“I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.”

– Richard Cobden.

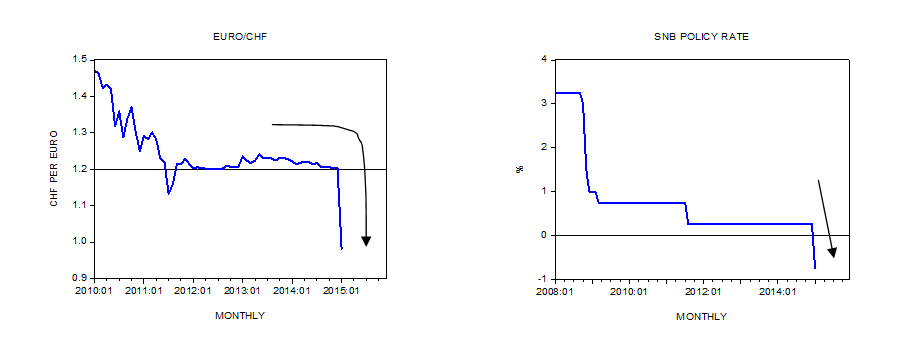

“Raj, 33, a London-based photographer and amateur commodities trader who has used Alpari since 2009, said he currently had about £24,000 trapped in his account at the company.

‘It was completely out of the blue, a total shock,’ he said. ‘I’ve never had any issues with them. I’ve been calling and I just keep getting their answerphone.’”

– From ‘Forex brokers suffer escalating losses in fallout from Swiss ditching franc cap’, The Financial Times, 17 January 2015.

“I don’t know what to say. I’ve been investing since January and I’ve never seen anything like it.”

– Unnamed Hong Kong housewife during the Asian financial crisis, 1997/8.

“But the Swiss, not being as smart as the Italians, do not believe in devaluations. You see, in Switzerland, they have never believed in the ‘euthanasia of the rentier’, nor have they believed in the Keynesian multiplier of government spending, nor have they accepted that the permanent growth of government spending as a proportion of gross domestic product is a social necessity.

“The benighted Swiss, just down from their mountains where it was difficult to survive the winters, have a strong Neanderthal bias and have never paid any attention to the luminaries teaching economics in Princeton or Cambridge. Strange as it may seem, they still believe in such queer, outdated notions as sound money, balanced budgets, local democracy and the need for savings to finance investments. How quaint!

“Of course, the Swiss are paying a huge price for their lack of enlightenment. For example, since the move to floating exchange rates in 1971, the Swiss franc has risen from CHF4.3 to the US dollar to CHF0.85 and appreciated from CHF10.5 to the British pound to CHF1.5. Naturally, such a protracted revaluation has destroyed the Swiss industrial base and greatly benefited British producers. Since 1971, the bilateral ratio of industrial production has gone from 100 to 175… in favour of Switzerland.

“And for most of that time Switzerland ran a current account surplus, a balanced budget and suffered almost no unemployment, all despite the fact that nobody knows the name of a single Swiss politician or central banker (or perhaps because nobody knows a single Swiss politician or

central banker, since they have such limited power? And that all these marvellous results come from that one simple fact: their lack of power).

“The last time I looked, the Swiss population had the highest standard of living in the world—another disastrous long term consequence of not having properly trained economists of the true faith.”

– Charles Gave of Gavekal, ‘Swexit !’.

“An increase in the quantity of money only serves to dilute the exchange effectiveness of each franc or dollar; it confers no social benefit whatever. In fact, the reason why the government and its controlled banking system tend to keep inflating the money supply, is precisely because the increase is not granted to everyone equally. Instead, the nodal point of initial increase is the government itself and its central bank; other early receivers of the new money are favoured new borrowers from the banks, contractors to the government, and government bureaucrats themselves. These early receivers of the new money, Mises pointed out, benefit at the expense of those down the line of the chain, or ripple effect, who get the new money last, or of people on fixed incomes who never receive the new influx of money. In a profound sense, then, monetary inflation is a hidden form of taxation or redistribution of wealth, to the government and its favoured groups, and from the rest of the population.. every change in the supply of money stimulated by government can only be pernicious.”

– Murray Rothbard.

“The longer the boom of inflationary bank credit continues, the greater the scope of malinvestments in capital goods, and the greater the need for liquidation of these unsound investments. When the credit expansion stops, reverses, or even significantly slows down, the malinvestments are revealed. Mises demonstrated that the recession, far from being a strange, unexplainable aberration to be combated, is really a necessary process by which the market economy liquidates the unsound investments of the boom, and returns to the right consumption / investment proportions to satisfy consumers in the most efficient way.

“Thus, in contrast to the interventionists and statists who believe that the government must intervene to combat the recession process caused by the inner workings of free market capitalism, Mises demonstrated precisely the opposite: that the government must keep its hands off the recession, so that the recession process can quickly eliminate the distortions imposed by the government-created inflationary boom.”

– Murray Rothbard, again.

“I don’t know what’s going to happen in Europe but there is one thing I am certain about – eventually, someone is going to take a big loss. As investors, the most important thing we can do is to make sure that we aren’t the parties taking that loss.”

– Jeffrey Gundlach, cited by Joshua Brown, September 2011.

“The designers of the good ship euro wanted to create the greatest liner of the age. But as everybody now knows, it was fit only for fair-weather sailing, with an anarchic crew and no lifeboat. Its rules of economic seamanship were rudimentary, and were broken anyway. When it struck a reef two years ago, the water flooded one compartment after another.. European officials now recognise the folly of creating the euro without preparing for trouble. It would be wise to be planning now for what to do if it sinks.. Even now, after decades of “European construction”, many Eurocrats cannot conceive of the euro as a wreck. Those who have worked hardest to keep it afloat are exhausted and know it is not in their power to save it anyway.”

– Charlemagne in ‘The Economist’, November 2011.

“Sir, It was a very cruel joke to publish Richard Barwell‟s recent letter (“Exit from first round of QE now seems premature”), particularly as it followed hot on the heels of Fed chairman Ben Bernanke’s announcement of so much more of the stuff. It was certainly a delicious coinage of Mr Barwell’s to suggest that this argument “makes no sense in theory”. This reminded me of those scientists who also contend that bumble bees cannot fly – in theory. Can I suggest that the FT letters page imposes some kind of moratorium on self-interested and highly conflicted “advice” from an academic school – economics – that having brought us to the brink, is now in danger of theorising itself into total absurdity ? To read that Mr Barwell is employed by the one organisation that has done more than any other to destabilise if not destroy the UK financial system – RBS – was the icing on this particularly ironic cake.

“QE does nothing more than put yet more capital into the hands of bankers who can then either play in the markets with it, or sit on it. In doing so, it also devalues its practitioners’ currencies versus those of regimes that have fundamentally sound economic policy. If our government and central bank wanted to do something properly constructive with all this newly created money, perhaps it could invest it into our country’s jaded infrastructure, rather than inflating further asset bubbles, the “wealth effect” of which is likely to be wholly illusory.”

– Tragically unpublished letter to the Financial Times from the author, November 2010.

“What really broke Germany was the constant taking of the soft political option in respect of money.”

– Adam Fergusson, ‘When Money Dies’.

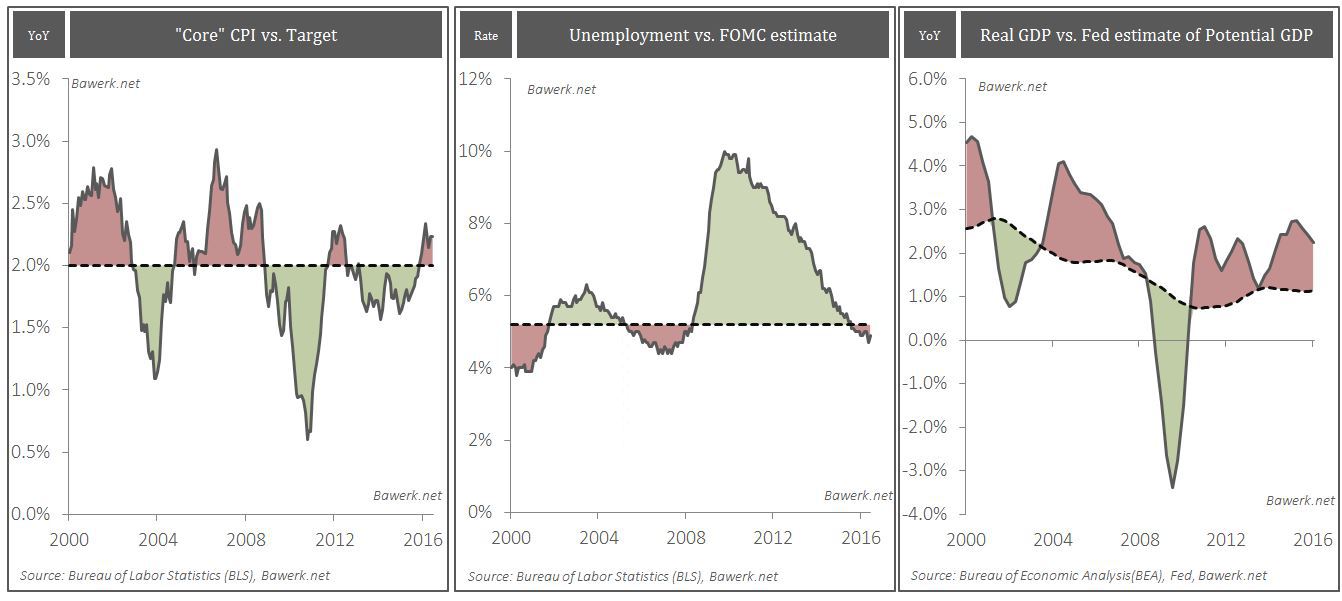

Still think QE is the answer for the euro zone ?