the central banks are still doing the same thing and expecting them to work. In actual fact they are laying the foundation for the ultimate collapse.

It could also be said that the negative (the “unseen” as Bastiat put it) impact of government spending occurs even sooner than future taxes.

If the deficit spending is financed by borrowing REAL SAVINGS then these savings are not avilable to finance investment (contrary to the propaganda of the collectivists, and corporate welfare seeking businessmen, government spending is NOT investment). And if the deficit spending is financed by credit-money expansion (which is how the British and American govenrments are presently doing it)then it creates a credit-bubble bubble which must burst.

The bursting of the present money bubble is likely to occur in 2013.